In this article, Ill discuss the Top Cross-chain Bridging Tokens To Watch as they reshape how digital assets travel across different blockchains.

These tokens fuel novel protocols that allow fast, low-cost, and decentralized transfers, often sidestepping the burdensome KYC checks seen in traditional finance. With demand for cross-chain swaps surging in DeFi and Web3, these projects are now central to the evolving vision of a truly multi-chain internet.

Key Point & Top Cross-chain Bridging Tokens To Watch List

| Protocol Name | Key Point |

|---|---|

| Across Protocol | Ultra-fast bridging with optimistic rollups and low fees for L2-to-L2 swaps. |

| Synapse Protocol | Cross-chain AMM + bridge with smart contract support across 20+ blockchains. |

| Stargate Finance | Omnichain liquidity layer using LayerZero with instant guaranteed finality. |

| Arbitrum | Leading Ethereum L2 rollup with native bridge, low gas, and fast settlement. |

| Rango Exchange | Aggregator supporting 50+ chains; combines bridges + DEXs for best route. |

| Orbiter Finance | L2-focused bridge offering gas-efficient Ethereum rollup transfers. |

| Allbridge | Multi-chain bridge connecting EVM and non-EVM chains like Solana & TRON. |

1.ACX (Across Protocol)

Across Protocol (ACX) is quickly becoming the go-to bridging token for anyone moving assets between Ethereum Layer 2 chains. Built with speed, low fees, and strong security in mind, the network skips the headaches many older bridges cause.

By adopting an optimistic relayer model, it cuts down on wait times and slippage while still using capital smartly. Because users deal with native coins instead of wrapped versions, transfers feel cleaner and more straightforward.

ACX plays a dual role-it fuels governance and rewards relayers- anchoring the protocols day-to-day work and its longer-term worth across growing L2 ecosystems.

| Feature | Details |

|---|---|

| Token Name | ACX (Across Protocol) |

| Launch Year | 2021 |

| Core Function | Cross-chain bridging with focus on L2-to-L2 Ethereum transfers |

| Key Technology | Optimistic relayer model, no wrapped assets |

| Supported Chains | Ethereum Mainnet, Arbitrum, Optimism, Base, Polygon, Linea, more |

| KYC Requirement | Minimal (no KYC for basic bridging) |

| Native Token Use | Governance, relayer incentives, protocol fees |

| Notable Strength | Fast, low-cost transfers with native asset bridging |

| Wallet Support | MetaMask, WalletConnect, and major Web3 wallets |

| Ideal For | Users seeking secure, efficient L2 cross-chain movement without KYC hassle |

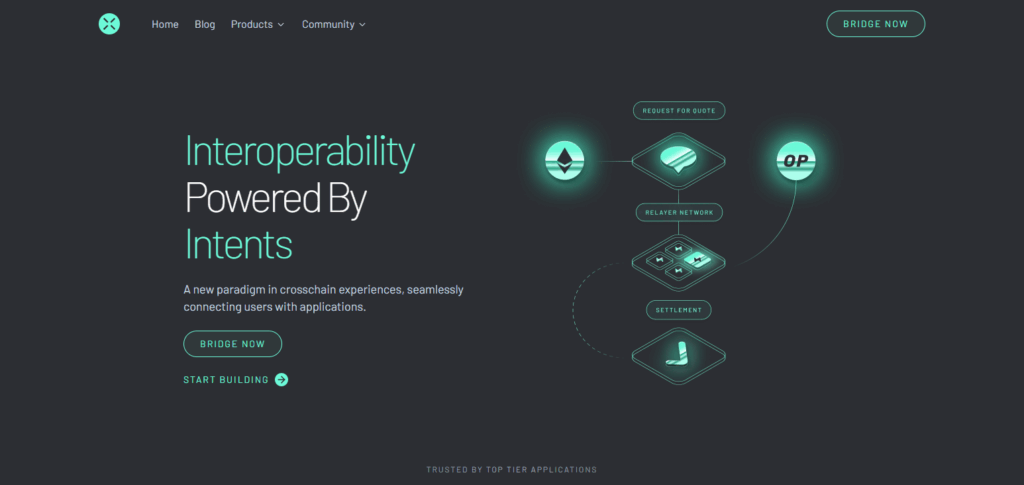

2.SYN (Synapse Protocol)

SYN, or the Synapse Protocol token, has quickly become a standout cross-chain bridge asset thanks to its rare mix of interoperability and built-in composability. It lets users move tokens and even call smart contracts across 20-plus chains, spanning both EVM and non-EVM networks.

Its integrated automated market maker lets people swap tokens on the fly, removing the hassle of separate trades before and after bridging. As a governance token, SYN guides protocol upgrades and rewards liquidity providers, firmly anchoring it in the effort to create a smooth, unified cross-chain DeFi space.

| Feature | Details |

|---|---|

| Token Name | SYN (Synapse Protocol) |

| Launch Year | 2021 |

| Core Function | Cross-chain bridging and AMM with smart contract support |

| Key Technology | Cross-chain messaging + integrated AMM |

| Supported Chains | 20+ blockchains (EVM & non-EVM including Ethereum, BNB, Avalanche, etc.) |

| KYC Requirement | Minimal (no KYC for swaps or bridging) |

| Native Token Use | Governance, liquidity mining, fee incentives |

| Notable Strength | Smart contract calls across chains + built-in AMM |

| Wallet Support | MetaMask, WalletConnect, Coinbase Wallet, etc. |

| Ideal For | DeFi users seeking seamless swaps and bridging across many networks |

3.STG (Stargate Finance)

STG, the token behind Stargate Finance, stands out in the crowded bridging space because it pulls liquidity from several blockchains into a single, easy-to-use pool. Built on LayerZero’s messaging layer, the protocol gives users fast swaps with finality they can actually trust-potentially solving one of the biggest pain points of older bridges that need separate, fragmented reserves.

STG tokens are not just passively staked; they vote on protocol upgrades, reward liquidity suppliers, and essentially power the whole cross-chain ecosystem. By turning multiple chains into one pool of capital, Stargate sets the stage for smoother and more reliable DeFi moves no matter where a user starts.

| Feature | Details |

|---|---|

| Token Name | STG (Stargate Finance) |

| Launch Year | 2022 |

| Core Function | Omnichain asset transfers with unified liquidity pools |

| Key Technology | LayerZero messaging + instant guaranteed finality |

| Supported Chains | Ethereum, BNB, Avalanche, Optimism, Arbitrum, Polygon, Fantom, etc. |

| KYC Requirement | Minimal (no KYC for general use) |

| Native Token Use | Governance, liquidity incentives, protocol fee sharing |

| Notable Strength | Shared liquidity model enables native assets transfer without fragmentation |

| Wallet Support | MetaMask, WalletConnect, and major Web3 wallets |

| Ideal For | Users needing fast, secure, and unified cross-chain liquidity access |

4.ARB (Arbitrum)

ARB (Arbitrum) stands out as a premier cross-chain bridging token, firmly tied to the top Ethereum Layer 2 network designed for speed and low fees. Its dedicated bridge lets users move assets to and from Ethereum securely and affordably, thanks to complete EVM compatibility.

What really separates ARB from rivals is its cutting-edge optimistic rollup tech, which delivers quicker transaction finality while still keeping security tight. Beyond that, the ARB token votes on updates and funds projects, playing a key role in Arbitrums drive toward wider adoption and true decentralization.

| Feature | Details |

|---|---|

| Token Name | ARB (Arbitrum) |

| Launch Year | 2023 (token), protocol launched in 2021 |

| Core Function | Ethereum Layer 2 scaling via optimistic rollups |

| Key Technology | Optimistic rollup with native Arbitrum-Ethereum bridge |

| Supported Chains | Ethereum Mainnet, Arbitrum One, Arbitrum Nova |

| KYC Requirement | Minimal (no KYC on native bridge or ecosystem apps) |

| Native Token Use | Governance of Arbitrum DAO and ecosystem funding |

| Notable Strength | Scalable and low-cost environment with full EVM compatibility |

| Wallet Support | MetaMask, Coinbase Wallet, WalletConnect, and others |

| Ideal For | Developers and users seeking low-fee Ethereum interactions without KYC |

5. RNG (Rango Exchange)

RNG, or Rango Exchange, has quickly emerged as a must-watch multi-chain token thanks to the smart bridge aggregator that sits at its core. By connecting more than seventy networks, EVM and non-EVM alike, Rango stitches together several bridges and DEXs to hunt down the best swap path.

The real standout feature is its ability to handle messy multi-hop deals from one clean dashboard, saving users time and gas fees. As the backbone token, RNG fuels governance and could someday reward lightning-fast routes, putting the coin at the heart of smooth, brainy cross-chain trading.

| Feature | Details |

|---|---|

| Token Name | RNG (Rango Exchange) |

| Launch Year | 2022 (platform), token launched in 2024 |

| Core Function | Cross-chain bridge and DEX aggregator across EVM and non-EVM chains |

| Key Technology | Route discovery using multiple bridges + DEXs |

| Supported Chains | 70+ chains (EVM, Cosmos, Solana, TRON, etc.) |

| KYC Requirement | Minimal (no KYC for swaps or bridging) |

| Native Token Use | Governance, fee discounts, and future protocol utility |

| Notable Strength | One of the widest multi-chain aggregators with optimized routing |

| Wallet Support | MetaMask, Keplr, WalletConnect, Trust Wallet, etc. |

| Ideal For | Users needing best-rate, multi-bridge token swaps without KYC friction |

6.ORB (Orbiter Finance)

ORB (Orbiter Finance) is becoming one of the most talked-about bridging tokens, and for good reason: it streams Layer 2-to-Layer 2 Ethereum rollup transfers at remarkable speed while keeping fees close to zero. Thanks to its peer-to-peer architecture, users skip the usual intermediate chains or annoying wrapped tokens, so assets move directly and securely.

The ORB token rewards the relayers who make this possible and also gives the community a voice in protocol upgrades. With cross-chain traffic steadily rising, Orbiter’s emphasis on Layer 2 scalability and gas-light transfers looks set to shape a smoother Ethereum future.

| Feature | Details |

|---|---|

| Token Name | ORB (Orbiter Finance) |

| Launch Year | 2021 (platform), token launched in 2024 |

| Core Function | Peer-to-peer bridging between Ethereum Layer 2 networks |

| Key Technology | Direct sender–maker model (no wrapped tokens or intermediaries) |

| Supported Chains | Ethereum, Arbitrum, Optimism, zkSync, Base, Linea, Starknet, etc. |

| KYC Requirement | Minimal (no KYC needed for standard transfers) |

| Native Token Use | Governance, fee discounts, and relayer incentives |

| Notable Strength | Fast, gas-efficient L2 transfers with high security and native token support |

| Wallet Support | MetaMask, WalletConnect, OKX Wallet, and others |

| Ideal For | Users bridging across rollups seeking low fees, speed, and no KYC barriers |

7.ABR (Allbridge)

Allbridge (ABR) has quickly emerged as one of the most talked-about cross-chain tokens, bridging EVM and non-EVM networks like Solana, TRON, and even the revamped Terra. What sets it apart is a universal asset-support engine and a modular bridge toolkit that lets developers plug in transfers with minimal fuss.

ABR powers daily protocol tasks, rewards liquidity providers, and serves as a voting stake for future upgrades. By centering on broad compatibility and developer-friendly tools, Allbridge aims to take the pain out of moving assets between once-isolated blockchain worlds.

| Feature | Details |

|---|---|

| Token Name | ABR (Allbridge) |

| Launch Year | 2021 |

| Core Function | Bridging assets between EVM and non-EVM chains |

| Key Technology | Custom bridge architecture with universal token support |

| Supported Chains | Ethereum, BNB, Solana, TRON, Avalanche, Polygon, Near, and more |

| KYC Requirement | Minimal (no KYC for standard bridging) |

| Native Token Use | Governance, fee payments, and liquidity incentives |

| Notable Strength | Supports cross-ecosystem transfers including non-EVM chains like Solana |

| Wallet Support | MetaMask, TronLink, Phantom, WalletConnect, and others |

| Ideal For | Users bridging between EVM and non-EVM networks without regulatory hurdles |

Conclusion

In summary, leading cross-chain bridging tokens-across platforms like ACX, SYN, STG, ARB, RNG, ORB, and ABR-are pushing the boundaries of blockchain connectivity. Each coin fuels a distinct framework that tackles bottlenecks such as limited scalability, split liquidity, and the friction of moving assets between chains.

With DeFi and Web3 pushing for tighter, faster links, these projects shine not only for their tech but for the secure, smooth travel they bring to users wallets. For anyone investing in-or building on-cross-chain visions, tracking this space is no longer optional; its a frontrunner alert.

FAQ

What are cross-chain bridging tokens?

These tokens power protocols that enable asset transfers and data communication across different blockchains.

Why are bridging tokens important?

They enable interoperability between blockchains, allowing users to move assets seamlessly and access broader DeFi ecosystems.