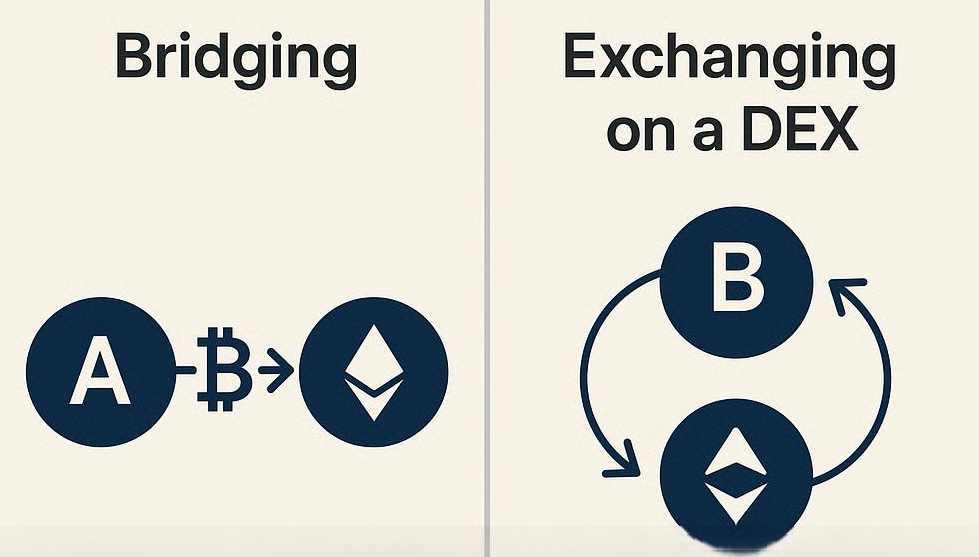

In this article, I will discuss the Bridging vs Exchanging on a DEX, highlighting when to use each, the various risks, and their ideal scenarios.

Whether you want to exchange a token for stablecoin or move value from one blockchain to another, knowing the mechanics at play will let you make smarter decisions.

This guide aims to clarify both methods so you can align them with your broader crypto strategy, always prioritizing security and operational efficiency.

What is Bridging ?

Bridging in crypto is all about shifting your digital assets from one blockchain to another. It lets you move tokens—say, ETH—across ecosystems like Ethereum, BNB Chain, Polygon, or Arbitrum.

The magic happens through dedicated bridging protocols: they lock your original token on the source chain and then create a wrapped token on the target chain.

This method is critical for tapping into dApps, DeFi protocols, and liquidity pools scattered across multiple networks, giving users more flexibility and access to a broader range of financial opportunities.

What is Exchanging on a DEX?

When you trade cryptocurrencies on a decentralized exchange (DEX), you’re swapping one token for another directly on the same blockchain. There are no middlemen; smart contracts run the trades between peers. DEXs such as Uniswap or SushiSwap let you instantly change ETH for USDC or any ERC-20 token on Ethereum.

The trades happen quickly, are usually cheaper, and you won’t need to create an account. The key difference from bridging is that the whole swap stays on one chain, so it’s straightforward and carries less risk for routine swaps.

Key Differences Between Bridging vs Exchanging on a DEX

| Feature | Bridging | Exchanging on a DEX |

|---|---|---|

| Purpose | Move assets across different blockchains | Swap tokens within the same blockchain |

| Blockchain Scope | Cross-chain (e.g., Ethereum ↔ BNB Chain) | Intra-chain (e.g., ETH ↔ USDC on Ethereum) |

| Speed | Slower (can take minutes to hours) | Faster (usually seconds) |

| Tools Used | Bridges (e.g., Synapse, Across, Wormhole) | DEXs (e.g., Uniswap, SushiSwap, PancakeSwap) |

| Complexity | Higher, often involves token wrapping | Simpler, one-step swaps |

| Fees | Gas + bridge + protocol fees | Gas + liquidity provider fees |

| Risks | Higher (bridge hacks, delays, smart contract risks) | Lower (slippage, MEV bots) |

| Use Case | Needed to access assets or dApps on other blockchains | Ideal for quick token swaps on the same chain |

| Wallet Compatibility | May require multi-chain wallets | Standard Web3 wallets are usually enough |

When to Use Exchanging vs Bridging

Pick Swapping on a DEX When

- You’re trading tokens within the same blockchain (like ETH to USDT on Ethereum).

- You want speed and simplicity with the least hassle.

- You’re looking to cut down on fees and risks (swapping usually costs less).

- You’re on DEXes such as Uniswap, SushiSwap, or PancakeSwap.

- You’re never leaving that chain—no need for dApps or assets on other chains.

Choose Bridging When:

- You need to shift assets between blockchains (like Ethereum to Arbitrum).

- You’re jumping into a dApp, liquidity pool, or DeFi project on a different network.

- You want to grab lower fees or quicker performance on the new chain.

- You’re juggling assets across multi-chain DeFi strategies.

- You’re aware of the security trade-offs and wait times that come with each bridge.

Security Considerations

Bridging Security Considerations

Target for Hackers: Bridges’ complex cross-chain logic makes them attractive hacking prizes; many past exploits prove the risk.

Stuck Transactions: Transfers can stall between networks, leaving assets in limbo and fees still charged.

Wrapped Asset Dependence: When you receive a wrapped token, it hinges on the bridge’s ability to redeem it; any breach can dilute its value.

Phishing Bridges: Fraudulent sites can mimic real bridges; always double-check the URL you’re using.

Audit and Track Record: Use only bridges with clear, independent audits and a history of safe operation.

DEX Exchanging Security Considerations

Price Slippage: Sudden market moves can change the quoted rate between confirmation and settlement, costing you more.

MEV Exposure: Bots can detect your transaction and reorder it to siphon value; use gas limits and privacy-focused wallets if concerned.

Contract Vulnerabilities: Unreviewed or buggy DEX contracts can freeze or drain liquidity; never assume a DEX is safe by default.

Approval Dangers: If a DEX’s contract is compromised after you approve tokens, your wallet can be drained; use approve-and-revoke tools for each session.

Stick to Trusted DEXs: Favor platforms with publicly verified contracts, active audits, and responsive user communities.

Pros & Cons Bridging vs Exchanging on a DEX

Pros & Cons Bridging

| Pros | Cons |

|---|---|

| Enables cross-chain asset transfers | Slower and more complex process |

| Access to dApps, DeFi, and liquidity pools on other networks | Higher risk of smart contract or bridge hacks |

| Helps reduce fees or gas costs by moving to cheaper chains | May involve wrapped tokens with dependency on third-party protocols |

| Expands trading and investment options across ecosystems | More fees (gas, bridge, protocol) and potential delays |

Pros & Cons Exchanging on a DEX

| Pros | Cons |

|---|---|

| Fast, simple, and user-friendly | Limited to tokens on the same blockchain |

| Lower security risks compared to bridging | Slippage and MEV attack risks |

| Direct token swaps with no wrapping involved | Less flexibility in multi-chain strategies |

| Often lower fees than bridging | Cannot access dApps or liquidity on other blockchains |

Conclusion

Grasping how bridging and exchanging on a DEX differ is key for navigating DeFi wisely and safely. Exchanging is quick and straightforward, perfect for swapping tokens on the same chain, while bridging lets you transfer assets between chains, opening up a wider range of DeFi possibilities.

Both methods come with distinct risks, costs, and scenarios where they shine. Recognizing the right moment and technique for each lets you streamline your crypto approach and sidestep excessive headaches or setbacks.

FAQ

What is the main difference between bridging and exchanging?

Bridging moves tokens across different blockchains, while exchanging swaps tokens within the same blockchain.

Is bridging more risky than exchanging?

Yes, bridging carries higher risks due to smart contract vulnerabilities, delays, and potential bridge exploits.

Do I need a different wallet for bridging?

Not always. Most modern Web3 wallets like MetaMask support multiple chains, but some bridges may require custom network setups.