In this article, I will discuss the Binance Earn vs Staking, two prominent strategies for making passive income with cryptocurrency. We shall look at each method’s operation, major differences, advantages, as well as disadvantages.

After going through this guide, you will be able to make an informed decision as to which one is better for your investment goals and risk appetite regarding the enhancement of your crypto portfolio.

What is Binance Earn?

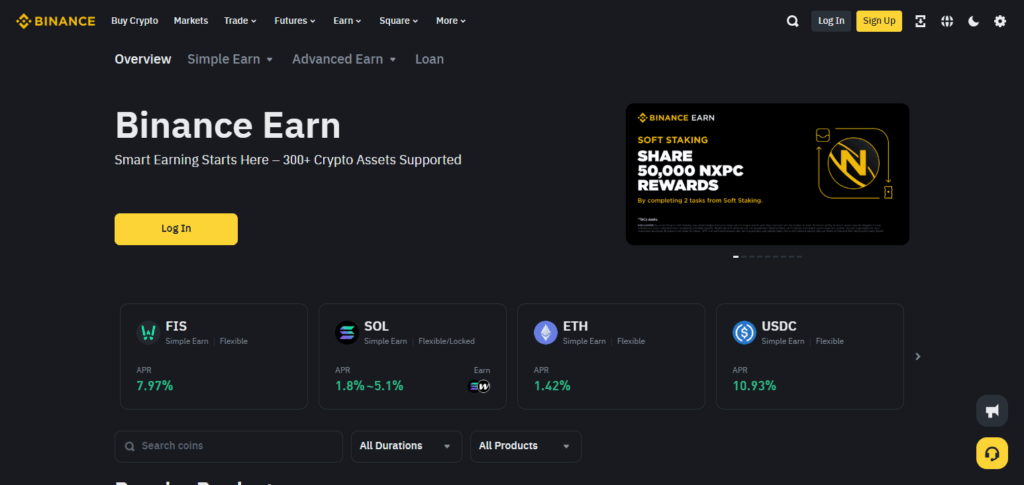

Binance Earn is an integrated feature of Binance that enables users to increase their crypto assets with minimal effort via multiple income earning methods. It has different products such as Flexible Savings and Locked Savings as well as Launchpool which caters to different investment appetite and risk profile.

Users may passively earn interest or rewards for their crypto deposits without the need for complex trading activities. Binance Earn is precisely designed for all types of investors, be it novice or seasoned, patient or aggressive, seeking to add value to their digital portfolio.

What is Staking?

Staking refers to the act of “freezing” cryptocurrency within a blockchain network for the purpose of facilitating its operation, like transaction validation and system security. This is typical in Proof of Stake (PoS) and equivalent consensus mechanisms.

Users are rewarded or paid interest for coins staked due to network maintenance, receiving interest for their coins. In crypto, passive investment has taken a new meaning with growing popularity, fixed lock-up terms, various risk levels, and better returns than classic savings offered, all attractive for crypto investors.

Key Differences Between Binance Earn and Staking

| Aspect | Binance Earn | Staking |

|---|---|---|

| Product Variety | Multiple products: Flexible Savings, Locked Savings, Launchpool, etc. | Primarily locking tokens to support blockchain networks |

| Risk Levels | Generally lower risk with flexible withdrawal options | Higher risk due to lock-up periods and potential network slashing |

| Rewards Structure | Interest-based earnings on deposited assets | Rewards from network incentives like block rewards or fees |

| Lock-up Periods | Flexible and fixed-term options available | Usually fixed lock-up periods |

| Supported Cryptos | Wide range of cryptocurrencies | Limited to PoS or similar consensus mechanism coins |

| User Complexity | Beginner-friendly, easy to use | May require technical knowledge and understanding of blockchain |

Which One Should You Choose?

Choose Binance Earn if

- You want to be able to access your funds with minimum constraints.

- You are planning on setting up your first ever passive income strategy.

- You would appreciate being able to invest in many crypto products without going through complex processes.

- You want safety with lower risk and guarantee interest payments.

Choose Staking if

- You are comfortable locking your crypto for a fixed period.

- You want to support blockchain networks and earn higher rewards.

- You have a good understanding of crypto networks and staking risks.

- You seek potentially higher returns through network incentives.

Pros and Cons of Binance Earn

Pros of Binance Earn

Different products to choose from based on individual risk appetites and objectives.

The platform is intuitive and simple enough for novices, while also catering to advanced traders.

Options that are flexible make it easier to withdraw funds.

Supports numerous cryptocurrencies which can be earning assets.

Provides passive income on a regular schedule through interest payments.

Cons of Binance Earn

Other high-risk methods may offer better returns.

Some locked products have access restrictions to funds for some time.

There are custodial risks concerning a centralized exchange.

All interest rates are subject to changes in the market.

There is limited information about the internal asset management of the deposits.

Pros and Cons of Staking

Pros of Staking

Outperform other forms of earning interest.

Enhances the security of a blockchain network.

Users can earn passive income by holding assets.

Additional rights in governance may be offered with some staking.

Reward earnings from previously staked assets can be reinvested to increase compounding.

Cons of Staking

Funds must be frozen for a set amount of time which affects liquidity.

Slashing penalties may be incurred if network rules are broken.

Network activity may determine reward availability.

May be hindered by lack of adequate technical skills.

Cryptocurrencies that utilize Proof of Stake or similar algorithms are the only ones usable.

Binance Earn vs Staking: Future Outlook

As both adapt to the evolving needs of crypto investors, The future of Binance Earn and staking is promising. Binance Earn is broadening its offerings by adding flexible forms of Soft Staking, which allows earning and liquidity simultaneously. This improves accessibility for novices and those valuing ease.

While still fundamental in DeFi, staking is evolving too—liquid staking lets users earn on assets while maintaining some asset flexibility. As trust and security of both regions increase, clarity in regulations will aid. All in all, technology as well as regulation will shape the future and adapt Binance Earn and staking, allowing for more versatile means of increasing crypto assets in the years to come.

Conclusion

To wrap things up, Binance Earn and staking present useful options for generating passive income through cryptocurrency, though each serves distinct priorities and appetites for risk. Easier access to funds and a wide selection of low-risk products make Binance Earn more accessible and flexible for beginners.

Alternatively, staking provides the potential for greater returns; however, it comes with the tradeoff of requiring assets to be locked for extended periods and carries certain network risks. Your objectives, willingness to take risks, and the desired level of involvement in managing crypto assets all determine which option is more favorable.