Introduction

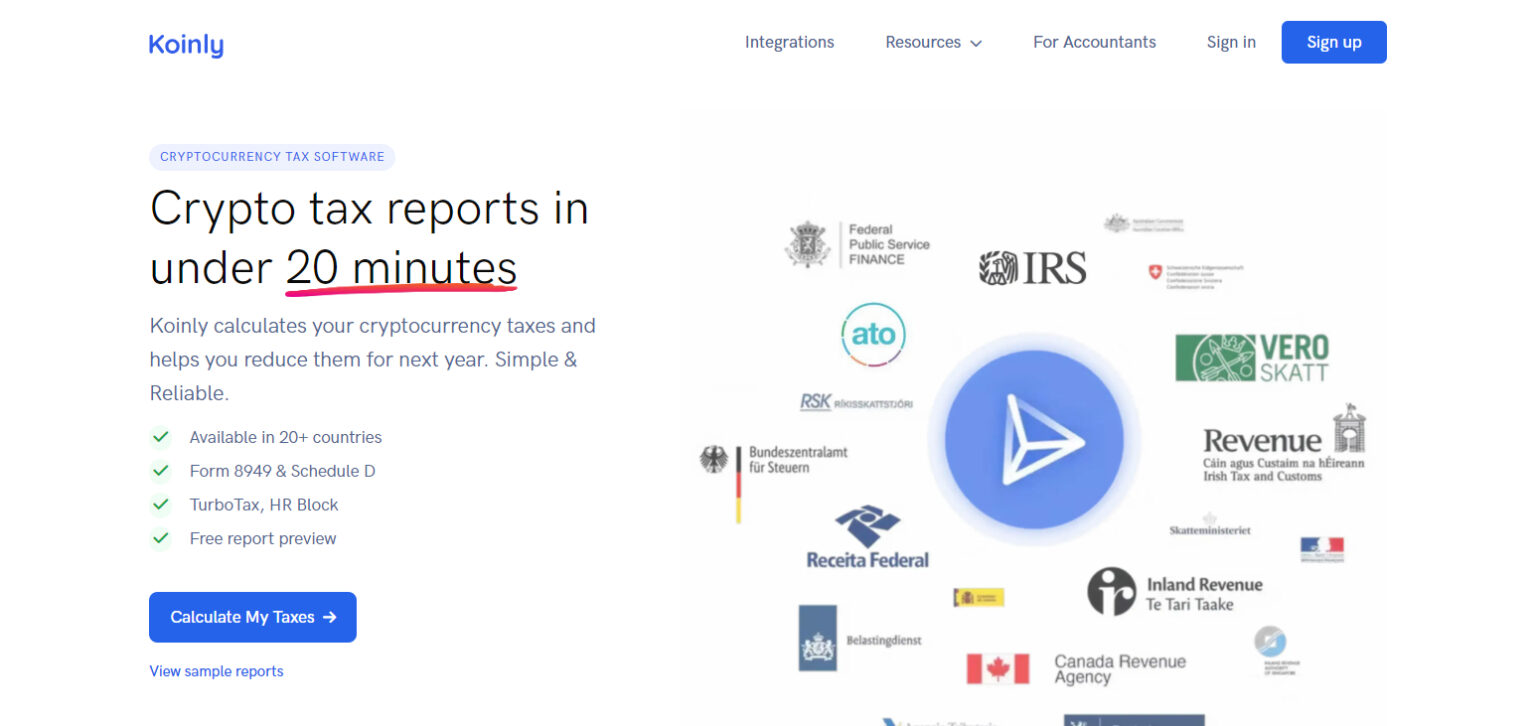

Koinly makes it easy to manage your cryptocurrencies by providing a tax reporting and portfolio management service that integrates with over 800 exchanges, wallets, and blockchains.

With Koinly, not only can you keep track of all your transactions and assets in one platform , simplifying the overview of your investments, but also allow for customized automated tax reporting based on the country you are in.

In addition to the tax report generation, Koinly allows you to track your portfolio on multiple platforms simultaneously, giving you an insight into your profits and losses in real time. Truly any person or accountant looking to simplify their crypto asset management and taxes would find Koinly useful.

| Feature | Details |

|---|---|

| Pricing | $49–$179/year (depending on plan) |

| Free Plan | Yes |

| Exchanges/Wallets Supported | 600+ |

| Tax Reports | Form 8949, Schedule D, FIFO, HIFO, LIFO, Average Cost, expense reports, staking, DeFi, NFT, liquidity pools, and country-specific reports. |

| Advanced Features | Supports DeFi, staking, NFTs, liquidity pools, and more. |

| Accounting Methods | FIFO, LIFO, HIFO, Average Cost |

| Security | Read-only API access and encrypted data storage for privacy and safety |

| Supported Countries | Global, with tailored tax reports for multiple countries (USA, UK, Canada, etc.) |

| Customer Support | Email support and extensive FAQ |

| Ideal For | Crypto traders and investors looking for an easy, automated way to manage crypto taxes. |

| Integrations | Syncs with over 600 exchanges, wallets, and blockchains |

How to Get Started on Koinly?

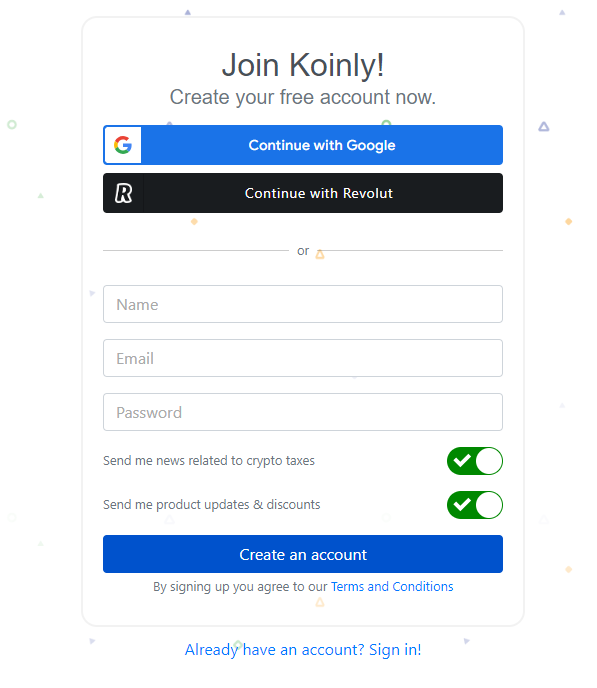

Create an Account

Navigate to the Koinly website and open an account using your email address or Google account. Using either option, set up an account-specific password.

Integrate Your Wallets and Exchanges

After signing up, users are allowed to add their wallets, exchanges or blockchains by connecting through API or uploading CSV files with transaction history. Koinly integrates with more than 600 platforms to make the process seamless.

Assess and Classify your Transactions

The good news is Koinly automatically fetches user transactions. However, this can later be modified as well to declare sold items, traded items be it through buying or staking or NFTs for tax purposes.

Prepare Tax Reports

After you have completed the transactions on Koinly, it will prepare and display all reports as per your country’s instructions (for instance, Form 8949, Schedule D). These can then be sent to your accountant or printed out.

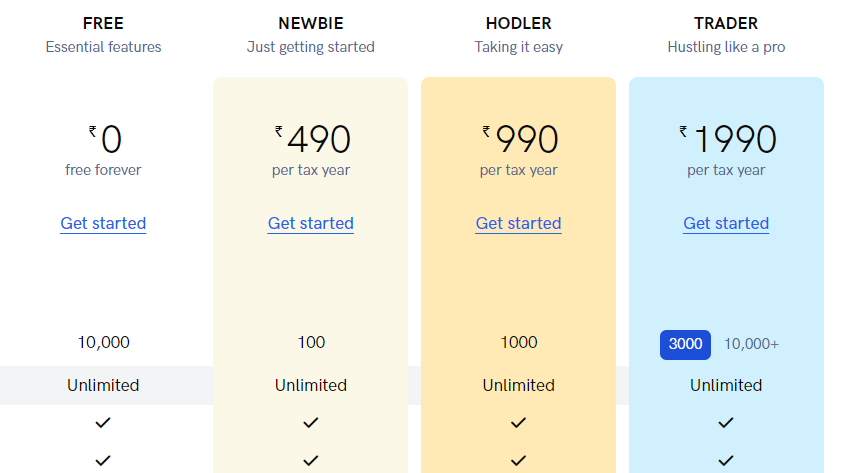

Purchase an Appropriate Pricing Plan

While registering, the user can utilize the free plan to familiarize himself/herself with the options available, the fee free plan provides comparatively limited but helpful features. Then the user may wish to also buy more thorough features such as tax reporting dependent on the animations done on the platform.

Complete Your Tax Returns

For all koinly tax reports freelancers can upload them directly into the software or email them to the accountant for easier filing. Koinly offers comprehensive reports that work with almost all tax filing apps.

Simple Pricing

How Koinly Works?

Koinly manages the complexities of cryptocurrency while calculating taxes in a seamless automated manner and an interactive interface. Below is a guide on how to go about using Koinly stepwise:

Wallets & Exchanges Connection Integrate the Koinly application with your cryptocurrency wallets, exchanges, and blockchains via API or through CSV files. This application entails more than 400 platforms, allowing it to be used with a majority of crypto services.

Transaction Synchronization Koinly syncs and imports all your transactions including trades, transfers, sales and purchases in real time. It detects inaccuracies, duplicates, and omissions to ensure fresh datasets.

Composting Transactions With Koinly, custom transaction types such as ‘gifts’, ‘donations’, and ‘staking’ can be used so that taxes can be calculated accurately.

Making Tax Reports Koinly first reviews all the transactions and then reports on gains/losses/income. Reports are generated on the basis of compliance with IRS guidelines, such as the R form 8949 or capital gains report issued by HMRC.

Reporting Generation Tax reports can be forwarded via accountant or uploaded directly into tax software such as Xero and TurboTax.

The handling of crypto taxes becomes much less burdensome thanks to Koinly, which conserves cash while also minimizing compliance hysteria

Koinly Product

| Product | Description |

|---|---|

| Crypto Tax Reports | Automatically calculates capital gains, losses, and income, generating tax reports tailored to your country’s requirements. |

| Portfolio Tracking | Monitors your crypto assets across multiple platforms, providing real-time insights into holdings, profit and loss statements, and overall portfolio performance. |

| Data Import | Seamlessly connects with over 800 exchanges, wallets, and blockchains to import transaction data automatically. |

| Tax Optimizer | Helps optimize tax reporting by selecting the most favorable accounting methods (e.g., FIFO, LIFO, Average Cost). |

| DeFi & NFT Support | Tracks transactions related to decentralized finance (DeFi) and non-fungible tokens (NFTs). |

| Wallet-Based Cost Tracking | Tracks the cost basis of assets based on the specific wallet they are held in. |

| Transaction Filtering | Allows advanced filtering of transactions to focus on relevant data for tax reporting. |

| Bulk Editing & Rules | Facilitates bulk editing of transactions and setting up rules for automated categorization. |

| Spam Detection | Identifies and excludes spam transactions to ensure accurate reporting. |

| Audit Reports | Generates comprehensive audit reports to verify the accuracy of tax filings. |

Koinly Features

Automatic Syncing

With Koinly taxes can be prepared quickly and much more easily because it has the ability of automatic integration with over 600 wallets, exchanges, and blockchains through uploading CSV files or API’s. It lets the user rest easy in terms of tracking their crypto activities as it has sheer accuracy in reporting the data for tax purposes.

Tax Reports That Are Perfectly Accurate

When it comes to Tax reporting or documentation, Koinly provides features such as fourteen forms, mix of forms, including tax reporting and documentation and complete expense summary, including Form 8949 and Schedule D, giving the service a solid foundation, thanks to its support of multiple ways of computing stocks costs including FIFO, HIFO, LIFO, Average Cost, Tax laws in several countries are now easy to navigate since taxpayers are able to compile all the reports into one document.

Support for All Activities Involved in Crypto

Getting into advanced features like DeFi staking, NFTs, or liquidity pool transactions can get very confusing when it comes to knowing their tax implications. The platform helps in resolving the problem by ensuring proper encryption while tax processing which helps boost its credibility. All these features make it a perfect fit for serious users looking for facilitation while dealing with complex financial activities.

Room for Improvement

The room for improvement in the service is without a doubt the Koinly’s interface as it is more focused on the wide range of features making the offering suitable for both newbies and experienced investors while the ability to quickly summarize portfolio efficiency and tax burden doesn’t make the use of service a challenge.

Tax Compliance Around the Global Sphere

Koinly has extended support to tax frameworks of numerous countries including US, Canada and Pillar 2 type, thus ensuring that local laws are catered to.

For those users from the US, UK, Canadian or other regions filing their taxes using Koinly will have no issues because the platform provides the tools to prepare accurate regional reports.

Increased Security

Koinly values user privacy. It employs read-only API interfaces and also encodes all information that is kept in the company’s storage which guarantees security. Such a solid security system makes it worry free to handle sensitive financial details.

Free and Customizable Plans

One free plan is for utility explorers, and the rest are paid and user oriented/ budget accommodating. It’s low cost pricing ensures that the platform is accessible to a range of users from those that use it occasionally to day traders and other active investors who have large transaction volumes.

Which Nations Are Covered By Koinly When it Comes To Tax Calculation?

Koinly allows cryptocurrency holders from most countries to prepare their tax reports, including the countries identified below.

The Americas – United States of America, Canada

Europe – United Kingdom, Germany, Sweden, Denmark, Finland, Norway, Netherlands, France, Spain, Italy, Austria, Lichtenstein, Ireland, Czech Republic, Estonia, Malta

Asia – Japan, South Korea, Singapore

Oceania – Australia, New Zealand

Comparing Koinly with Other Crypto Tax Calculators and Reporting Software

| Crypto Tax Software | Pricing | Free Plan Available | Exchanges/Wallets/Services to Integrate | Reports to Generate |

|---|---|---|---|---|

| Koinly | $49–$179/year | Yes | 600+ | FIFO, HIFO, LIFO, Average Cost, Form 8949, Schedule D, expense and fee reports, etc. |

| CoinTracking | $10.99–$54.99/month (custom corporate plans available) | Yes | 100+ | LIFO, HIFO, LOFO, HPFO, LPFO, HAFO, LAFO, AVCO, OPTI, ZERO. Income and capital gain tax reports. |

| Coinpanda | $49–$189 (100 to 3000+ transactions) | Yes | 800+ | Form 8949, Schedule D, K4 blanketten (Sweden), RF-1159 (Norway), among others. |

| Accointing | $79–$299 | Yes | 300+ | FIFO, LIFO, HIFO, and formal tax reports tailored to various countries’ regulations. |

| TokenTax | $65–$2,500/year | No | 85+ | IRS Form 8949, capital gain and income tax reports, audit trail report, tax loss harvesting, mining/staking income, ETH gas fees, FBAR, and international reports. |

Koinly Pros & Cons

Pros

Numerous Integration Options Koinly integrates with more than 600 exchanges, wallets, and blockchains, automating transaction syncing and making it functional with the majority of crypto applications.

Tax Filing Reports Production with High Level of Accuracy Encompasses various tax compliance requirements as it prepares global tax reports including Form 8949 or Schedule D and many more.

Designed Interface that is Easy to Use Both inexperienced and experienced users can perform tasks such as searching through transactions, managing them, or generating reports due to the easy interface.

Great Support for Advanced Crypto Activities Manages sophisticated activities such as DeFi staking NFTs and liquidity pools to develop advanced tax approaches for skilled users.

Dependable and Safe Guarantees user confidentiality and security through read-only access to APIs and encrypted databases.

Price is Flexible Offers free options for testing the application and reasonably priced paid subscriptions for various transaction amounts and types.

Cons

Free Plans are Limited in Scope Doesn’t generate tax reports, which the paid subscription is needed to do along with the minimal number of functionalities on the free subscription.

Frequent Traders will Face High Charges Heavy transaction users may find it costly to use Koinly and for traders it is unfeasible due to the increased costs.

No 24/7 Support Services Support services depend on emails and FAQs which results in users who need support instantaneously getting slow responses.

May Need Manual Changes as Well Tthere can be the necessity to do manual tagging also in certain categories of transactions so as to account for tax liability properly, thus increasing the workload.

Is Koinly Safe?

Yes, Koinly is considered reliable for filing your crypto taxes and managing your portfolio. Koinly implements various security features including two factor authentication, data encryption, and regular security audits which help in identifying any existing vulnerabilities.

Besides, Koinly cold stores most of its funds off the internet and thus minimizes hacking risks as no internet connection is available.

Most Koinly customers have also spoken highly on their customer care support which is readily available and helpful during security issues. All in all, Koinly is a safe and easy portal to use for all your dealings with crypto taxes and investment.

Conclusion

Koinly is an excellent Tax reporting tool which allows for easy integration with over 600 blockchain networks as well as wallets, exchanges and even traders. It is a great tool to use by casual and active investors alike due to its ease of use and robust security features.

It’s attention to countries specific regulations means that it provides great support for all kinds of crypto activities and simplifies tax management on the whole. Overall, the tools provided by Koinly in the form of its intuitive interface and various pricing models help keep its users and their investments stress free.