In this article, I will explore the top strategies on how to earn bridging referral fees, which is particularly fascinating to people in business, finance, or real estate. Whether you are a consultant, marketer, or a professional networker

There is money to be made in referring clients to bridging lenders. From offline collaborations to online tactics, I will share helpful strategies you can utilize to start earning referral commissions by 2025.

key Points & Best Ways To Earn Bridging Referral Fees In 2025 List

| Strategy | Key Point |

|---|---|

| Partner with Bridging Loan Brokers | Build relationships with brokers to get paid per successful referral. |

| Create a Real Estate Lead Website | Drive traffic to your site and earn by referring clients to lenders. |

| Join Affiliate Programs of Lenders | Earn commissions by promoting lender services via unique affiliate links. |

| Work with Property Investment Groups | Refer members in need of bridging finance and get paid referral fees. |

| Collaborate with Mortgage Advisors | Send clients needing quick funding to bridging lenders and earn fees. |

| Offer Bridging Loan Consultations | Act as an intermediary and connect clients with lenders for a commission. |

| Use Social Media and Online Ads | Promote bridging finance options and earn from leads that convert. |

| Target Auction Buyers and Developers | Refer those needing fast property funding for auctions or builds. |

| Build a Niche Email List | Promote bridging loans to your list and refer interested subscribers. |

| Network with Estate Agents | Partner to refer buyers needing short-term financing and split the fees. |

10 Best Ways To Earn Bridging Referral Fees In 2025

1.Partner with Bridging Loan Brokers

Perhaps the most straightforward method for earning referral fees is partnering with bridging loan brokers. Most brokers have a robust system for paying people who send them qualified leads.

You can send clients who require urgent and short-term finances for property deals. Once the deal is closed, you earn a commission. Strong networking skills and basic understanding of bridging finance are all that’s needed.

It is great for professionals in real estate, finance, or even property investing who always have someone within reach looking for alternative lending options.

Features:

- Quick entry with minimal resources.

- Payment received for each loan referral.

- Brokers take care of the loan follow-up with clients.

- Best suited for networking and for property industry players.

2.Create a Real Estate Lead Website

A real estate lead generation website captures and channels traffic seeking instant property loans. Entrepreneurs can monetize their interest by providing valuable content, such as blogs, guides on bridging finance, and FAQs for potential borrowers.

They can then serve as intermediaries by referring clients to lenders or brokers after collecting information through contact forms or lead magnets.

This approach is scalable and can be automated with SEO and paid advertisements. Besides initial effort building and funneling the site’s content, if optimized, the lead website can be a source of steady passive income.

Features:

- Drives traffic via search engines or content.

- Provides lead capture through forms and landing pages.

- Can sell leads through partnerships with multiple lenders.

- Low maintenance costs afterwards.

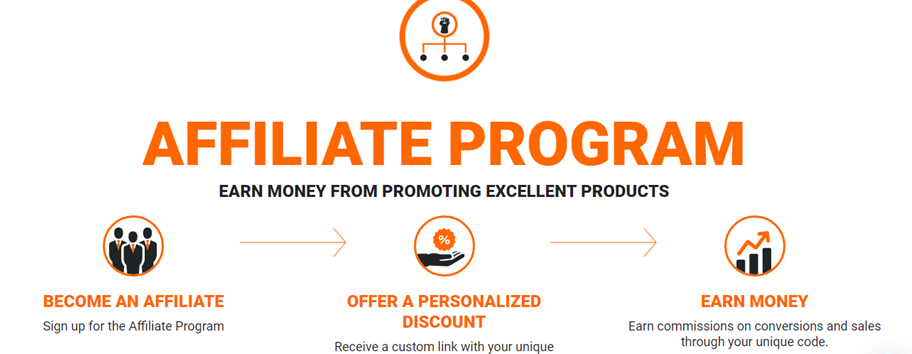

3.Join Affiliate Programs of Lenders

A growing number of bridging loan providers develop affiliate programs that offer commissions for referrals who become clients.

You will earn a commission once a referred individual clicks the link, applies and is granted a loan through the unique tracking link you share on your website, blog, email, or social media.

This is an easy approach to finances and is ideal for digital marketers or social media influencers for whom finances are the target audience.

To make sure there are no problems down the line with funding, choose trustworthy lenders with transparent terms and high conversion rates.

Features:

- Receives commission through affiliate links.

- No direct communication with clients needed.

- Can be advertised on blogs, YouTube, and other social platforms.

- Passive income opportunity that yields good results.

4.Work with Property Investment Groups

Being a part or collaborating with property investment groups can provide consistent opportunities for earning referral fees. These groups often have investors who are looking for short-term financing for renovations, flips, or auction buys.

If you are outlined as a focussed and knowledgeable connector, you can refer members to bridging lenders and get paid the fee for brokerage on every deal.

These groups can be located online or offline for instance in Facebook groups, local meet-ups, or even mastermind sessions. It is all about providing trust and key contacts. The more contacts that you are able to provide that are trustworthy makes it easier for investors and lenders.

Features:

- Comes with a large pool of potential investors needing urgent loans.

- Potential repeat commissions from referrals.

- Chance to establish lifelong business relationships.

- Actively participate in online discussion boards and local networking groups.

5.Collaborate with Mortgage Advisors

There are times when a mortgage advisor overlooks a prospective client due to lack of funds available needing urgent funding not meeting the lending requirement.

If you work with such advisors, it is possible to become a solution provider by dealing with clients needing bridging lenders.

This guarantees a referral fee, while the advisor retains his working relationship with the client. Everyone wins in this scenario as each party is able to extend their service offering.

It is essential to have transparent working relations with brokers and outline commission shares pre-agreed on. This partnership can lead with time to a reliable collection of onboarding clients.

Features:

- Non-bank lenders usually have very few clients, hence the gap is easily filled.

- Advisors refer clients who are not catered for by other lenders.

- Permits an increase in service offerings for both parties.

- Fosters steady referral flows that are qualified.

- Works best less formally with agreements on commission splits.

6.Offer Bridging Loan Consultations

As a property bridging finance consultant, you now have the ability to advise buyers, developers, and investors.

Even in the absence of a broker’s license, you can collect proprietary information, analyze client needs, and connect them to a lending partner who compensates you as a referrer.

This is ideal for someone who has basic lending knowledge and can explain to clients the timelines, fees, and other requirements associated with obtaining a loan.

Many clients appreciate dealing with people who understand their level of understanding when it comes to the complexities of bank lending.

You are able to append value to the preexisting work, therefore, you will be able to win the trust of your clients leading to higher chances of successful deals.

Features:

- Distinguishes you as a helpful link or specialist.

- Lets clients pre-qualify before sending them to lenders.

- Empowers trust with clients for better conversions.

- Makes sense for individuals who understand finance or real estate.

7.Use Social Media and Online Ads

Networking on social media sites including Facebook, LinkedIn, and Instagram enables users to promote bridging loan services.

Developers, Investors, and other real estate professionals can be targeted through content, ads, or direct outreach resulting in referrals and overall buzz.

Use engaging content, from social media posts to explainer videos, that redirects users to your landing page or referral links. Social media ads allow you to reach a more specific audience and do so rapidly.

Spending money to promote your referral link means more potential users to your service, thus easily earning referral fees. Credibility is needed to work your way up gaining trust, but consistency is essential for turning clicks to commissions.

Features:

- Allows targeting specific groups of potential borrowers.

- Effective with appealing graphics and testimonials.

- Offers a quick approach to generate warm leads in bulk.

- Links can go directly to your referral forms or lender pages.

8.Target Auction Buyers and Developers

Bridging loans are ideal for auction buyers and property developers because they tend to require immediate capital. You can find them at property auction events, networking sessions, and on LinkedIn and niche forums.

If you offer immediate financing solutions through your lending partners, you become invaluable. You make referral fees for every introduction you successfully make.

You don’t need financial expertise—just comprehend their pain points and how bridging loans alleviate them. Concentrating on this segment can bring you repeat business and referrals with higher value.

Features:

- Centered on clients who require quick access to funds.

- Leads with high deal value result in greater referral fees.

- Simple to reach through auctions, forums & LinkedIn.

- Provides chances for repeat business and upsells.

9.Build a Niche Email List

Advancing your business is easier with a targeted email list of investors, property developers, or landlords. You can directly promote bridging finance to this specific audience.

Ebooks, checklists, and webinar invites can serve as lead magnets to build your list. After people subscribe, you can email helpful resources about bridging loans and referral links/contact forms.

Email marketing is a good long-term investment that helps build trust, increase conversion rate, and is cost-effective. Every time a subscriber of your recommendation applies for a loan, you receive a fee. A well-cultivated list is a reliable source of income over time.

Features:

- Sends direct messages to specified groups.

- Promotes bridging loans consistently over the long term.

- High ROI through sustaining and follow-up campaigns.

- Can be enhanced with lead magnets and ads.

10.Network with Estate Agents

Acquire a few estate agents contacts because they interact with buyers that require immediate access to capital to acquire a property.

If you establish relationships with local or online agents, you may provide them with a quick finance policy through your bridging loan contacts.

In exchange, you either share the referral fee with them or pay a set fee per lead. This arrangement boosts the contractor’s close rate and enables you to receive commissions.

Go to property networking events or directly ask agents to find a deal that works for both of you. Effective agent partnerships may be an endless supply of warm, premium leads.

Features:

- Clients urgently need funds, which agents usually have.

- Facilitates lead-sharing and fee-sharing agreements.

- Assists agents to close more sales, which helps everyone.

- Nurtures trust for referrals throughout the pipeline.

Conclusion

in summary If you are connected to the property, finance, or even real estate industries, then earning bridging referral fees will help you generate extra income in 2025.

Through partnerships, their own social media accounts, or even websites, consistent referrals will always earn them good commissions.

Trust and value when teamed with direct calls can help form dependable income from bridging loans referrals.