In this article, I will discuss the How to Stake Tokens After Bridging Them. Bridging assets lets you move them between networks, and staking allows you to earn from those assets.

After detailing the steps and platforms, I’ll discuss the benefits, security measures, and other crucial pointers that ensure a smooth, profitable staking experience post-bridging of your tokens.

What is Staking Token?

Staking a token is the process of locking your cryptocurrency in a network for validating transactions and securing the network. You earn rewards which are usually in the form of tokens.

Staking is common practice in proof-of-stake (PoS) and similar consensus mechanisms. Staking gives users certain governance rights and serves as a source of passive income. While each platform has different processes, most require users to have a minimum token amount and a lock-in period of commitment.

How to Stake Tokens After Bridging Them Step-by-step

Example: Withdrawing ETH and Staking on BSC

Bridge ETH to BSC

- Use reputable bridges like Binance Bridge or Multichain.

- Connect your MetaMask and make sure your wallet is linked.

- Ensure that the source chain is set to Ethereum, the destination is BSC, and select ETH.

- Confirm transaction and gas fees are paid.

Receive BEP-20 ETH on BSC

- You will receive BEP-20 ETH on BSC post bridging.

Stake BEP-20 ETH on PancakeSwap

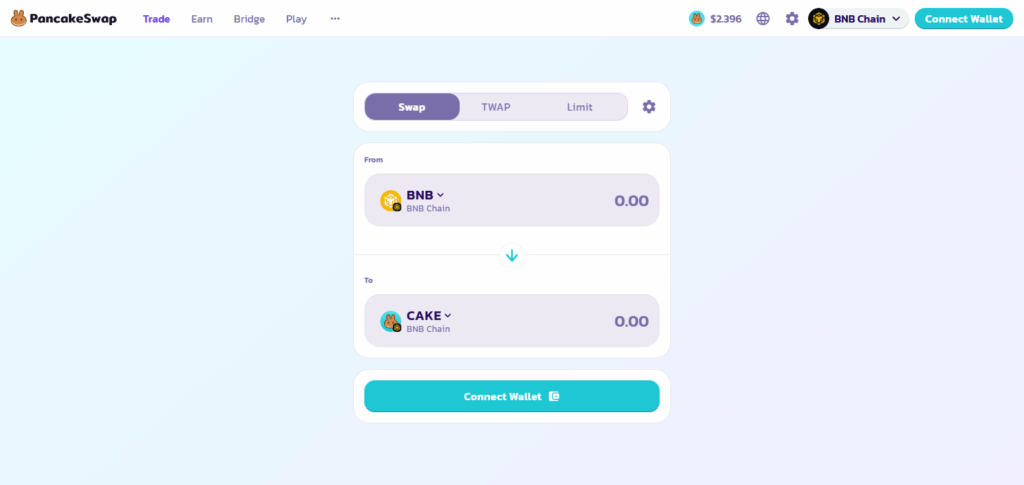

- Go to PancakeSwap.

- Connect your wallet and ensure you are on BSC network.

- Go to Earn → Staking or Pools.

- Pick ETH staking pool, hit Stake, input desired amount and sign the transaction.

Check Rewards

- You will earn rewards from the staked ETH.

- Earnings can be accessed through PancakeSwap and wallets.

Popular Staking Platforms for Bridged Tokens

Lido

Lido is a leading liquid staking provider which works well with bridged assets such as stETH since users can stake and retain liquidity at the same time. Users are able to stake through Lido without losing access to their assets after bridging ETH or other supported tokens.

For bridged tokens, Lido is one of the best options due to its usage in many DeFi services which ensures continuous utility and earnings for them. With Lido, users don’t have to struggle with complex tutorials and restrictions to start post-bridge staking.

Ankr

Ankr provides an effective solution for users looking to stake tokens post bridging, thanks to its user-friendly multi-chain ecosystem and streamlined staking dashboard. Following token bridging, Ankr simplifies the staking process across multiple chains for users who may not be very tech savvy.

Ankr’s prominent strength is combining staking and cross-chain interoperability, which permits users to earn rewards while taking advantage of decentralized node hosting. Branded tokens can be staked safely with Ankr because of its fast, adaptable, and low-cost infrastructure.

Rocket Pool

Rocket Pool is a more self-directed option for bridging ETH and wanting to stake it since the user can control their staking nodes. Users can run their own mini nodes with only 8 ETH which is a very advantageous feature of Rocket Pool considering it is post-bridge accessible.

Decentralized trust is offered by Rocket pool along with non-custodial staking which sets Rocket Pool apart from other centralized platforms. Earning rewards while helping Ethereum is a great option so for those looking to stake post-bridge with community driven infrastructure, Rocket Pool is an excellent choice.

Why Stake Tokens After Bridging?

Earning Through Staking: Staking bridged tokens earns rewards and offers passive income, in contrast to assets held idle in wallets.

Bridge To New Opportunities: With bridging, cross-chain opportunities are unlocked and staking allows you to earn yield on those new networks.

Aid In Blockchain Security: Your staked tokens are utilized in validating and securing the blockchain while earning yield on new networks. This helps maintain the integrity of the blockchain ecosystem.

Entry Into Decentralized Finance Systems: Staking tokens on new chains grants access to DeFi tools, liquidity pools and the ecosystem earns various associated rewards.

Minimize Opportunity Cost: While waiting to swap back, earning on the on destination chain is possible till it is time to move assets around again.

Security Tips for Staking Bridged Tokens

Use Staking Platforms and Bridges You Trust

To protect your money, only use well-reviewed, known bridges and staking services. This will make it harder to lose funds or get scammed.

Token Contracts Should Always Be Verified

In order to protect against bad actors, always confirm the address of bridged tokens before staking so you do not fall for fake or malicious tokens.

Avoid Phishing Threats and Links

Staking platforms should be accessed through their official pages. Avoid clicking links on social media or from unknown sources.

Turn On Wallet Security Features

For more protection, using hardware wallets, turning 2FA on, when available, adds another layer of security.

Confirm Network Is Checked

To avoid any loss or lockout, make sure your bridged token is compatible with the staking protocol on the target chain.

Look For Any Monitoring Platform Changes

Follow direct channels from the bridge and staking platforms so you can stay on top of any important security risks or updates.

Small Amounts Should Always Come First

Start by testing the process with a small amount of tokens before fully committing on new chains or platforms.

Pros and Cons

| Pros | Cons |

|---|---|

| Earn passive income through staking | Risk of bridge failures or smart contract bugs |

| Utilize tokens on new chains | Potential high gas or transaction fees |

| Access broader DeFi ecosystems | Limited staking support for some bridged tokens |

| Support network security and governance | Unstaking periods or lock-up times may apply |

| Flexibility with liquid staking options | Requires extra steps and knowledge to manage safely |

Conclusion

Bridging cross-chain tokens and staking them is a good way to earn passes, control network utility, and participate in new opportunities in decentralized finance.

Taking trusted platforms for bridging and staking, ensuring the tokens work together, and following common principles enables one to stake in a fast and safe manner.

Whether your goal is earning rewards or having more options while managing assets, staking of bridged tokens ensures enhancement to cross-chain strategies. Ensure informed decisions and safety while engaging in activities.

FAQ

Can I stake any token after bridging?

Not always. Only tokens supported by the staking platform on the destination chain can be staked. Always verify compatibility before bridging.

Do I need a specific wallet to stake bridged tokens?

Yes, your wallet must support the destination blockchain and the staking platform. Wallets like MetaMask and Trust Wallet are commonly used.

Is staking bridged tokens safe?

Staking is generally safe on reputable platforms, but risks exist, especially with bridges. Always use audited bridges and staking services.