In this article,I will walk about the How to Stake Cross-Chain Tokens Seamlessly without running into technical headaches, so you can earn rewards across multiple blockchains.

As decentralized finance keeps growing, cross-chain staking is becoming a top choice because it brings more flexibility, higher efficiency, and better earnings.

I’ll break down the steps, share the best practices, point out the tools you’ll need, and outline the risks. This way, you’ll have everything to stake confidently in a network that connects multiple blockchains.

What Are Cross-Chain Tokens?

Cross-chain tokens are digital assets designed to move fluidly across different blockchains, promoting interoperability throughout the crypto landscape.

In contrast to standard tokens, which are bound to one network, cross-chain tokens leverage bridges or specialized protocols to move value securely from one chain to another.

This capability lets users interact with diverse decentralized applications, participate in staking, and add liquidity across multiple ecosystems without needing to swap or convert their holdings.

The result is a streamlined experience, decreased friction, and a broader range of possible applications within decentralized finance and the emerging Web3 landscape.

How to Stake Cross-Chain Tokens Seamlessly

Example: Staking ETH on Solana through Liquid Staking and Bridge Aggregators

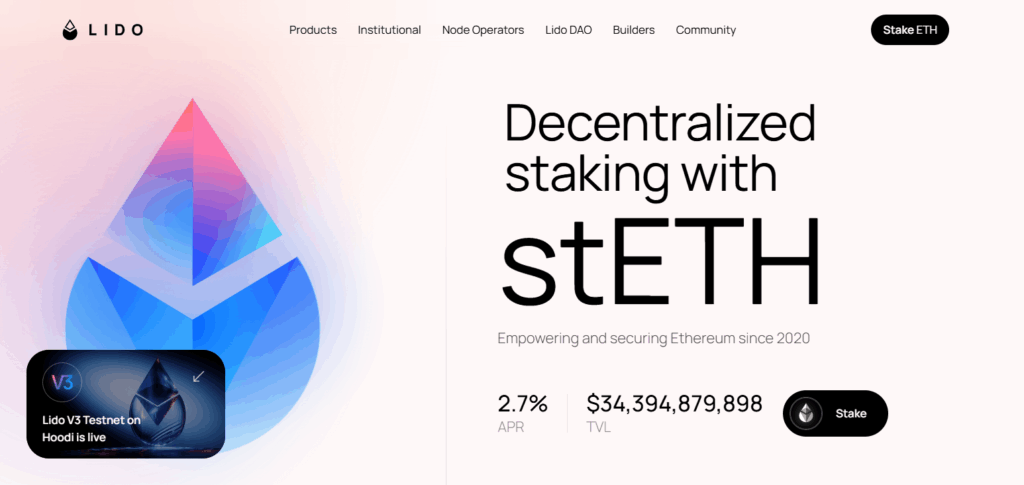

Stake ETH via Lido to Get stETH

- Head to Lido Finance

- Deposit your ETH to mint stETH. This token accrues ETH rewards while your original ETH stays staked.

- You can now use stETH in DeFi without unlocking the original ETH.

Bridge stETH to Solana via Swing or Portal

- Choose Swing.xyz or Portal Token Bridge

- These bridges accept wrapped stETH and automatically handle routing, liquidity pools, and security checks.

- Just approve the token and follow the prompts.

Deposit stETH into Solana-Based DeFi

- On Solana, protocols like Marinade Finance or Jito let you stake or lend the bridged stETH.

- You’ll collect Solana yield alongside the ETH rewards without extra legwork.

- Look out for auto-compounding or liquidity pool options.

Monitor and Manage Assets Across Chains

- Use DeFi dashboards like DeBank, Zapper, or Keiko Finance.

- They show your APYs, gas fees, and the health of your bridges all in one view.

- You can also set alerts for reward milestones and liquidity shifts.

Easily Unstake or Swap Whenever

- Whenever you want, unstake stETH on Solana and bridge it back to Ethereum.

- Alternatively, use the built-in DEXs to trade it for stablecoins or other tokens.

Other Place Where to Stake Cross-Chain Tokens Seamlessly

EigenLayer

EigenLayer represents a transformative leap that lets holders of ETH or liquid staking tokens re-deploy their staked assets across diverse chains while still reaping staking returns. The core idea centers on shared security: users can collateralize their ETH in one go, and that same collateral protects multiple applications and blockchains.

The result is a fluid, cross-chain staking environment where the security originally baked into Ethereum is seamlessly scaled to other ecosystems. This dramatically cuts down on capital fragmentation and lets users make their staked assets work harder. One deposit, one piece of collateral, and you can now engage with a host of protocols across chains—slimming down both your operational load and your exposure to risk.

Symbiosis

Symbiosis is a cross-chain liquidity protocol that simplifies staking, allowing users to swap and stake tokens across multiple blockchains via one intuitive interface. Its main advantage is that it removes the hassle of manual bridging or juggling multiple wallets.

By combining decentralized liquidity routing with smooth cross-chain execution, Symbiosis lets users stake tokens directly on their chosen blockchains without ever departing the platform. This consolidated workflow keeps the advantages of staking while ensuring users retain complete custody of their assets and encounter far fewer transaction steps.

Rubic

Rubic delivers an intuitive cross-chain toolkit that empowers anyone to swap and stake tokens across different blockchains no coding skills required. The platform’s standout feature is its aggregator engine, which continuously surveys multiple decentralized exchanges and bridging solutions to pinpoint the best available paths for cross-chain staking.

Customers can, for example, stake an asset from Avalanche straight into an Ethereum validator, enjoying lower gas costs and tighter spreads. Rubic wraps all of this into a smooth, one-click interface, packaging a multi-chain staking experience that’s both user-friendly and anchored in the security and decentralization that the ecosystem demands.

Why Stake Cross-Chain Tokens?

Access to Multiple Ecosystems: Cross-chain staking opens the door to a range of blockchain networks in one go. You’re not tied to a single ecosystem anymore, so you can explore a wider array of decentralized finance opportunities without the hassle of multiple wallets.

Maximized Yield Potential: Moving your stake from chain to chain lets you chase the highest returns on the market. You can check yields across networks, pick the most lucrative pools, and keep your earnings climbing without being anchored to one chain.

Enhanced Asset Utility: Idle tokens gather dust; staking them across chains puts them to work. Your assets contribute to various networks, powering liquidity and governance while you earn rewards, so every token plays an active role in your portfolio.

Improved Capital Efficiency: Cross-chain staking lets you shift, restake, or reallocate across protocols in a single flow. You avoid the costs and delays of converting assets to other chains, saving on transaction fees and freeing up your liquidity when you need it.

Resilience Through Diversification: Spreading stakes across several chains buffers you from single-network failures. You tap into multiple ecosystems and their upcoming projects, which lowers the risk of one chain dragging the whole portfolio down.

Support for Interoperability and Innovation: When you participate, you’re not just earning; you’re nurturing the cross-chain future. Your choices today help the interoperable finance stack grow, which accelerates the adoption of the next generation of blockchain infrastructure.

Best Practices for Seamless Cross-Chain Staking

Pick Trusted Bridges and Protocols: Stick to well-reviewed, thoroughly audited bridges and platforms—like Multichain and Wormhole—to minimize the chances of hacks and ensure your tokens arrive safely.

Verify Network Compatibility: Confirm that the staking platform recognizes the specific chain and token you’re moving. Network mismatches can trigger failed transactions or, worse, permanent token loss.

Fortify Your Wallets: Choose non-custodial wallets that handle multiple chains, such as MetaMask or Rabby, and pair them with hardware wallets when dealing with larger stakes for added protection.

Test with Minimal Transfers: Execute a tiny token transfer as a proof of concept before you scale up, confirming that the entire cross-chain flow functions as expected.

Watch Gas Prices and Network Timing: Keep an eye on gas fees and pick off-peak times for your transactions, especially on chains like Ethereum where fees can spike.

Monitor Protocol Announcements: Subscribe to project updates and security channels, since staking parameters or supported chains can change, and staying informed helps you adapt quickly.

Safeguard Recovery Phrase Backups: Write down your wallet’s recovery phrases and store them offline; losing these in the middle of a cross-chain move can sever your access.

Track Rewards and Validator Health: Use crypto dashboards or analytics platforms to keep an eye on your staking returns, validator performance, and token positions across every network involved.

Risks and Challenges

Bridge Vulnerabilities

Cross-chain bridges remain frequent targets for attackers. A breach could mean immediate loss of staked funds or prolonged delays in moving tokens from one network to another.

Smart Contract Bugs

Sophisticated multi-chain staking platforms depend on intricate smart contracts. Any unnoticed bug or deliberate exploit can erase funds or void staking rewards.

Network Congestion and High Gas Fees

When heavily used chains—especially Ethereum—slow down, pending transactions pile up and gas prices soar, cutting into staking profitability and timeliness.

Validator Risks

Chains with permission-less or semi-permission-less validators may expose users to underperforming or outright rogue operators, leading to reduced staking rewards and, in worst cases, slashing.

Asset Compatibility Issues

Not every token can flow smoothly from one chain to another. A miscalculated bridge choice or forgotten approval can render tokens lost or locked.

Liquidity Constraints

Staking on emerging or niche chains often means shallow liquidity. Trying to exit a position could force a sale at unfavorable rates, fracturing expected returns.

Lack of Unified Management Tools

With no single interface to oversee multi-chain assets, operators must juggle wallets and explorers. Even minor human errors in this fragmented landscape can trigger costly missteps.

Future of Cross-Chain Staking

Cross-chain staking is on a path toward seamless interoperability, smart automation, and a polished user experience. Innovations such as zero-knowledge proofs and intent-based architectures will cut the dependency on fragile bridges, turning every cross-chain transfer into a safer, leaner process.

Projects like EigenLayer and Cosmos’ IBC are already laying down the rails for shared security and true native staking across chains. Soon, AI-driven services will fine-tune staking strategies on the fly, balancing higher yields against ever-shifting risks.

As clear regulations materialize and interfaces grow more intuitive, cross-chain staking will transition into a widely adopted way to earn passive rewards while bolstering decentralized networks around the world.

Conclusion

Staking tokens across different chains is getting easier every day because of improved protocols, cross-chain platforms, and tools designed with users in mind. When you stick to best practices, pick reliable bridges, and keep up with risks and new developments, you can tap into big opportunities spread across many blockchains.

You might be looking to boost rewards, lower risk by diversification, or back decentralized networks—either way, cross-chain staking gives you a nimble and effective way to grow your crypto. As the space keeps moving forward, smooth cross-chain staking will be a key piece of the decentralized finance future.

FAQ

What does cross-chain staking mean?

Cross-chain staking allows users to stake tokens across different blockchain networks using bridging or interoperable protocols without converting or swapping assets manually.

Do I need multiple wallets to stake cross-chain tokens?

No. Many modern wallets like MetaMask or Rabby support multiple chains, allowing you to manage and stake tokens across networks from one interface.

Is cross-chain staking safe?

While generally safe, it carries risks like bridge exploits or smart contract vulnerabilities. Always use reputable platforms and double-check addresses and protocols.