In this article, I will explain bridging tokens between networks which is something very important for every user in the multi-chain crypto universe.

Bridging lets you move assets such as ETH or USDT from one blockchain to another, providing exciting potential for innovation in DeFi, NFTs, and numerous other sectors.

I will walk you through the concepts and demonstrate the most effective and secure methods to accomplish this task.

What Is Token Bridging?

Token bridging is the moving of digital assets across different blockchain networks. Most blockchains work independently, meaning that value tokens such as ETH or USDT are stranded on certain chains and require support in moving freely across chains .

Bridges resolve such issues by locking the original token on the source chain and issuing a wrapped version on the destination chain. Users can access dApps on other chains and lessen fee considerations or obtain different investment options.

Bridging is important supporting cross-chain interoperability in the crypto ecosystem; however, it can be dangerous due to untrusted bridge platforms resulting in smart contract bugs or security vulnerabilities.

How To Bridge Tokens Between Networks

Multichain is one of the most popular user-friendly cross chain bridges supporting a good number of blockchain networks. The following is a simple guide to bridging tokens using Multichain.

Go to the Official Multichain Website

For your safety go to the official Multichain bridge platform at multichain.org.

Connect Your WalletClick “Connect Wallet” and connect your MetaMask, Trust Wallet, or Wallet Connect.

Choose the Destination and Source NetworksIdentify the blockchain (Binance Smart-chain) you want to transfer tokens from and the network (Ethereum) you want to borrow to.

Select the Tokens and AmountPick the tokens you want to borrow (say USDT or ETH) and enter the amount as well.

Check Transaction Fees and ConfirmReview the estimated transaction fees and bridging time, confirm the transaction on your wallet.

Wait for CompletionThe bridge will first lock your tokens on the source chain and then mint wrapped tokens on the destination chain, thus, completing the transfer.

Popular Cross-Chain Bridges

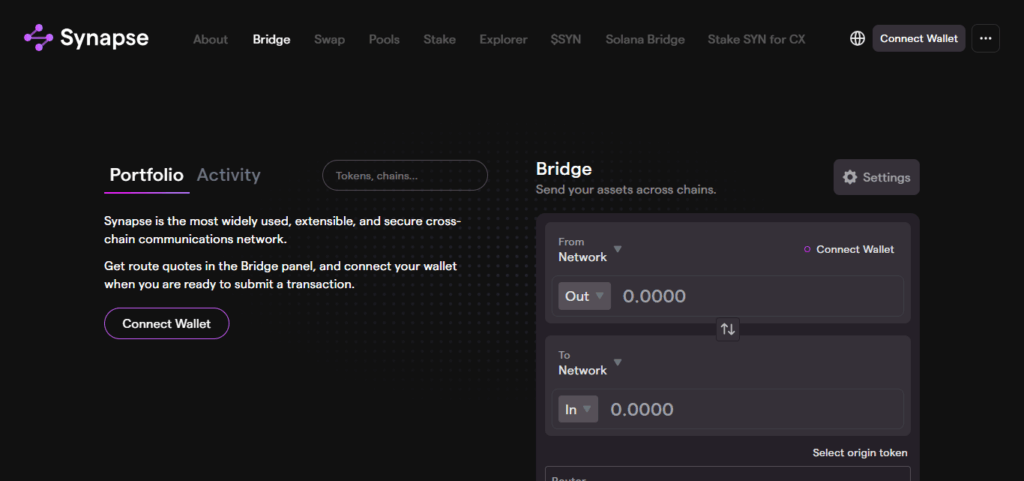

1.Synapse Protocol

The Synapse Protocol functions as a cross-chain bridge to facilitate multi-chain token transfers, operating in a decentralized fashion. This service supports popular chains such as Ethereum, Binance Smart Chain, Avalanche, among others.

Synapse combines liquidity pools and smart contracts to achieve automated bridging. Unlike traditional intermediaries, Synapse relies on decentralized counterparts ensuring security and efficiency. Additionally, it enables cross-chain swaps, letting users bridge and exchange tokens simultaneously.

The emerging community and security audits boost trust- offering low fees and moderate transaction speeds cites Synapse’s appeal for DeFi participants requiring inter-chain fluidity.

2.Portal (Wormhole)

Portal powered by Wormhole is a leading messaging solution and token bridge for cross-chain messaging with Etherem, Solana, Binance smart chain, and Terra.

It allows users to transfer tokens and NFTs from one chain to another by locking the asset on the source chain and minting a wrapped equivalent on the destination chain.

Wormhole employs a decentralized network of guardians for trust-less and secure bridging.

It is extensively used by developers and users interacting with Solana-based projects enabling them to interct with Ethereum and other ecosystems because of its friendly cross-chain asset movement interface.

3.Hop Protocol

Hop Protocol is developed as a rollup-to-rollup bridge and supports fast and efficient token transfer between layer 2 networks and the Ethereum mainnet. It also supports Arbitrum, Optimism, Polygon, and Ethereum.

By utilizing liquidity pools on each chain to enable instant swaps instead of waiting for finality, Hop enables users to bridge assets quickly as opposed to the long waiting time conventionally associated with bridges.

Its design is centered around reducing transaction overhead and enhancing the user experience in multi-chain DeFi ecosystem. It is most popular among traders and DeFi participants who frequently move assets across layer 2 solutions.

4.LayerZero / Stargate

Stargate, an omnichain interoperability protocol that powers a cross-chain liquidity transfer protocol aimed at enabling bridging of native assets across chains.

Unlike wrapped tokens, Stargate moves actual tokens between blockchains, which permits true liquidity portability.

It connects networks including Ethereum, Avalanche, and Binance Smart Chain, among others, and uses LayerZero’s ultra-light nodes to aids in security and efficient communication.

Stargate’s design enables instant finality and reduction in bridging costs so that DeFi users as well as developers have enhanced adoption incentives.

Enhancing security with each cross-chain transaction is made possible by the unified messaging LayerZero provides that enables execution of cross region transactions.

Common Use Cases for Bridging Tokens

Expansion of Investment Opportunities: Users bridge tokens to take part in the DeFi protocols which exist on different blockchains for investment and yield opportunities.

Saving on Transaction Fees: Transferring tokens to a network with lower gas fees, for instance from Ethereum to Polygon, allows users to save on expensive transaction costs.

Moving NFTs Across Chains: Bridging tokens allows the use and transfer of NFTs across different blockchain ecosystems to increase exposure and flexibility.

Arbitrage and Trading: Traders exploit the price discrepancies between chains by quickly moving assets using bridging.

Providing Cross-Chain Liquidity: Users enhance their returns by contributing liquidity on different chains through bridging tokens.

Gaming and Metaverse Participation: Gamers bridge tokens to take part in blockchain-based games and virtual worlds which are hosted on different chains.

Tips for Safe Token Bridging

Official Bridges Should Be Used: Access bridges only from their official websites or trusted platforms to avert phishing schemes.

URLs Should Be Checked Most Carefully: When connecting your wallet, make sure to verify the website’s address well to avoid fake sites.

Start With Smaller Amounts: In case something goes wrong, you can test whether the bridge works by transferring a smaller amount of tokens first.

Token Compatibility Must First Be Confirmed: Ensure that the token you wish to bridge is available on the source and destination chains.

Monitor Peripheral Security Closely: Makr hardware citadel wallets or high security password protected wallets with two factor authentication to keep your wallet secure.

Keep Track of the Fees and Time Estimations: Seeing the estimated time spent gas fees will allow for time management to avoid waiting and frozen transactions.

Look Into The Bridge Audit History: Bridges that get checked regularly for security breaches and active developers are preferred.

Conclusion

In summary, facilitating the movement of assets between different blockchains using bridging tokens opens new opportunities within the crypto ecosystem.

By employing secured bridges and taking proper precautions, users can transfer assets across different blockchains in an effective and safe manner.

Regardless of the purpose, be it trading, engaging in DeFi, or exploring NFTs, knowing how to maneuver through the process of bridging assets is vital for optimization in today’s multi-chain environemnt.