Hey, everyone! In today’s i will discuss the , we are going to go in-depth on Top 7 Non-Kyc Exchanges In Russia, where trading can be done in the most effortless and secure manner.

If you’re new in you’re into the crypto world or you have years of trading behind you – these exchanges offer fast services at low costs and give you privacy. So, without further ado, here are the best non-KYC exchanges in Russia.

What is KYC in Crypto?

KYC (Know Your Customer) in crypto means that cryptocurrency platforms need to verify users in order to comply with legislation and prevent illegal practices like money laundering or fraud.

The process is that a user submits their personal details like name, id document, address, and sometimes also a photo or a fingerprint.

KYC facilitates better openness, security, and trust in the holding of accounts connected with identifiable persons meaning that there is some supervision over accounts.

While enhances compliance and risk mitigation, its detractors claim it violates an individual’s right to privacy which is against the very nature of cryptocurrency as it was intended to be decentralized and anonymous.

Top 7 Non-Kyc Exchanges In Russia Key Point & List

| Platform | Key Point |

|---|---|

| BloFin | A centralized exchange offering advanced trading tools and derivatives. |

| Bybit | A leading crypto derivatives exchange known for perpetual contracts. |

| dYdX | A decentralized exchange specializing in perpetual trading with low fees. |

| PrimeXBT | Multi-asset platform with crypto, forex, and commodities trading options. |

| Uniswap | Top decentralized exchange (DEX) enabling token swaps on Ethereum. |

| PancakeSwap | A popular DEX on Binance Smart Chain with low fees and yield farming. |

| Changelly | Instant crypto exchange with no custody and competitive rates. |

Our Top 7 Pick Non-Kyc Exchanges In Russia For 2025

1. BloFin

According to BloFin, It’s a centralized exchange which is meant for professionals only, as it aims to deliver advanced trading tools plus a safe environment.

It focuses on derivatives market, trading in futures and perpetual contracts being relevant for professionally oriented and institutional clients.

BloFin offers excellent liquidity configures, services with low fees, and offers users interesting products.

The platform is equipped with advanced risk management tools and supports rapid trading. BloFin has also been able to keep security intact with rigid compliance controls and multi-faceted protection systems.

The platform aims to ease the burden of complex trading processes around by making them user friendly as well facilitating new users with educational material. BloFin aims to provide more than just reliability and performance, A comprehensive use case for all active traders.

| Feature | Details |

|---|---|

| Fees | Spot Trading: 0.1% (Maker/Taker) Futures Trading: 0.02% (Maker), 0.06% (Taker) |

| Supported Currencies | Over 300 cryptocurrencies |

| Customer Support | 24/7 support via live chat and email |

| Website Link | BloFin |

2. Bybit

Bybit is a crypto exchange that originated in Asia and is now expanding globally, they provide trading with perpetual contracts and margin trading as well.

Define your funds using Bybit’s trading interface where you can place trades with a leverage of up to 100x, which is a trading feature on Bybit that proves to be beneficial for both beginner and experienced traders.

They have such fast transaction speeds which ensures their users have a seamless trading experience along with being provided with deep liquidity.

Other highlights of the Bybit platform are its advanced charting tools and stop-loss trading along with other risk management features.

They have effective two-factor authentication (2FA) and implement cold wallets for enhancing user security.

Bybit is still developing as an exchange as it has already launched staking, spot trading and lending products alongside derivatives trading.

| Feature | Details |

|---|---|

| Fees | Spot Trading: 0.1% (Maker/Taker) Futures Trading: 0.055% (Maker), 0.1% (Taker) |

| Supported Currencies | Over 300 cryptocurrencies, including BTC, ETH, and various fiat currencies |

| Customer Support | 24/7 support via live chat, email, and help center |

| Website Link | Bybit |

3. dYdX

DYdX is a layer-2 scaling solution that is built on Ethereum, it enables users the to trade and invest in perpetual and derivative assets without worrying about custodial issues.

As dYdX is a decentralized exchange its space is competitive making it a derivative and perpetual trading platform that is quite popular.

Since there is no authority involved, people have unrestrained access to their funds, this ensures that trading can be done in a safe and secure environment provided smart contracts are used.

Users of dyDx can trade with assurance of high liquidity regardless of whether they choose isolated-margin or cross-margin trading and take advantage of being able to trade with a leverage of up to 20x.

What this platform stands out for is always focusing on dApps and perpetual contracts as they benefit traders looking for powerful trading tools due to its DeFi focus, owing much to these aspects.

| Feature | Details |

|---|---|

| Fees | Maker: 0.02% – 0.04%, Taker: 0.02% – 0.04% (Volume dependent) |

| Supported Currencies | BTC, ETH, USDC, DAI, SOL, DOT, and more |

| Customer Support | Help Center, Support Ticket, Telegram Questions |

| Website Link | dYdX |

4. PrimeXBT

PrimeXBT is a multi-asset trading platform that allows its users to trade in cryptocurrencies, Forex, commodities as well as indices.

It does indeed have something different than the rest by providing a variety of financial assets on the same platform that is mainly attractive to traders who wish to diversify.

PrimeXBT gives as much as 100x leverage on crypto assets and even more on Forex margin.

The platform does place a high emphasis on the speed of execution and therefore takes sufficient measures to lower latency, and provide sufficient depth in the liquidity in order to avoid slippage.

Advanced tools like charting features, copy trading (through Covesting) and risk management options are also provided by PrimeXBT in apportioning for both novice and seasoned traders.

For users dependence and security, there is multi-factor authentication and cold storage for funds.

| Category | Details |

|---|---|

| Fees | – Zero commission |

| – Spreads as low as 0.1 pips for CFDs | |

| – Maker/Taker fees for Crypto Futures starting at 0.01% | |

| Currency | – Supports major currencies like USD, EUR, GBP, JPY |

| – Cryptocurrencies: BTC, ETH, LTC, XRP, and over 30 others[_{{{CITATION{{{_4{PrimeXBT Review [2024] | |

| Support | – 24/7 customer support via live chat, email, and phone {Fees and Trading Conditions |

| Website Link | PrimeXBT |

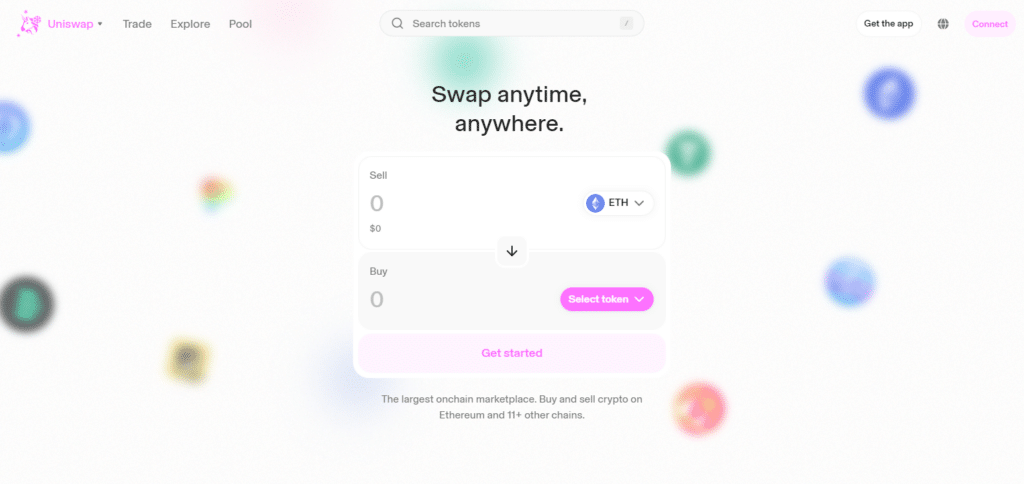

5. Uniswap

Uniswap is one of the most popular Decentralized exchanges in the Ethereum blockchain which allows users to switch tokens directly among themselves.

It employs what is known as Automated Market (AMM), where the liquidity pools take over the conventional order books and permit trades to take place without interest or pays.

It allows its users to trade, in other words, it allows them to swap ERC-20 tokens, lend tokens out and earn a percentage in the form of fees.

Uniswap is operated without a centralized entity which helps in better decentralization and security. Its open-source code helps developers build new and integrate existing Decentralized applications( dApps) into the platform.

Uniswap is very important in the DeFi world since it offers opportunities for yield farming, governance through its UNI token, and future low-cost Layer 2 integrations. Everyone who uses crypto currencies can use it due to the low barrier.

| Category | Details |

|---|---|

| Fees | – Varying fee tiers: 0.01%, 0.02%, 0.03%, 0.04%, 0.05%, 0.3%, 1% |

| – Fees collected and stored separately, not reinvested automatically | |

| Supported Currencies | – ETH, USDC, WBTC, and thousands of ERC-20 tokens |

| – Supports multiple blockchain networks including Ethereum, Base, Arbitrum, etc | |

| Support | – Help Center, FAQ, Support Ticket, Email: support@uniswap.org |

| Website Link | Uniswap |

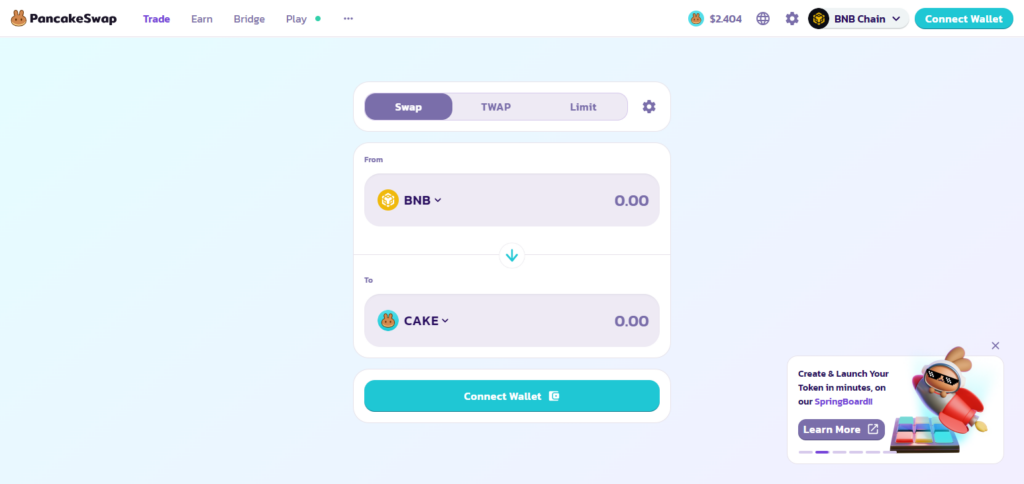

6. PancakeSwap

PancakeSwap is a decentralized exchange operating within the Binance Smart Chain ecosystem, acclaimed for its competitiveness in fees and speedy transaction times.

It facilitates rural token exchange, staking harvesting, and versatile farming making it a center of DeFi trends.

PancakeSwap has deployed an Automated Market Maker (AMM) which enables transactions through liquidity pools directly.

The system allows users to add liquidity to the pools and earn transaction fees in return and engage in farming where they earn CAKE tokens.

Other services provided include game lotteries, purchase of NFTs, and farm offerings.

The low amount of fees and fast pace of transactions makes PancakeSwap favorable for trade and yield farmers as well.

| Category | Details |

|---|---|

| Fees | – Spot Trading: 0.25% |

| – Perpetual Futures: Varies by tier (0.01%, 0.05%, 0.25%, 1%) | |

| Supported Currencies | – Over 3241 cryptocurrencies, including BEP-20 tokens, BTC, ETH, USDT, etc |

| Support | – Help Center, FAQ, Telegram channel |

| Website Link | PancakeSwap |

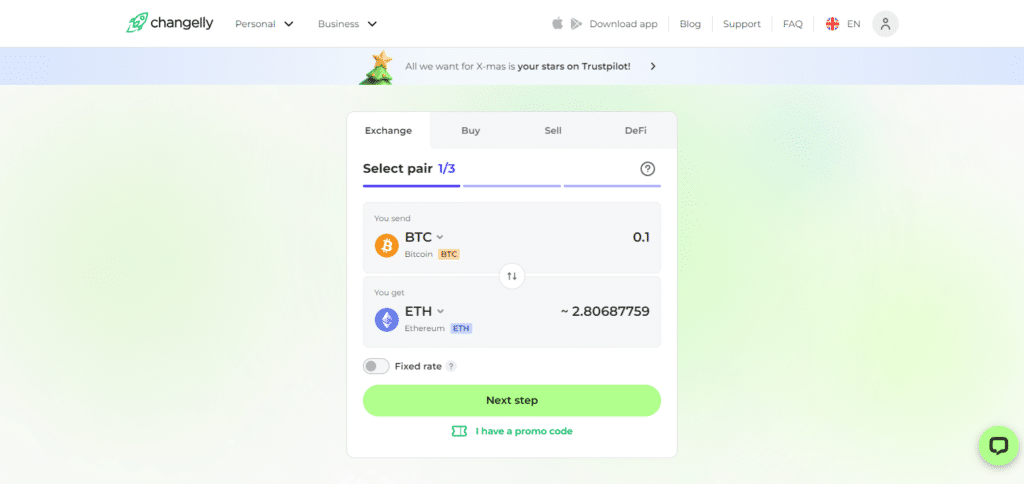

7. Changelly

Changelly is a simple to use interface that allows users to exchange currencies at the current best available rates without holding any custodian assets.

The platform has support for above 500 different coins and provides a great user experience.

Changelly works as a broker where they search for the users’ required rates among the best rate providers on various platforms.

Users don’t hold custodial assets so they fully own their assets before, during and after the transaction has taken place.

The platform also allows users to purchase coins or tokens with their credit cards or bank transfers.

It also limits KYC requisites for small transactions in order to make the process more private.

Changelly is perfect for users that want fast and discreet currency exchanges without restrictions.

| Category | Details |

|---|---|

| Fees | – Crypto-to-crypto: 0.25% |

| – Crypto-to-fiat: Minimum 3.95% | |

| Supported Currencies | – Over 160 cryptocurrencies, including Bitcoin, Ethereum, Litecoin, etc |

| Support | – Help Center, FAQ, Live Chat, Email: support@changelly.com |

| Website Link | Changelly |

Are KYC-Free exchanges Safe?

KYC-Free exchanges come with varying risks however they certainly offer ways to remain anonymous.

These types of exchanges allow users to trade by ignoring the whole ID verification process, however they are highly susceptible to unlawful activities, scams, or even hacking as they are poorly governed.

KYC essential implements security measures, without it the chances of losing the funds increase substantially.

Apart from that, it is also possible that going through such exchanges will go against the law of the land, thus putting the users in jeopardy.

While the KYC-free platforms do guarantee user privacy, they cannot be held accountable for any legal responsibilities; therefore, a regulated kind of exchange can be considered to be much safer and efficient for long term trading.

How to Choose the Top No KYC Crypto Exchange?

There are a number of things you should consider in order to find the best no-KYC crypto exchange:

Security: Look for SSL encryption, 2FA and cold wallets to be in place in order to protect the funds of the users.

Reputation: Read user and community reviews to see the best platforms that have been used previously.

Trading Features: What are the number of trading options offered, the cryptocurrencies supported, leverage and liquidity.

Anonymity: Make sure that the exchange does not ask for any personal information while allowing for transaction confidentiality.

Fees: Look for maximum trading, withdrawal and networks fees to have a cheaper platform.

Accessibility: The platform should be easy to use and in your region.

Pros & Cons Of Top No KYC Crypto Exchange

| Pros | Cons |

|---|---|

| 1. Privacy & Anonymity: Users can trade without sharing personal data. | 1. Security Risks: Less regulation can mean weaker security measures. |

| 2. Accessibility: Available globally, no geographic restrictions. | 2. Legal Risks: Operating without KYC may violate local regulations. |

| 3. Faster Onboarding: No verification process, allowing instant access. | 3. Limited Features: May lack advanced trading tools and fiat support. |

| 4. No Data Leaks: Personal information isn’t stored, reducing data risks. | 4. High Scam Potential: Higher chances of fraud or unreliable platforms. |

| 5. Lower Fees: Many no-KYC platforms offer competitive trading fees. | 5. Lack of Support: Limited customer support in case of disputes. |

Conclusion

There are many non-KYC crypto exchanges located in Russia that are easy to use and guarantee a degree of privacy coin.

dYdX, Uniswap, and PancakeSwap are also perfect for users that prefer to remain anonymous since they allow for low-fee transactions making them a perfect fit.

Also, there are Centralized ones such as PrimeXBT and Changelly that allow no KYC onboarding with the support of a great number of assets and quick onboarding.

This enables Russians to trade crypto on these KYC-less exchanges without verification requirements With their integration into their trading applications.

However, when selecting an exchange, users that aim to maintain a level of risk and funds security should consider risks linked with non-KYC choices as well as customer service assistance, liquidity, and recommendations for each provider. Be careful at all times to avoid losing your funds.