In this article, I will cover the Best Crypto Lending Platforms, focusing on those that allow you to borrow against your digital assets in a safe, flexible, and convenient manner.

These platforms offer streamlined access to liquidity, whether you’s prefer a centralized service with fiat settlements or a decentralized service with minimal KYC. Check out the top recommendations and choose the platform that best suits your crypto lending requirements.

Key Point & Best Crypto Lending Platforms List

| Platform | Key Point |

|---|---|

| YouHodler | High LTV loans with fiat support and multiple crypto options |

| Nexo | Instant crypto loans with 0% APR for loyal users and NEXO token benefits |

| Crypto.com | Flexible loans via app with CRO rewards and wide crypto support |

| CoinRabbit | Fast, anonymous crypto loans with no monthly payments |

| Binance Loans | Low-interest loans with flexible/fixed terms and broad asset selection |

| Coinbase Borrow | Easy BTC-backed loans with no credit checks (US only) |

| Aave | Decentralized lending with dynamic interest rates and no KYC |

| Compound Finance | Algorithm-based DeFi lending with full decentralization |

| SpectroCoin | Crypto loans with EUR/USD payouts and instant access |

1.YouHodler

YouHodler emerged as one of the top tier platforms in crypto lending because of its loan-to-value ratio (LTV) of 90% which enables users to access more funds in loans to their crypto assets.

Lower loan rates are more favorable and encourage lending. YouHodler also allows instant withdrawals in cash and stable coins, and supports various forms of cryptocurrencies. YouHodler’s multi-HODL feature sets it apart as it enables users to earn and multiply their assets using crypto as collateral, merging lending with smart asset growth.

| Feature | Details |

|---|---|

| Platform Name | YouHodler |

| Founded | 2018 |

| KYC Requirement | Minimal KYC (required only for larger withdrawals or fiat use) |

| Supported Assets | BTC, ETH, LTC, USDT, USDC, BNB, and more |

| Loan-to-Value (LTV) | Up to 90% |

| Interest Rate (APR) | ~4.8% – 12.3% (varies by asset and LTV) |

| Loan Currencies | USD, EUR, GBP, USDT, USDC |

| Unique Feature | Multi-HODL for asset growth + fiat and crypto loan flexibility |

| Payout Speed | Instant upon collateral lock |

| Custody Insurance | Up to $150 million via Ledger Vault |

2.Nexo

Nexo is widely acknowledged as one of the top crypto lending platforms because of its instant loans, daily interest payments, and perks associated with the native NEXO token. Its 0% APR loan offering for users with a high loan-to-value ratio combined with NEXO token staking is a significant competitive edge.

As for security, Nexo provides $375 million insurance on custodial assets. Its automation in loan approval, ease of payment, support for over 40 cryptocurrencies, and user-friendly interface enhance the platform’s efficiency.

| Feature | Details |

|---|---|

| Platform Name | Nexo |

| Founded | 2017 |

| KYC Requirement | Basic KYC for borrowing; no extensive verification for small limits |

| Supported Assets | 40+ assets including BTC, ETH, XRP, USDT, USDC |

| Loan-to-Value (LTV) | Up to 50% |

| Interest Rate (APR) | 0% – 13.9% based on loyalty tier and LTV |

| Loan Currencies | USD, EUR, GBP, USDT, USDC |

| Unique Feature | 0% APR for users staking NEXO + instant credit line |

| Payout Speed | Instant after approval |

| Custody Insurance | Up to $375 million via BitGo, Ledger Vault, and others |

3.Crypto.com

Crypto.com is among the top platforms for crypto lending because it strategically integrates lending and trading alongside amassing rewards all within a single app. Its most unique feature is that it uses the CRO token to lower interest rates and increase the cap on loans.

Users can instantly borrow against their crypto collateral for up to 50% without undergoing any credit assessment. Offering major cryptocurrencies and easy to repay terms makes Crypto.com a one-stop shop for everyone from the casual users to the fully immersed investors.

| Feature | Details |

|---|---|

| Platform Name | Crypto.com |

| Founded | 2016 |

| KYC Requirement | Basic KYC for access; minimal for small lending features |

| Supported Assets | BTC, ETH, CRO, USDC, USDT, and more |

| Loan-to-Value (LTV) | Up to 50% |

| Interest Rate (APR) | 8% – 12%, reduced with CRO staking |

| Loan Currencies | USDC, USDT, BTC, ETH |

| Unique Feature | CRO staking reduces interest + full ecosystem integration |

| Payout Speed | Instant after collateral lock |

| Custody Insurance | Crypto.com maintains multi-layer security and custodial insurance |

4.CoinRabbit

CoinRabbit is regarded as one of the top crypto lending platforms for users searching for privacy and simplicity. Its distinctive advantage is providing instantaneous loans without the need for identity verification (KYC) and monthly payments. Borrowers are free to manage debt as they wish.

CoinRabbit supports a broad range of crypto assets and provides up to 70% LTV, making borrowing both accessible and flexible. The platform is well-suited for users who value speed and anonymity as they provide a seamless lending experience devoid of intricate verification burdens.

| Feature | Details |

|---|---|

| Platform Name | CoinRabbit |

| Founded | 2020 |

| KYC Requirement | No KYC required |

| Supported Assets | BTC, ETH, USDT, USDC, BCH, BNB, and more |

| Loan-to-Value (LTV) | Up to 70% |

| Interest Rate (APR) | ~10% fixed |

| Loan Currencies | USDT, USDC |

| Unique Feature | Anonymous crypto loans with no monthly payments |

| Payout Speed | Instant approval and funding |

| Custody Insurance | Assets held with trusted custodians like BitGo |

5.Binance Loans

Binance Loans has emerged as one of the leading crypto loans platforms and it’s because it is part of the Binance exchange ecosystem. One of the main strengths of Binance Loans is the ability for users to borrow on both fixed and flexible terms.

Apart from this, Binance offers a wide range of tokens, and even with high loan to value ratios, the interest remains reasonable. There is a single interface for most of the operations one needs to do, and the users enjoy the bonus of trading versus the value of their crypto assets on loan.

| Feature | Details |

|---|---|

| Platform Name | Binance Loans |

| Founded | 2017 |

| KYC Requirement | Basic KYC required for access; minimal for lower limits |

| Supported Assets | Wide range including BTC, ETH, BNB, USDT, USDC, and more |

| Loan-to-Value (LTV) | Up to 75% |

| Interest Rate (APR) | ~11% – 15% (varies by asset and duration) |

| Loan Currencies | USDT, BUSD, USDC |

| Unique Feature | Flexible and fixed loan terms with deep liquidity from Binance exchange |

| Payout Speed | Instant upon approval |

| Custody Insurance | Platform security with SAFU (Secure Asset Fund for Users) |

6.Coinbase Borrow

Coinbase Borrow stands out as one of the top crypto lending platforms for USA users who value simplicity and certainty. As a standout, users are able to take out cash loans and secure them with Bitcoin for collateral and a loan-to-value (LTV) of up to 40% without a credit check.

The Coinbase Borrow platform is seamlessly integrated with the Coinbase ecosystem, allowing for a smooth and secure borrowing experience. It is especially addictive for users who prefer a simple, streamlined, and regulated approach to liquidity due to the fixed interest rates, transparent pricing, and absence of a rigid repayment schedule.

| Feature | Details |

|---|---|

| Platform Name | Coinbase Borrow |

| Founded | 2020 |

| KYC Requirement | Basic KYC required (U.S. users only) |

| Supported Assets | Bitcoin (BTC) only |

| Loan-to-Value (LTV) | Up to 40% |

| Interest Rate (APR) | ~8.7% fixed |

| Loan Currencies | USD (bank transfer to U.S. accounts) |

| Unique Feature | No credit check, fixed APR, no monthly payment schedule |

| Payout Speed | Typically same-day bank deposit |

| Custody Insurance | Insurance for digital assets held in Coinbase wallets |

7.Aave

Aave differentiates itself from other crypto lending platforms through it’s decentralised, non custodial framework which allows users to lend and borrow without intermediaries, making it one of the best lenders out there.

Borrowers enjoy the shifting of stable and variable interest rates which gives them an upper hand when dealing with fluctuating markets. Aave also pioneered flash loans, allowing users to borrow money without collateral as long as it is paid back within the same transaction. Aave is best suited for users seeking transparency, autonomy, and innovation in DeFi lending as it is governed by the token holders.

| Feature | Details |

|---|---|

| Platform Name | Aave |

| Founded | 2017 |

| KYC Requirement | No KYC required (fully decentralized) |

| Supported Assets | ETH, DAI, USDC, USDT, WBTC, AAVE, and more |

| Loan-to-Value (LTV) | Up to ~80% (varies by asset) |

| Interest Rate (APR) | Dynamic variable and stable rates (~2%–12%) |

| Loan Currencies | Any supported asset (on-chain liquidity pool) |

| Unique Feature | Decentralized protocol with rate switching and flash loans |

| Payout Speed | Instant via smart contract |

| Custody Insurance | No insurance; users retain control via Web3 wallets |

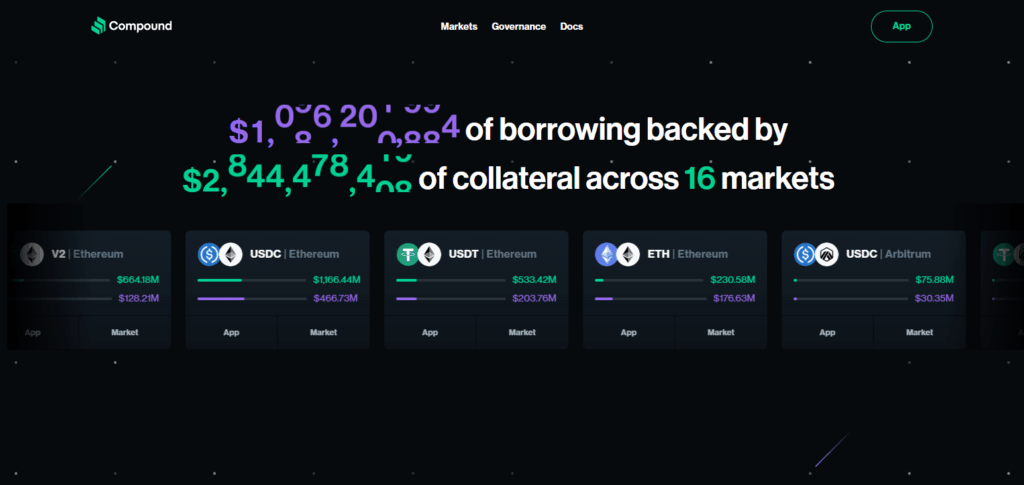

8.Compound Finance

Compound Finance emerges as one of the leading platforms for crypto lending due to its fully automated and decentralized model where smart contracts govern the funds. One of its most distinguishing attributes is the model for interest rates which is algorithmically calculated and changes in real-time according to supply and demand.

Assets can be borrowed or interest earned via Web3 wallets, allowing users to control their crypto fully. Compound offers unmatched security while also ensuring the backed governance and transparency of the system provided by the COMP token holders which empowers the users to actively participate in trustless lending and borrowing.

| Feature | Details |

|---|---|

| Platform Name | Compound Finance |

| Founded | 2018 |

| KYC Requirement | No KYC required (fully decentralized) |

| Supported Assets | DAI, USDC, ETH, WBTC, UNI, LINK, and more |

| Loan-to-Value (LTV) | Up to ~75% (varies by asset) |

| Interest Rate (APR) | Algorithmic rates (~2%–10%) |

| Loan Currencies | Any supported asset on the protocol |

| Unique Feature | Automated interest rates via smart contracts and COMP governance |

| Payout Speed | Instant via Web3 wallet interaction |

| Custody Insurance | No custodial risk; user-controlled through decentralized wallets |

9.SpectroCoin

SpectroCoin is among the leading platforms for crypto lending for individuals who need cash quickly. What sets SpectroCoin apart is the fact that it offers crypto-backed loans that are paid out in EUR or USD, which is perfect for those who need liquidity in fiat currency.

Borrowing is made easy with instant approval and flexible loan terms, support for numerous digital assets and other features. Moreover, SpectroCoin offers crypto wallets and exchange services so that users can enjoy the experience of full-suite crypto banking in one secure and easy to use platform.

| Feature | Details |

|---|---|

| Platform Name | SpectroCoin |

| Founded | 2013 |

| KYC Requirement | Basic KYC required for loan access |

| Supported Assets | BTC, ETH, XEM, DASH, and more |

| Loan-to-Value (LTV) | Up to 75% |

| Interest Rate (APR) | ~9% – 13% fixed |

| Loan Currencies | EUR, USD, USDT |

| Unique Feature | Crypto-backed loans with fiat payouts and instant credit line |

| Payout Speed | Fast processing with instant disbursement |

| Custody Insurance | Assets stored with secure third-party custodians |

Conclusion

To summarize, the top-performing crypto lending platforms like YouHodler, Nexo, Crypto.com, CoinRabbit, Binance Loans, Coinbase Borrow, Aave, Compound Finance, and SpectroCoin have rich crypto lending features, and they aim at different users segments.

These platforms continue providing seamless access to liquidity against crypto assets, be it high LTV ratios loans, no-KYC loans, decentralized protocols, or fiat integrated services. These platforms are beneficial to all users within the crypto ecosystem, be it casual users or sophisticated investors, offering unique features tailored for everyone.

FAQ

What is a crypto lending platform?

A crypto lending platform allows users to borrow fiat or stablecoins by using their cryptocurrency as collateral. It also lets users earn interest by lending out their crypto assets.

Are crypto loans safe?

Yes, reputable platforms use strong security measures and smart contracts. However, risks like liquidation during market volatility and platform insolvency still exist, so research is essential.

Do I need to pass KYC to get a crypto loan?

It depends on the platform. Centralized platforms like Nexo or Binance Loans require KYC, while decentralized platforms like Aave or Compound typically don’t.