In this article, I will talk about the Best Crypto Indicators that every trader should consider using to be able to take more informed decisions in the unpredictable crypto market.

For example, trend-following tools like Moving Averages and momentum indicators such as RSI, these tools are effective in analyzing the market.

Knowing how to properly use these indicators can strengthen your trading strategies and maximize your profits.

Key Point & Best Crypto Indicators List

| Indicator | Key Point |

|---|---|

| Moving Averages | Smooths out price data to identify trends by calculating the average price over a specific time period. |

| Relative Strength Index (RSI) | Measures the speed and change of price movements, indicating overbought or oversold conditions. |

| Bollinger Bands | Consists of a moving average with upper and lower bands that indicate volatility and potential price reversal. |

| MACD (Moving Average Convergence Divergence) | Shows the relationship between two moving averages, helping identify potential buy and sell signals. |

| Stochastic Oscillator | Compares a security’s closing price to its price range over a set period to signal overbought or oversold conditions. |

| Volume | Indicates the number of shares or contracts traded in a specific period, helping confirm price trends. |

| Fibonacci Retracement Levels | Key levels derived from the Fibonacci sequence used to identify potential support and resistance points. |

| Ichimoku Cloud | Provides a comprehensive view of support, resistance, momentum, and trend direction. |

| Candlestick Patterns | Visual patterns on price charts that help predict future market behavior based on past price movements. |

| On-Balance Volume (OBV) | Measures the cumulative flow of volume, helping confirm the strength of a price trend. |

1. Moving Averages

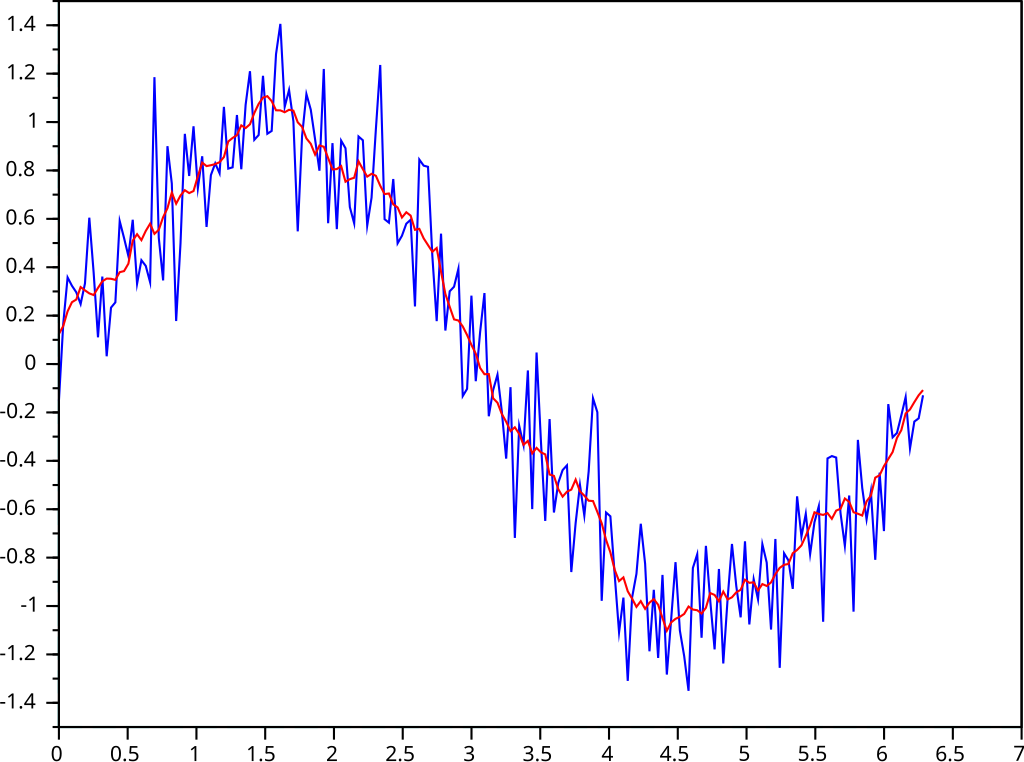

Moving Averages are widely considered among the best crypto indicators for predicting movements.

Moving Averages are effective tools because they are relatively easy to implement and eliminate most of the market noise thus allowing the traders to concentrate on the trend.

By Removing these price distortions, they portray the general direction complied by the market.

This is most important in the case of the crypto market which is very active and where price moves are completely random.

The method clearly depicts an ability to track trends over small increments and long-term periods using various timeframes like 50-day and 200-day moving averages allowing traders to cover themselves ideally lowering risk profits and amending trades.

Moving Averages Features

- Identify trends using historical data smoothing techniques with periodic intervals

- Two common forms: simple (SMA) and exponential (EMA)

- Calculates support and resistance levels

2. Relative Strength Index (RSI)

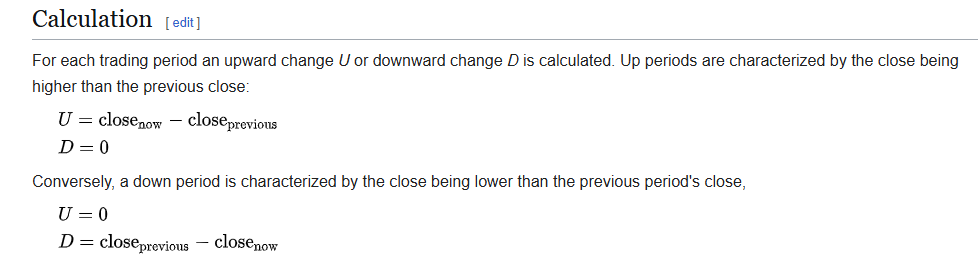

The Relative Strength Index (RSI) is one of the best crypto indicators that a trader would like to use.

RSI is mainly praised for its ability to indicate when an asset is overbought or oversold, which practically alerts traders of possible reversals.

Different from the averages, traders need to like RSI because it works in the range of 0 to 100 and has fixed thresholds of 70 and 30 which indicates overbought and oversold respectively thus enabling ease in targeting entry and exit points for trades.

In the ever-changing world of cryptocurrencies, RSI aids in locating suitable times to make or exit a trade by showing extreme price levels which helps in strategizing and controlling risk exposure and increasing the reward.

Relative Strength Index (RSI) Features

- Analysis of market momentum

- Ranges from zero to one hundred. Above seventy indicates overbought while below thirty indicates oversold

- Serves well in determining possible trend direction changes

3. Bollinger Bands

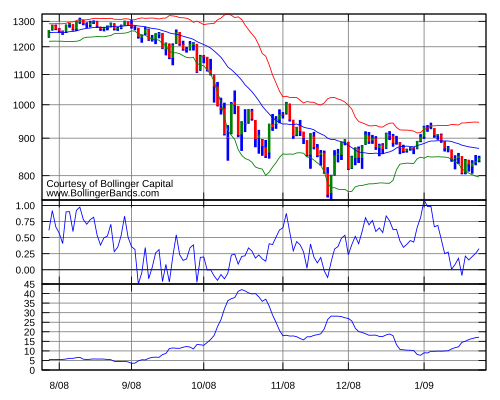

Bollinger Bands are said to be among the most effective indicators of crypto instruments.

Bollinger Bands offer the best services as they analyze both volatility and trends simultaneously.

They are built up in such a way that they consist of a simple moving average and two bands of standard deviations placed above and below, thereby making them responsive to the current market situation.

Because of this flexibility, Bollinger Bands are able to represent various forms of volatility, which helps traders to pinpoint extreme activity in the marketplace. A contraction of bands, for instance, shows quiet periods, whereas an expansion indicates a breakout.

In the chaotic world of cryptocurrency, Bollinger Bands are critical in determining the volatility of prices and the momentum of a particular market which, in effect, assists in improving the performance of the timing of the trades.

Bollinger Bands Features

- Made of a middle moving average and upper and lower two bands

- Bolbands expand and contract based on volatility

- Determines whether an asset is overbought or oversold and provides breakout opportunities

4. MACD (Moving Average Convergence Divergence)

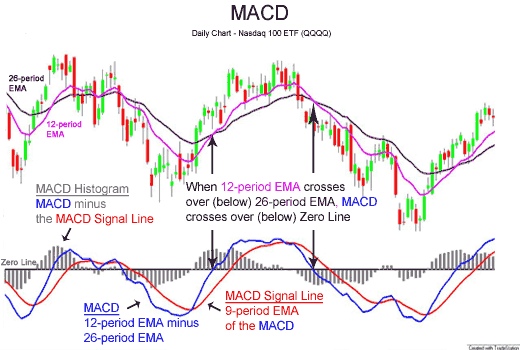

MACD stands for Moving Average Convergence Divergence. Many traders consider MACD one of the best crypto indicators.

To explain, MACD is an amalgamation of a trend-following and momentum indicators into a single tool; this makes it easier to find potential buy and sell signals.

In more detail, the deviation from each of two moving averages is determined firstly, their 12 day and 26 day values, and then, a signal line is produced.

If the MACD moves above the signal line, it indicates that the momentum is bullish; if it crosses below it, the momentum is regarded to be bearish.

Its adaptability is an important characteristic in MACD for the crypto world, since it allows traders to take advantage of trend reversals as well as momentum changes resulting in greater market entry and exit points for trades.

MACD (Moving Average Convergence Divergence) Features

- Merges moving averages to show how a currency is trending on price with the strength of that trend

- MACD Line, signal line and histogram

- Good at telling bullish or bearish crossovers

5. Stochastic Oscillator

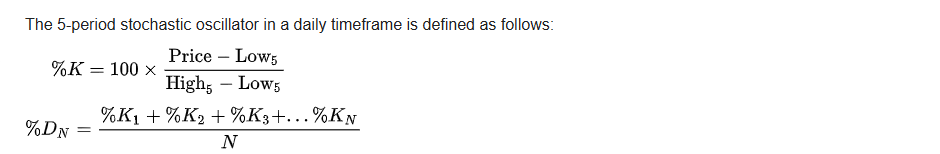

The Stochastic Oscillator is said to be one of the most reliable crypto indicators available in the market. Its efficiency can be further substantiated with the fact that it measures momentum and identifies whether the asset is oversold or overbought.

It aids traders in determining price reversal opportunities with respect to a cryptocurrency by positioning its closing price against its price range over a set period.

Its outputs vary from 0 to 100, with over 80 being interpreted as overbought and under 20 being interpreted as oversold, which means that the Stochastic Oscillator can work excellently in every field especially in the volatile crypto market.

This indicator works perfectly in the current fast-paced world where prices change in an instant which allows traders to operate efficiently.

Stochastic Oscillator Features

- Represents the level of current price relative to its range for a specified duration.

- Values between zero and one hundred. Above eighty indicates overbought while below twenty oversold.

- Good for sideways market reversals

6. Volume

Volume is deemed as one of the best indicators when dealing with crypto assets. This is due to its significance in determining the strength behind the price movement.

Strong market sentiment is normally associated with high trading volumes which act as confirmation to the existing trend while low volumes suggest reversals or absence of conviction.

Furthermore, other indicators focus on price levels whereas volume deals with participation levels making it critical towards determining the sentiment of the market.

Given the volatile nature of the cryptocurrency space, alongside keeping up with the volume helps traders distinguish breakouts from the real trends, and this provides greater insights about the market.

Volume Features

- The total amount of the asset traded

- Validates trend strength during a price movement when sold volume increases.

- A sudden increase in volume can also signify a breakout or reversal.

7. Fibonacci Retracement Levels

Fibonacci Levels are arguably one of the best crypto indicators. Fibonacci can become potential’s levels of support and resistance because these are derived from important ratios of the Fibonacci sequence.

To be more specific, we have 23.6%, 38.2%, 50%, 61.8%, 78.6% which are boundaries of a kind to where corrections of the price tends to turn around.

In the crypto volatile market where violent price shifts are the norms, such retracement levels help traders to define boundaries within which if prices pullback, or reverse allowing them to enter or exit trades at the profit making points.

Fibonacci Retracement Levels

- Utilized by some traders based on the underlying Fibonacci sequence (23.6%, 38.2%, and 61.8%)

- Assists with locating possible support or resistance levels.

- Commonly applied to price targets, as well as entry and exit points.

8. Ichimoku Cloud

The Ichimoku Cloud is a multifaceted instrument that integrates all major aspects of the market, such as trends, momentum, resistance, and support.

It incorporates a moving average with a ‘cloud’ which makes identifying possible changes in the market much easier, it works alongside several indicators which solely rely on prices and marketing volume.

This is very helpful for the crypto market due to there being so much volatility. Not only does this cloud estimate the current trend, but it also forecasts potential points for new market positions, therefore traders can make strategic decisions depending on the market’s strength and reversal signals

Ichimoku Cloud Features

- Displays trend, momentum, and support/resistance levels in a single view.

- Comprised of five lines, including an ‘cloud’ that predicts future support or resistance levels.

- Excellent for determining the market trend.

9. Candlestick Patterns

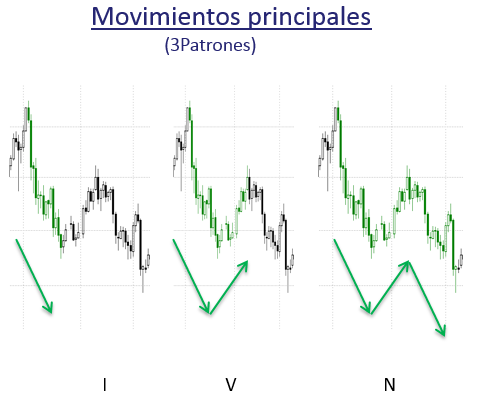

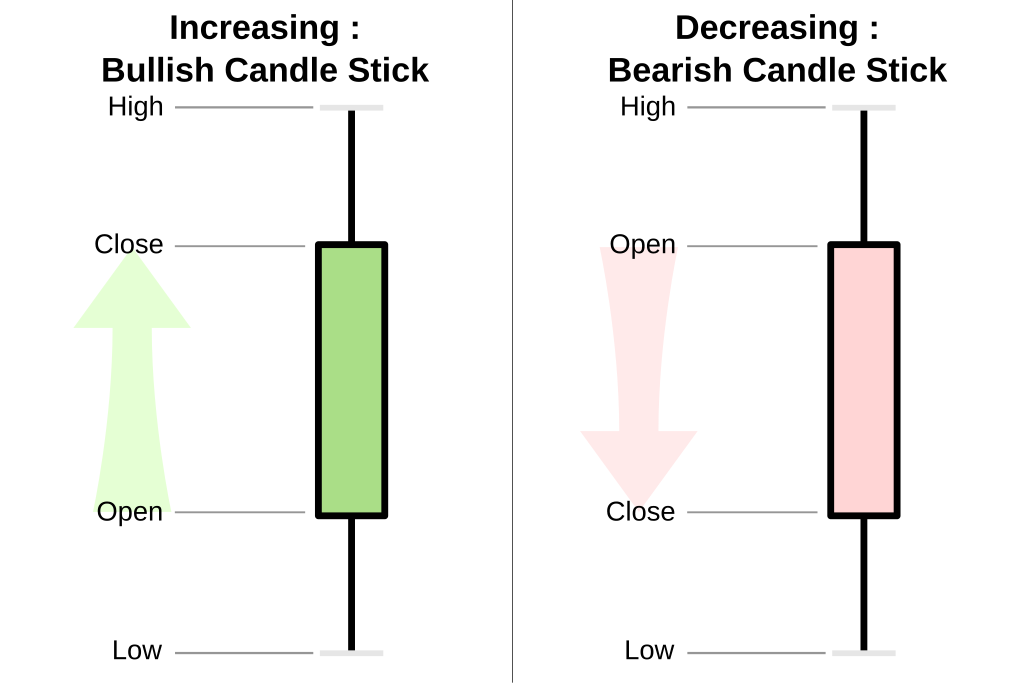

Candlestick Patterns are arguably the best crypto indicators. The reason why candlestick patterns have a high degree of effectiveness when trading is that they allow you to gauge the action of the price and the market sentiment in a defined period easily.

By looking at the shape, size, and location of candlesticks, traders can predict reversals, trend continuations, or shifts in sentiment.

These patterns give us an immediate understanding such as Doji, Engulfing and Hammer of whether buyers or sellers are more in number.

With the crypto market having an exponential pace enabling prices to change dramatically and suddenly, candlestick patterns supply relevant information that helps in planning and executing trades easily.

Candlestick Patterns Features

- Graphic illustration of price movements over a given period.

- Doji, Hammer, and Engulfing are examples of patterns that indicate turnarounds.

- Enhances traders ability to act quickly and optimally to the market’s historical dynamics.

10. On-Balance Volume (OBV)

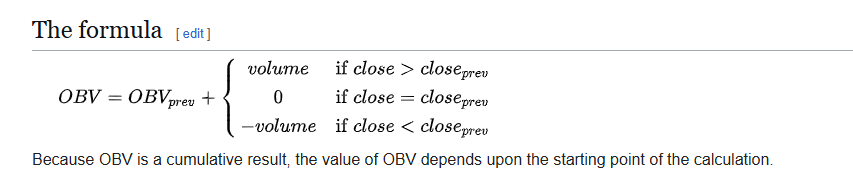

The On-Balance Volume (OBV) metric is one of the few on-chain metrics that has captured the attention of traders and is also among the best crypto indicators around.

It has been reported that OBV is effective because it integrates price with volume and determines the total money flow for a particular cryptocurrency.

Cumulative lines are provided by OBV as it adds volume on the up days and deducts it on the down days allowing the user to measure the vigorousness of a trend.

OBV is also distinctly different from your regular technical indicators as it is able to predict price changes. In the highly risky crypto world, OBV allows traders to see decipher early trend shifts without any or little risk thereby confirming price movement or trend shift which makes any investing highly effective.

On-Balance Volume (OBV) Features

- Measures buying and selling pressure by analyzing price and volume together.

- An upward OBV is an indicator of accumulation and a downward is an indicator of distribution.

Conclusion

On a final note, the best crypto indicators come in handy to traders operating in the uniquely volatile crypto market.

Each one of the indicators for instance Moving Averages, RSI, Bollinger Bands and the rest especially MACD and Fibonacci Retracement Levels deliver one of a kind information as to the behavior of the market in terms of direction, strength and turning points.

Using these indicators in combination enables the trader to formulate a suitable trading plan that does minimize risks and maximize chances.

After all, the best crypto indicators are those tools that best integrate with one’s trading style by sending out clear signals along with material information for one to act on in an obscured situation.