In this article, I will discuss the Top Bridging Protocols for Ethereum Alternatives, tools that let users move assets smoothly, quickly, and safely between chains.

These bridges matter when you step outside the Ethereum network, since they keep costs low, ask little personal info, and work with many blockchains. Whether your goal is sending tokens or diving into cross-chain DeFi, the right protocol will make interoperability feel easy and natural.

Key Point & Top Bridging Protocols for Ethereum Alternatives List

| Bridge Protocol | Key Point |

|---|---|

| Portal (Wormhole) | Connects over 20 blockchains with fast, decentralized cross-chain transfers. |

| Across Protocol | Optimized for Ethereum L2 bridging with low slippage and fast finality. |

| Stargate Finance | Offers native asset bridging with unified liquidity and instant swaps. |

| Orbiter Finance | L2-to-L2 bridge with minimal fees and gas-efficient transaction execution. |

| Hop Protocol | Uses Bonders for fast bridging between Ethereum and L2 chains like Arbitrum. |

| Allbridge | Supports EVM and non-EVM chains with simple UI and broad chain coverage. |

| Arbitrum Bridge | Official bridge for Ethereum to Arbitrum with full security and native assets. |

| Celer cBridge | Liquidity-based bridge with low fees and broad multichain support. |

| Rango Exchange | Aggregates multiple bridges and DEXs for optimal cross-chain routes. |

| RhinoFi | Layer 2 gateway offering fast, gas-free bridging with minimal KYC. |

1.Portal Token Bridge (Wormhole)

Wormholes Portal Token Bridge is the go-to cross-chain tool for users looking to move assets off Ethereum, thanks to its broad multichain reach. It now links more than twenty networks, from Solana and BNB Chain to Avalanche and Polygon, letting people send tokens quickly and without a single point of control.

Their robust Guardian Network, made up of independent validators, guards every transfer and keeps security decentralized. By handling both wrapped and native coins, Wormhole gives apps and users the freedom to anchor liquidity wherever it is needed most, reinforcing its role as a gateway beyond Ethereums borders.

| Feature | Details |

|---|---|

| Name | Portal Token Bridge (Wormhole) |

| KYC Requirement | Minimal or none for standard bridging |

| Supported Chains | 20+ including Solana, Ethereum, BNB Chain, Avalanche, Polygon |

| Asset Type | Native and wrapped tokens |

| Security Model | Guardian Network (decentralized validators) |

| Speed | Fast finality, varies by chain |

| Use Case | Cross-chain token transfers, DeFi, NFT movement |

| Unique Advantage | Broadest multichain coverage with no centralized custody |

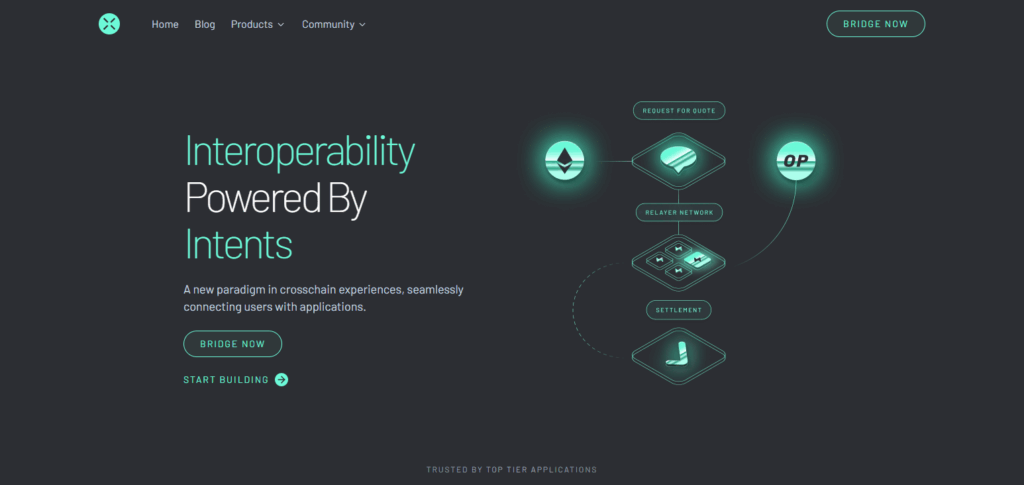

2.Across Protocol

Across Protocol is quickly becoming the go-to bridge for users moving assets between Ethereum and its growing roster of alternative chains. Its trusted optimistic model relies on off-chain relayers and a unified liquidity pool on Ethereum, keeping slippage low and fees light.

By pooling capital rather than scattering it across multiple bridges, Across cuts through the usual confusion and danger that come with fractured liquidity. The protocol is especially tuned to Layer 2 ecosystems like Arbitrum and Optimism, delivering speedy, secure cross-chain transfers while behaving much like an Ethereum-native transaction in terms of finality and safety.

| Feature | Details |

|---|---|

| Name | Across Protocol |

| KYC Requirement | Minimal or none |

| Supported Chains | Ethereum, Arbitrum, Optimism, Base, Polygon, Avalanche |

| Asset Type | Native tokens |

| Security Model | Optimistic bridge with relayers and a single liquidity pool on Ethereum |

| Speed | Near-instant transfers with optimistic confirmation |

| Use Case | L2-to-L1 and cross-L2 bridging with capital efficiency |

| Unique Advantage | Unified liquidity and low slippage for fast, secure transfers |

3.Stargate Finance

Stargate Finance stands out as the leading bridging protocol for Ethereum-adjacent chains because it allows users to move native tokens without the extra step of wrapping. Powered by LayerZero’s omnichain messaging, it pools all liquidity in a single, shared reservoir, drastically cutting the fragmentation seen in older bridges.

This architecture delivers instant, guaranteed finality and removes the once-common problems tied to mismatched liquidity. With major networks like BNB Smart Chain, Avalanche, and Fantom deeply connected, Stargate opens up a reliable, efficient pathway for DeFi users aiming to expand beyond Ethereums crowded playground.

| Feature | Details |

|---|---|

| Name | Stargate Finance |

| KYC Requirement | Minimal or none |

| Supported Chains | Ethereum, BNB Chain, Avalanche, Polygon, Fantom, Arbitrum, Optimism |

| Asset Type | Native tokens (no wrapping) |

| Security Model | Built on LayerZero’s omnichain messaging with unified liquidity |

| Speed | Instant finality with guaranteed destination execution |

| Use Case | Cross-chain DeFi, stablecoin transfers, native asset swaps |

| Unique Advantage | Single liquidity pool per asset, eliminating fragmentation |

4.Orbiter Finance

Orbiter Finance has quickly become the go-to bridging protocol for Ethereum Layer 2 networks thanks to its dedicated L2-to-L2 transfer focus. Users can move funds between big rollups such as Arbitrum, Optimism, and zkSync nearly instantly and at minimal cost, all while the protocol’s streamlined engineering keeps gas expenses low.

Rather than depending on giant liquidity pools like many rival bridges, Orbiter adopts a maker-relayer model that settles trades in real time. That approach not only cuts delays but also boosts security, giving users a dependable and scalable way to shift assets across Ethereum’s expanding rollup ecosystem.

| Feature | Details |

|---|---|

| Name | Orbiter Finance |

| KYC Requirement | None |

| Supported Chains | Ethereum, Arbitrum, Optimism, zkSync, Linea, Base, Scroll |

| Asset Type | Native tokens (mainly ETH and stablecoins) |

| Security Model | Maker-relayer model with on-chain settlement |

| Speed | Fast L2-to-L2 transfers |

| Use Case | Efficient Layer 2 bridging with low gas fees |

| Unique Advantage | Specialized in L2-to-L2 bridging without relying on large liquidity pools |

5.Hop Protocol

Hop Protocol has emerged as the leading bridge for Ethereums growing array of Layer-2 chains, largely because it focuses on fast, scalable transfers. Its standout bonded model provides immediate liquidity, letting users send assets almost instantly instead of waiting for the source chains finality.

By combining this approach with Ethereums security checks, Hop keeps latency low while protecting funds. The protocol handles native tokens directly, sidestepping cumbersome wrapping steps that can confuse newcomers or clog rollups. By prioritizing smooth interaction and Layer-2 efficiency, Hop has become essential for anyone looking to expand Ethereums reach.

| Feature | Details |

|---|---|

| Name | Hop Protocol |

| KYC Requirement | None |

| Supported Chains | Ethereum, Arbitrum, Optimism, Polygon, Gnosis |

| Asset Type | Native tokens and hTokens (Hop’s intermediate token) |

| Security Model | Bonder-based liquidity with fraud-proofed transfers |

| Speed | Near-instant L2-to-L2 and L2-to-L1 transfers |

| Use Case | Cross-rollup DeFi transactions and fast asset bridging |

| Unique Advantage | Bonders front liquidity for speed without compromising security |

6.Allbridge

Allbridge has earned its status as a leading bridging protocol by bringing together both EVM and non-EVM chains, including Solana and Terra. This broad cross-ecosystem support lets users send assets far beyond Ethereum-focused networks without technical headaches.

Modular architecture further invites projects to build tailored connections, strengthening general interoperability over time. Yet the team keeps things simple, offering a clean interface and clear fees that anyone in DeFi can quickly understand. With deep connectivity and such an accessible design, Allbridge plays a central role in the ongoing shift to multichain token travel.

| Feature | Details |

|---|---|

| Name | Allbridge |

| KYC Requirement | None |

| Supported Chains | Ethereum, BNB Chain, Solana, Polygon, Avalanche, Tron, Near, and more |

| Asset Type | Native and wrapped tokens |

| Security Model | Validator-based system with smart contract controls |

| Speed | Moderate to fast, depending on chain pair |

| Use Case | Cross-ecosystem asset transfers (EVM and non-EVM) |

| Unique Advantage | Supports both EVM and non-EVM chains with a simple UI and wide coverage |

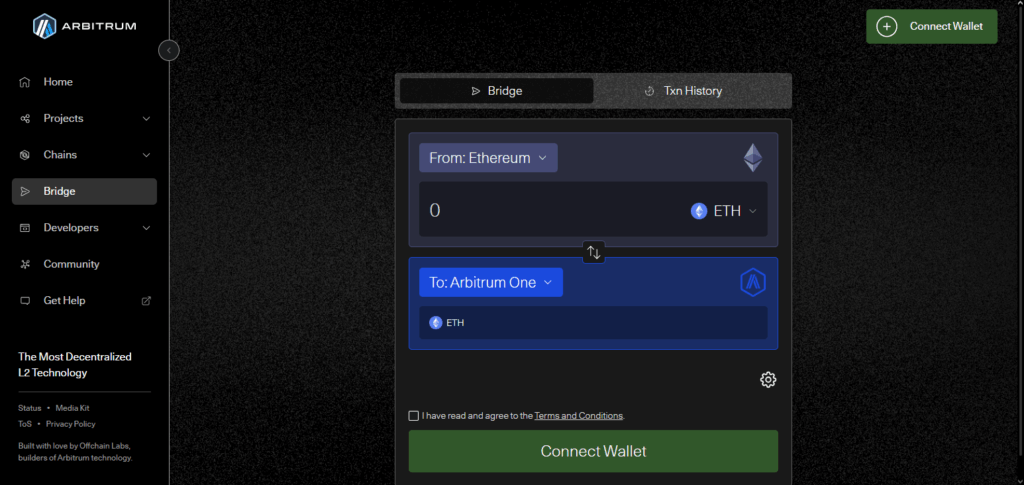

7.Arbitrum Bridge

Arbitrum Bridge stands out among cross-chain tools for Ethereum alternatives because it provides a secure and native pathway between mainnet Ethereum and the Arbitrum Layer 2 sidechain. Built by Offchain Labs, the official bridge directly inherits Ethereums consensus guarantees, letting users transfer ETH and ERC-20 tokens with minimal delay and cost.

A trustless design means customers never depend on centralized actors, and smooth compatibility with Arbitrums expanding dApp ecosystem makes the service particularly attractive to developers chasing scalable solutions.

| Feature | Details |

|---|---|

| Name | Arbitrum Bridge |

| KYC Requirement | None |

| Supported Chains | Ethereum ↔ Arbitrum One / Arbitrum Nova |

| Asset Type | Native ETH and ERC-20 tokens |

| Security Model | Trustless rollup architecture secured by Ethereum |

| Speed | Fast deposits; withdrawals take ~7 days due to fraud-proof window |

| Use Case | Secure L1-to-L2 and L2-to-L1 asset transfers |

| Unique Advantage | Official, most secure bridge for Arbitrum ecosystem with native token support |

8.Celer cBridge

Celer cBridge has quickly become the go-to bridging service for Ethereum-adjacent chains, thanks to its liquidity-first design and wide multichain reach. Covering more than forty networks, it lets users send tokens almost instantly and for a fraction of the cost, all without needing wrapped versions of those tokens.

The addition of the State Guardian Network SGN brings decentralized security and reliable message checks, so participants can move funds with greater peace of mind. Because cBridge plugs smoothly into both EVM-compliant and non-EVM blockchains, developers and everyday users alike can shift assets across the broader crypto landscape far beyond Ethereums borders.

| Feature | Details |

|---|---|

| Name | Celer cBridge |

| KYC Requirement | None |

| Supported Chains | Ethereum, BNB Chain, Avalanche, Polygon, Arbitrum, Optimism, Fantom, more |

| Asset Type | Native tokens (no wrapping required) |

| Security Model | State Guardian Network (SGN) for decentralized verification |

| Speed | Fast finality with low fees |

| Use Case | Multichain token transfers across both EVM and non‑EVM ecosystems |

| Unique Advantage | Extensive chain coverage and low-cost bridging with robust security |

9.Rango Exchange

Rango Exchange has quickly risen to prominence as the leading bridge for users moving assets off Ethereum while maintaining cross-chain flexibility. Instead of treating each destination chain as a separate gate, Rango meshes dozens of bridges and DEXs into one streamlined dashboard, letting anyone see and pick the quickest route with a single click.

Behind that interface, an adaptive smart router examines more than sixty blockchains-EVM, Cosmos, and their cousins-identifies fresh bottlenecks, then pushes transactions along the least-cost, lowest-lag path. By taking that burden off end-users, Rango cuts fees, speeds transfers, and turns what once required charts and dozens of tabs into a calm, single-window experience for multi-hop bridging.

| Feature | Details |

|---|---|

| Name | Rango Exchange |

| KYC Requirement | Minimal or none |

| Supported Chains | Ethereum, BNB Chain, Solana, Polygon, Avalanche, Cosmos, Fantom, and more |

| Asset Type | Native tokens and wrapped assets via integrated bridges and DEXs |

| Security Model | Aggregated bridge + DEX protocols with routing smart contracts |

| Speed | Fast transfers via optimized routing and swap execution |

| Use Case | Multi-hop bridging and asset swaps across wide cross-chain routes |

| Unique Advantage | Aggregates multiple bridges & DEXs into one UI for optimal cost and route |

10.RhinoFi

RhinoFi sets itself apart as one of the leading cross-chain bridges devoted to Ethereum-aligned blockchains, mainly because it prioritizes user privacy and the speed afforded by Layer 2 tech. At its core lies a zk-rollup architecture that turns standard asset swaps into rapid, low-fee operations, while zero-knowledge proofs shield transaction details from prying eyes.

The protocol smoothly links Ethereum with zkSync, offering a blend of high throughput and robust security which current users and developers value. With only basic KYC and a clear pro-privacy stance, RhinoFi quickly attracts anyone looking for fast, discreet cross-chain transfers as the broader Ethereum landscape continues to evolve.

| Feature | Details |

|---|---|

| Bridge Name | RhinoFi (formerly DeversiFi) |

| Founded | 2020 |

| Supported Chains | Ethereum, Arbitrum, Polygon, zkSync, Optimism, Starknet, BSC, Linea, Base |

| Bridge Type | Layer 2 bridge & DEX aggregator |

| KYC Requirement | ❌ No KYC for swaps and bridging |

| Wallets Supported | MetaMask, WalletConnect, Coinbase Wallet, Ledger |

| Fee Structure | Low network fees, no extra platform fee |

| Bridging Time | 2–10 minutes (varies by chain) |

| Token Support | ETH, stablecoins, L2-native tokens |

| Unique Features | Gas-free swaps on L2s, yield vaults, privacy-focused |

| Security Model | Smart contract-based, audited |

| Best Use Case | Fast, low-fee bridging between Ethereum L2s and alt-L1s |

Conclusion

Overall, emerging bridging protocols for Ethereum spin-offs are steadily knitting the wider blockchain world together. Wormhole shines with broad multichain reach, Across Protocol minimizes idle capital, Stargate simplifies native token swaps, and RhinoFi tacks on private transfers.

When pharmacy-like speed, ironclad security, or ecosystem fit take precedence, users can pick the bridge that speaks to them. Collectively, these options trim costs and latency while expanding choice beyond the Ethereum orbit, signaling a bright, interoperable future for decentralized finance.

FAQ

What are bridging protocols for Ethereum alternatives?

Bridging protocols connect Ethereum with other blockchains, allowing users to move assets and data seamlessly across chains like Arbitrum, Polygon, Solana, and others.

Why use a bridge instead of centralized exchanges?

Bridges offer faster, cheaper, and more decentralized transfers without needing to trust a third party or withdraw funds to an exchange.

Which bridge is best for speed and low fees?

Across Protocol and Orbiter Finance are optimized for fast, low-cost transfers, especially between Ethereum Layer 2s.