In this article, I am going explain how to earn bridging transaction fees which is an emerging opportunity in crypto. Bridging fees are rewards given to people who transfer assets from one blockchain to another by providing liquidity or staking tokens.

You will learn the essentials, steps to initiate the process, and ways to increase your earnings through reliable cross-chain protocolwfks fees and rewards those maintaining adequate liquidity on both sides of the bridge. Conversely, liquidity providers and bridge infrastructure operators stand to gain these fees as passive income.

What is paid out is determined by the volumes of transactions, liquidity supplied, and the bridge protocol used. This is a primitive step towards interoperability in DeFi.

How To Earn Bridging Transaction Fees

Synapse Protocol enables crossing bridging transactions from one blockchain to another. Additionally, it supports USDC and other assets on Ethereum and Avalanche. To earn bridging transaction fees on Synapse, you can become a liquidity provider.

Find below a guideline:

Access Synapse’s website and ensure to sign in to your crypto wallet.

Choose a liquidity pool that is compatible with the Synapse Protocol (example USDC on Ethereum and Avalanche).

Add tokens into the liquidity pool.

For bridging transactions, you will “capture a share of fees” for every transaction that you put through for bridging assets.

How Cross-Chain Bridges Work

Cross-chain bridges are protocols capable of facilitating the transfer of assets, or data between various blockchains. Each blockchain such as Ethereum, BNB Chain, and Solana operates independently; hence, bridges are connection points of interoperability.

When a user attempts to send a token using a bridge, the asset is first locked on the source chain, and a token is either minted or released on the destination chain.

The transaction is automated through the use of smart contracts or validators which maintain the level of security and verifiability of the transfer. This system allows free movement of assets across ecosystems.

Top Platforms That Offer Bridging Fee Rewards

Multichain (formerly Anyswap)

Multichain is a frontrunner in terms of cross-chain bridges, allowing transfers in over 90 blockchains. Users can receive bridging transaction fees by providing liquidity to its pools.

Each time a user performs a cross-chain swap, Multichain keeps the initial asset and mints a corresponding one on the destination chain. Multichain also facilitates token bridging for both native and wrapped tokens.

Its high transaction volume and coverage make it a great candidate for passive income through consistent fee sharing, while liquidity providers earn part of these transaction fees as rewards.

LayerZero

LayerZero facilitates secure and ultra-light cross-chain interactions as an interoperability protocol. It does not function like a traditional bridge but instead powers several dApps and bridges like Stargate.

Like most other bridging methods on LayerZero, users are expected to provide liquidity on LayerZero-powered platforms like Stargate Finance in order to earn bridging fees. When users carry out cross-chain transactions, liquidity providers earn a portion of the total fees that are paid during those transactions.

LayerZero employs the use of ultra-light nodes for security along with oracles and relayers for validation. With the help of such associated protocols and systems, users can earn passively from transactions on cross-chain movements that are powered by LayerZero, making it a crucial building block of DeFi.

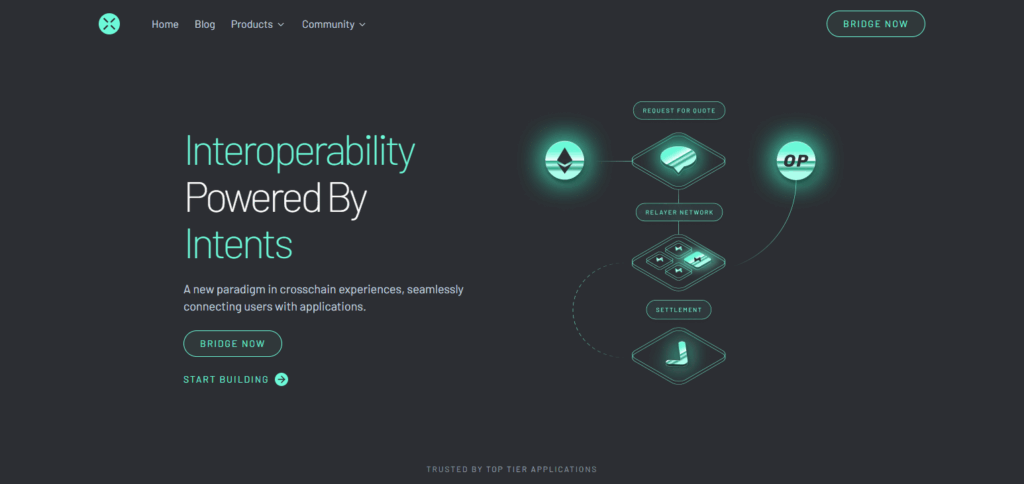

Across Protocol

Across Protocol is an efficient, cross-chain bridging system that allows easy and secure transfers from Ethereum to its rollups like Arbitrum, Optimism, and Base. It employs a relay payment system wherein relayers front the funds on the destination chain and liquidity providers back the system.

By providing assets to Across’s liquidity pools, you earn a share of the bridging fees paid by users. Across leverages UMA’s optimistic oracle to validate transfers making sure security and decentralization is upheld.

The protocol is famous for its low fees and the instant bridging experience it provides. Liquidity providers enjoy high transaction throughput and fast settlements while Within ACB ecosystem supporting a scalable bridge ecosystem.

Hop Protocol

The Hop Protocol allows users to transfer tokens quickly and in a trustless manner throughout the layer-2 networks of Ethereum, including Arbitrum, Optimism, Polygon, and Base. It uses a system of Bonders who front liquidity on the destination chain.

Users can earn bridging fees by providing liquidity to Hop pools and Bonder participants. These participants assist in the quick transfers and the overall capital sufficiency. By pre-positioning liquidity

Hop minimizes steps of slippage and delays only traditional bridging methods. Its preferred by DeFi users because of its support for major stable coins, ETH, and increased efficiency. Steady rewards benefit those who provide liquidity on Hop because of his frequent use.

Pros And Cons

| Pros | Cons |

|---|---|

| Passive Income: Earn fees by supplying liquidity. | Smart Contract Risks: Vulnerabilities can lead to loss of funds. |

| Supports DeFi Growth: Helps power cross-chain activity. | Impermanent Loss: LPs may suffer losses due to token price changes. |

| High Demand Platforms: Bridges are heavily used. | Volatile Returns: Earnings vary with bridge usage. |

| Multiple Platforms Available: Choose from many trusted protocols. | Technical Complexity: Requires understanding of bridging mechanics. |

| No Active Trading Needed: Suitable for long-term holders. | Regulatory Uncertainty: Earnings may face unclear tax treatment. |

Conclusion

In summary, the innovative earning of bridging transaction fees provides users with a unique opportunity for passive income in the DeFi world.

Users stand to benefit from high transaction volumes across numerous blockchains by providing liquidity to reputable cross-chain protocols.

As much as reward potential is attractive, assessing risks and selecting reliable platforms is equally important.

Conducting proper research assures users that their efforts can convert bridging fees into a consistent and reliable stream of income devoid of pain points.

FAQ

What are bridging transaction fees?

Bridging transaction fees are charges paid by users when transferring assets across different blockchains via a bridge. These fees reward liquidity providers or validators who facilitate these cross-chain transactions.

Which platforms pay bridging transaction fees?

Popular platforms include Multichain, Synapse Protocol, LayerZero-powered bridges, Across Protocol, and Hop Protocol.

Are there risks involved?

Yes. Risks include smart contract vulnerabilities, impermanent loss, token volatility, and potential bridge hacks.