In this article,I will discuss the Top Bridging Aggregator For Polygon Network, centering on protocols that deliver rapid, secure, and cost-effective cross-chain asset mobility.

These aggregators empower users to shuttle funds to and from Polygon with only the lightest KYC burden, which suits DeFi traders who demand frictionless interoperability with chains like Ethereum, BNB Chain, Arbitrum, and more.

Key Point & Top Bridging Aggregator For Polygon Network List

| Platform | Key Point |

|---|---|

| Rango Exchange | Multi-chain DEX aggregator supporting wallets and chains like Cosmos, EVM. |

| Bungee Exchange | Cross-chain bridge aggregator with fast routing and minimal slippage. |

| DeBridge | Decentralized messaging and liquidity protocol for secure cross-chain swaps. |

| Symbiosis Finance | Seamless stablecoin and token swaps across multiple blockchains. |

| Swoop Exchange | Aggregates liquidity from multiple bridges and DEXs for cost-effective swaps. |

| OpenOcean | Leading DEX and CeFi aggregator offering lowest slippage swaps. |

| Matcha (0x) | Aggregates DEX prices to offer best execution via 0x Protocol. |

| Orbiter Finance | Optimized for fast and cheap cross-rollup ETH and token transfers. |

| Across Protocol | Fast, secure Layer-2 bridge using optimistic relays and single-liquidity pools. |

1.Rango Exchange

Rango Exchange immediately catches the eye as the premier bridging aggregator for Polygon, chiefly because it integrates multiple blockchains and wallet connections within a single on-ramp.

Its defining advantage is the way it collates a variety of bridges and decentralized exchanges, directing users along the path of least resistance for each asset move, thereby trimming slippage and cutting costs.

Tailored for Polygon, Rango enables lightning-fast cross-chain swaps from a roster of more than sixty networks—ranging from Cosmos to all EVM-compatible chains—making it the single-stop gateway that developers and traders alike rely on for streamlined access to the Polygon ecosystem.

| Feature | Details |

|---|---|

| Platform Name | Rango Exchange |

| Network Support | 60+ chains including Polygon, Ethereum, BNB Chain, Cosmos, Avalanche |

| KYC Requirement | Minimal or No KYC for most operations |

| Bridge Aggregation | Aggregates top bridges like Multichain, Celer, Wormhole, etc. |

| Wallet Support | Compatible with MetaMask, Keplr, Trust Wallet, and more |

| Unique Feature | Supports both EVM and non-EVM chains in a single interface |

| Transaction Speed | Fast routing with automatic bridge selection |

| User Interface | Intuitive design for one-click cross-chain swaps |

| Security | Non-custodial; relies on underlying bridge security |

| Target Use Case | Seamless asset transfers to/from Polygon across multiple chains |

2.Bungee Exchange

Bungee Exchange has become the go-to cross-chain bridging aggregator for the Polygon Network, thanks to its relentless emphasis on speed, security, and a seamless user journey.

The platform’s intelligent routing engine analyzes a wide array of bridges and pathways, algorithmically identifying the quickest and least expensive route to Polygon every time. What truly sets Bungee apart, however, is its unwavering commitment to user safety, featuring dynamic slippage controls and built-in security validations.

This combination ensures that anyone moving assets to Polygon encounters minimal friction, enjoying a dependable transfer that never sacrifices speed or cost-effectiveness.

| Feature | Details |

|---|---|

| Platform Name | Bungee Exchange |

| Network Support | Multiple chains including Polygon, Ethereum, Arbitrum, Optimism, BNB Chain |

| KYC Requirement | Minimal or No KYC required |

| Bridge Aggregation | Aggregates top bridges like Hop, Connext, Celer, Across, and more |

| Wallet Support | Supports MetaMask, WalletConnect, Coinbase Wallet, and others |

| Unique Feature | Smart routing engine selects best route based on speed, cost, and reliability |

| Transaction Speed | Fast execution using optimized paths |

| User Interface | Clean, interactive UI with clear route breakdowns |

| Security | Non-custodial, depends on selected bridge protocols |

| Target Use Case | Quick and reliable bridging into Polygon with low fees |

3.DeBridge

DeBridge has emerged as the leading bridging aggregator for the Polygon Network, thanks to its robust infrastructure designed for secure, decentralized cross-chain connectivity.

Users can execute native asset transfers alongside generalized message passing, empowering developers to create intricate cross-chain applications that seamlessly engage the Polygon ecosystem.

What distinguishes DeBridge is its validator-based security model combined with flexible routing options, delivering transfers that are not just speedy but also exceptionally dependable. This capability makes DeBridge an indispensable tool for developers and users looking to weave Polygon into expansive, multi-chain architectures.

| Feature | Details |

|---|---|

| Platform Name | DeBridge |

| Network Support | Supports Polygon, Ethereum, BNB Chain, Arbitrum, Avalanche, and more |

| KYC Requirement | Minimal or No KYC required |

| Bridge Aggregation | Native bridging with support for cross-chain message passing |

| Wallet Support | Compatible with MetaMask, WalletConnect, and other major wallets |

| Unique Feature | Validator-based security with generalized message passing |

| Transaction Speed | Fast settlement with optimized bridge routing |

| User Interface | Developer-friendly and simple interface for users |

| Security | Decentralized validator layer and optimistic validation model |

| Target Use Case | Secure, programmable cross-chain asset and data transfers to Polygon |

4.Symbiosis Finance

Symbiosis Finance has emerged as the leading bridging aggregator on the Polygon Network by turning the cumbersome process of cross-chain swaps into a simple, single-click experience for stablecoins and tokens flowing between chains.

Its standout capability is the liquidity aggregation service that bridges EVM and non-EVM networks alike, giving users a broad, interoperable reach.

Polygon users, in particular, benefit from swift, low-gas bridges that don’t require wallet changes or interface swaps. This frictionless process has naturally positioned Symbiosis as the go-to solution for traders and developers alike, deeply embedded within the Polygon ecosystem.

| Feature | Details |

|---|---|

| Name | Symbiosis Finance |

| Type | Cross-chain DEX Aggregator & Bridge |

| Supported Chains | Polygon, Ethereum, BNB Chain, Avalanche, Arbitrum, Optimism, zkSync etc. |

| Best For | Seamless multi-chain token swaps and bridging to Polygon |

| KYC Requirement | Minimal KYC (No KYC for most swaps; depends on provider) |

| User Interface | Web-based DApp with user-friendly design |

| Token Support | ERC-20 and native tokens across EVM-compatible chains |

| Fees | Variable gas fees + low swap/bridge fee (displayed before confirming) |

| Wallet Compatibility | MetaMask, WalletConnect, Trust Wallet, Coinbase Wallet, etc. |

| Security | Audited smart contracts, non-custodial architecture |

| Extra Features | Aggregates best routes automatically for cost-efficiency |

| Official Website | https://symbiosis.finance |

5.Swoop Exchange

Swoop Exchange stands out as the leading bridging aggregator for the Polygon Network, seamlessly merging multiple bridge and DEX leg routes into a single, optimized transaction. It intelligently gathers liquidity from a wide array of protocols, guaranteeing the most favorable exchange rates and minimal slippage when moving assets onto Polygon.

What differentiates Swoop is its strong focus on gas efficiency and user-centric design, enabling users to complete intricate cross-chain operations in a single step. This smooth, all-in-one approach is tailor-made for users who frequently transact on Polygon.

| Feature | Details |

|---|---|

| Name | Swoop Exchange |

| Type | Cross-chain Bridge & DEX Aggregator |

| Supported Chains | Polygon, Ethereum, Arbitrum, BNB Chain, Optimism, Avalanche, Base, etc. |

| Best For | Fast and cost-efficient bridging and swapping to/from Polygon |

| KYC Requirement | Minimal KYC (No account or ID required for most operations) |

| User Interface | Clean web UI with intuitive bridge/swap flow |

| Token Support | Major ERC-20 tokens across supported chains |

| Fees | Aggregated best route with low gas and bridge fees |

| Wallet Compatibility | MetaMask, WalletConnect, Rainbow, Coinbase Wallet, etc. |

| Security | Non-custodial, uses secure, audited liquidity routes |

| Extra Features | Auto-route optimization across multiple DEXs & bridges |

| Official Website | https://swoop.exchange |

6.OpenOcean

OpenOcean stands out as the leading bridging aggregator for the Polygon Network, thanks to its tight coupling with both decentralized finance (DeFi) and centralized finance (CeFi) liquidity sources.

This architecture grants users access to the deepest pools available. The platform’s sophisticated routing engine scours the network for optimal trading and bridging routes, guaranteeing the tightest spreads and minimal slippage.

The real game-changer, however, lies in its ability to seamlessly mesh both DeFi and CeFi worlds, enabling users to move assets onto Polygon while balancing price, speed, and fee considerations—altogether from a single, cohesive dashboard.

| Feature | Details |

|---|---|

| Name | OpenOcean |

| Type | Cross-chain DEX & Bridge Aggregator |

| Supported Chains | Polygon, Ethereum, BNB Chain, Arbitrum, Optimism, Avalanche, Fantom, etc. |

| Best For | Cross-chain swaps and bridging with best price execution to Polygon |

| KYC Requirement | Minimal KYC (No login or ID needed for standard operations) |

| User Interface | Advanced yet user-friendly DApp interface |

| Token Support | Wide support for ERC-20 and native tokens across integrated chains |

| Fees | Aggregates lowest fees across DEXs; shows final cost before confirmation |

| Wallet Compatibility | MetaMask, WalletConnect, Trust Wallet, Coinbase Wallet, etc. |

| Security | Non-custodial, audited contracts, and secure routing |

| Extra Features | Smart routing, price comparison, cross-chain bridging |

| Official Website | https://openocean.finance |

7.Matcha (0x Protocol)

Powered by the 0x Protocol, Matcha stands out as the leading bridging aggregator for the Polygon Network, effortlessly pulling liquidity from countless DEXs while delivering frictionless cross-chain transfers.

Its crowning capability lies in smart order routing that spans Polygon and every EVM-compatible chain, guaranteeing users the tightest spreads and the least slippage.

Matcha prioritizes transparency by showing in-line quotes and gas estimates, and the sturdy 0x relay network underpins its efficiency, making it the go-to, trustworthy option for moving assets in and out of Polygon.

| Feature | Details |

|---|---|

| Name | Matcha (by 0x Protocol) |

| Type | DEX & Cross-chain Bridge Aggregator |

| Supported Chains | Polygon, Ethereum, Arbitrum, Optimism, Avalanche, Base, BNB Chain, etc. |

| Best For | Finding best prices across DEXs & bridging assets to Polygon |

| KYC Requirement | Minimal KYC (No sign-up or ID needed for standard use) |

| User Interface | Simple and elegant web-based platform |

| Token Support | ERC-20 tokens and cross-chain assets across supported networks |

| Fees | No extra Matcha fees; user pays standard DEX/bridge gas & slippage |

| Wallet Compatibility | MetaMask, WalletConnect, Coinbase Wallet, and more |

| Security | Non-custodial; built on audited 0x Protocol infrastructure |

| Extra Features | Smart order routing, MEV protection, cross-chain bridging |

| Official Website | https://matcha.xyz |

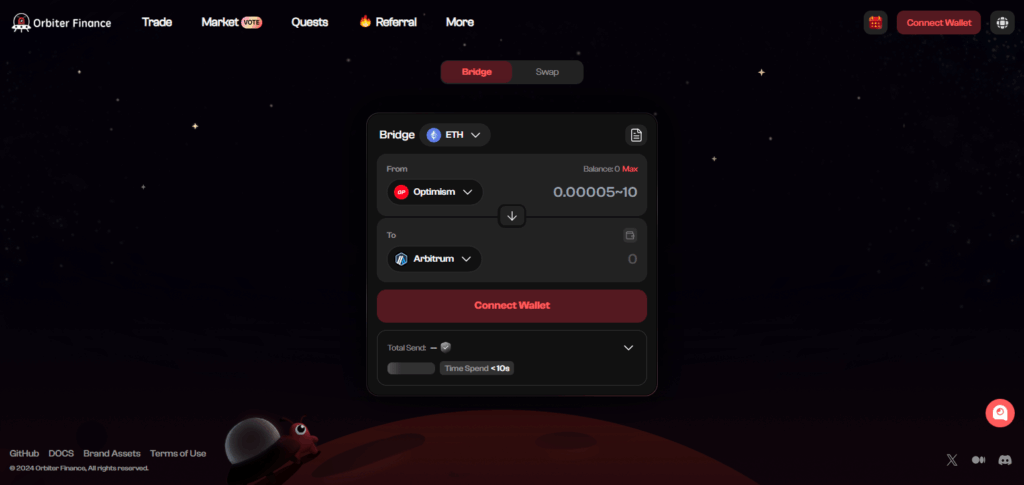

8.Orbiter Finance

Orbiter Finance stands out as the premier bridging aggregator for the Polygon Network, delivering lightning-fast, ultra-low-cost transfers between rollups and mainnets. The platform’s edge is its ability to exploit rapid relay networks, allowing assets to reach Polygon with settlement times that border on instant and transaction fees that barely register.

Orbiter sidesteps the cumbersome locking and unlocking of assets that plagues traditional bridges, shrinking the attack surface and operational friction for users. This design caters perfectly to the daily Polygon user and to developers who require dependable, economical cross-rollup transfers, achieving the balance of speed, safety, and simplicity that frictionless multi-chain ecosystems demand.

| Feature | Details |

|---|---|

| Name | Orbiter Finance |

| Type | Cross-rollup & Layer 2 Bridge |

| Supported Chains | Polygon, Ethereum, Arbitrum, zkSync, Linea, Optimism, Base, Scroll, etc. |

| Best For | Fast and low-cost bridging between Layer 2s and Polygon |

| KYC Requirement | Minimal KYC (No account or identity verification required) |

| User Interface | Lightweight and fast web DApp interface |

| Token Support | Primarily ETH and stablecoins (USDT, USDC, etc.) |

| Fees | Low bridge fees with transparent display; low gas on Layer 2 |

| Wallet Compatibility | MetaMask, WalletConnect, Coinbase Wallet, etc. |

| Security | Non-custodial with verified contracts; real-time bridge status display |

| Extra Features | Real-time transaction tracking, fast confirmations |

| Official Website | https://orbiter.finance |

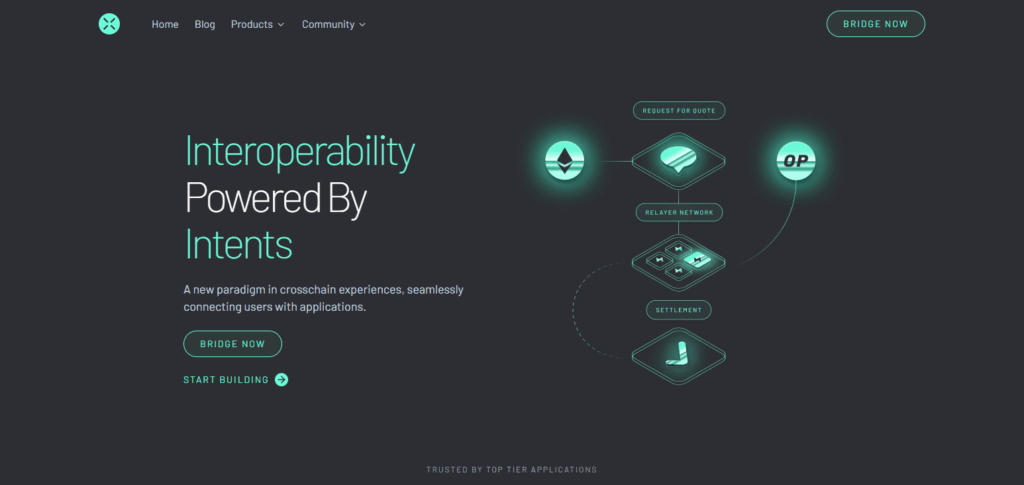

9.Across Protocol

Across Protocol has emerged as the leading bridging aggregator for Polygon, thanks to its pioneering intent-based architecture and a decentralized relayer network. In contrast to conventional bridges that freeze assets in smart contracts, the Across protocol draws upon a single liquidity pool and a web of relayers to deliver near-instant transfers at exceedingly low fees.

This configuration boosts capital efficiency and trims both slippage and confirmation times. By incorporating UMA’s Optimistic Oracle for fraud-proof validation, Across guarantees secure and dependable cross-chain operation, positioning itself as the preferred solution for anyone needing rapid, affordable bridging to and from Polygon.

| Feature | Details |

|---|---|

| Name | Across Protocol |

| Type | Decentralized Cross-Chain Bridge |

| Supported Chains | Polygon, Ethereum, Arbitrum, Optimism, Base, Avalanche, Zora, etc. |

| Best For | Fast, low-cost bridging to and from Polygon |

| KYC Requirement | Minimal KYC (No sign-up or ID verification needed) |

| User Interface | Simple and clean web-based DApp |

| Token Support | ETH, USDC, USDT, DAI, and other major assets |

| Fees | Low fees with rebates; relayer-based gas optimization |

| Wallet Compatibility | MetaMask, WalletConnect, Coinbase Wallet, and others |

| Security | Non-custodial, audited smart contracts, UMA oracle system |

| Extra Features | Instant bridging with bonded relayers, MEV protection |

| Official Website | https://across.to |

Conclusion

To sum up, the leading bridging aggregators for the Polygon Network stand out by delivering fast, smooth, and low-cost cross-chain asset transfers. Rango Exchange, Bungee Exchange, DeBridge, and their peers intelligently merge sophisticated routing engines, robust security layers, and broad liquidity to elevate the Polygon user journey.

Their cutting-edge architectures trim fees, minimize slippage, and quicken settlement times, positioning them as must-have solutions for both developers and traders within Polygon’s growing multi-chain landscape. Selecting the appropriate bridging aggregator enables swift and dependable cross-chain interactions.

FAQ

What is a bridging aggregator?

A bridging aggregator combines multiple blockchain bridges and liquidity sources to provide the best, fastest, and cheapest cross-chain asset transfers in one platform.

Why use a bridging aggregator for Polygon?

Bridging aggregators optimize transfers to Polygon by reducing fees, slippage, and wait times, ensuring efficient and secure multi-chain asset movement.

Which features make a bridging aggregator top for Polygon?

Key features include multi-bridge support, smart routing, low gas fees, fast settlement, strong security, and user-friendly interfaces tailored for Polygon users.