In this article, I will discuss the How to Choose a Binance Smart Chain Bridging Provider. With numerous choices, picking the right provider is important for safe and optimal cross-chain transfers.

I will address security, other supported networks, charges, transaction speed, and overall navigation experience to aid your decision regarding bridging assets to BSC.

What is a BSC Bridging Provider?

A BSC bridging provider or bridging service is a specialized platform that allows the transfer of assets like tokens and NFTs from BSC to other blockchains such as Ethereum or Polygon and vice versa.

These service providers allow for cross chain interoperability by locking assets in one chain and minting tokens on another all on the background.

Users make use of bridging to access defi apps, lower their fees or gain access to new ecosystems without having to sell their assets. An efficient bridging provider will guarantee fast and secure cross chain transactions.

How to Choose a Binance Smart Chain Bridging Provider Step-by-Step Process:

Example: Moving USDT from Ethereum to BSC Bridge Selection

Outline Key Requirements

Your focus is on a low fee, quick transfer and strong security.

Evaluate Leading Bridges

You look at:

- Multichain: Known for over 50 supported chains with low fees and strong security.

- Celer cBridge: They are known for their speed, and low fees.

- Binance Bridge: Has direct integration with the Binance ecosystem.

- Synapse Protocol: Known for offering liquidity pools and low slippage.

Confirm AvailabilityEnsure the bridge works with USDT as well as both Ethereum and BSC networks.

Analyze Costs & Transaction Time

- Multichain: 1–2$ fee, transaction lasts around 2 minutes.

- cBridge: Around 0.5$ with a 1 minute carry out time.

- Binance Bridge: 0.1% charge and takes 5 minutes.

Trustworthiness & Previous Rating

You choose Multichain because of their decentralized design and large user base.

Wallets Setup and Bridging Steps

- MetaMask (Ethereum) and MetaMask (BSC) are linked.

- Do a 1,000 USDT transaction on Multichain bridge.

- Confirm transaction and see receiving USDT.bsc on BSC.

Popular BSC Bridging Providers to Consider

Celer cBridge

Celer cBridge remains one of the best options for bridging assets to Binance Smart Chain because of its cross-chain capabilities and fast, cheap transfers. Celer cBridge separates itself from the rest by using advanced layer-2 scaling and a State Guardian Network for fast finality and added security.

Unlike many bridges, Celer cBridge supports cross-chain seamless liquidity provision which reduces slippage and delays. For users placing great importance on decentralization and efficiency while bridging on BSC, Celer cBridge is a good option due to its simple interface and good uptime.

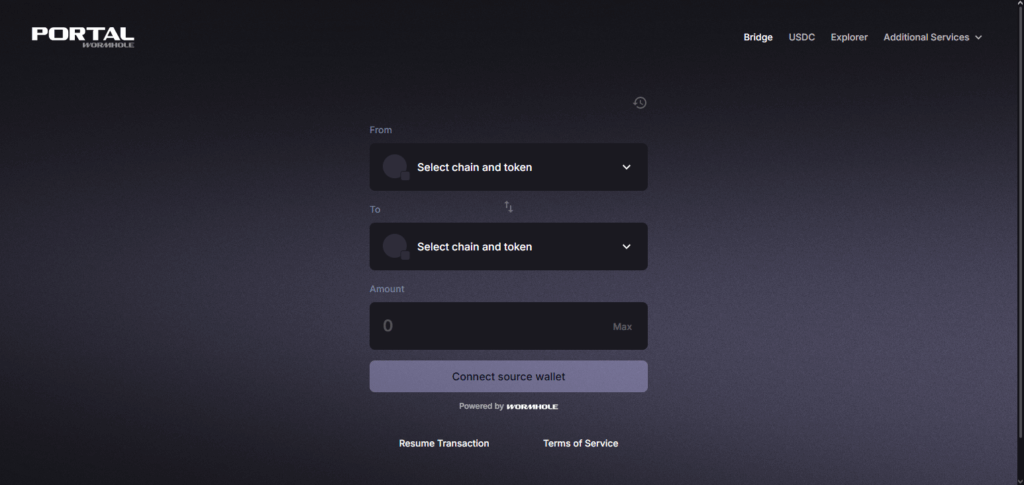

Portal Token Bridge

Portal Token Bridge stands out as an option for bridging to Binance Smart Chain due to their emphasis on true decentralization as well as trust-minimized cross-chain transfers. Portal uses the Wormhole protocol which allows for fast, permissionless movement of assets without the need for centralized custodians.

Its unique validator network ensures security through consensus, not control, making it suffer from fewer single points of failure. Portal provides robust scalability and resilience off services, supporting numerous blockchains and assets. For users seeking secure BSC interoperability, the offer is more than satisfactory.

Why Choose a Binance Smart Chain Bridging Provider

Lower Transaction Costs

Compared with Ethereum and other chains, BSC’s gas fees are considerably lower.

Quick Transactions

The fast pace of BSC’s block confirmation is excellent for real-time DeFi and NFT interactions.

Cross-Chain Interoperability

With a bridging provider, assets can be easily moved from and to BSC with Ethereum, Polygon and Solana, and others.

Expanded DeFi Access

Participants can access BSC-based DeFi platforms as well as farming, staking, and NFT markplaces.

Productive Use of Capital

Cut down on unproductive assets without liquidating or incurring taxes by moving them to more efficient generating sites.

Simplicity for DApps and Projects Scaling

Bridges provide means for developers to scale app functionalities across chains.

Stay Away from CEX

Maintain custody of private keys while transferring through decentralized bridges.

Greater Control Over Portfolios

The BSC network allows users to hold a diversified ecosystem across various ecosystems.

Common Mistakes to Avoid

Working with Scam or Unverified Bridges: Always confirm the URL and check if the bridging site is genuine.

Not Checking for Audits Done on the Smart Contracts: Do not use bridges without security audits or those that do not provide information concerning their codebase.

Not Verifying if the Token is Compatible: Check that the bridge accepts both the token and the target blockchain.

Ignoring Fee Calculation: Overlooking fees can result in cost or loss during transfer.

Assuming All Transfers Will Work the Same Way: Always initiate with a small amount prior to executing large transfers.

Expecting Immediate Transfers: Do not panic when waiting; some bridges may take minutes or hours.

Not Checking for Status or Updates on Bridges: Be wary of inactive bridges; they may be undergoing maintenance which results in delays.

Mistyping Recipients Wallet Addresses: Ensure you confirm the addresses of the recipients, especially between chains.

Ignoring System Traffic and Congestion: Attempting to bridge during peak times can lead to transfer failures or delays.

Not Keeping Backup Phrases or Wallet Keys: Not backing up your data means you will risk complete loss of assets, especially if you lose access while attempting to bridge.

Pros & Cons

| Pros | Cons |

|---|---|

| Enables cross-chain asset transfers | Potential security risks if using unaudited bridges |

| Lower fees on BSC compared to other chains | Possibility of high slippage with low liquidity |

| Access to BSC DeFi, NFTs, and DApps | Some bridges have slow transaction finality |

| No need for centralized exchanges | Risk of phishing and scam sites |

| Supports portfolio diversification | Limited token support on certain bridges |

| Promotes decentralization and self-custody | Complex for beginners without proper guidance |

| Reduces need to sell assets for chain switch | Additional gas fees required on both chains |

| Broad network compatibility with top blockchains | Bridge downtime or maintenance can delay transfers |

Conclusion

Selecting a Binance Smart Chain bridging provider impacts the safety, speed, and cost of cross-chain transfers. Prioritize platforms with robust security audits, multi-chain support, low fees, and quick transaction speeds.

To avoid low industry standards, pay attention to user reviews as well as liquidity and overall platform usability. Always check a bridge’s legitimacy and begin with small transfers. With the right bridging provider, you can safeguard your assets while simultaneously expanding your access to the evolving BSC ecosystem.

FAQ

Why is security important when choosing a bridge?

Security ensures your assets are protected from hacks, exploits, or smart contract bugs. Always choose audited and trusted bridges.

How do I know if a bridge supports my token or chain?

Check the bridge’s official documentation or interface for a list of supported tokens and compatible blockchains.

Are decentralized bridges better than centralized ones?

Decentralized bridges offer better security and transparency, while centralized ones may offer speed but carry custodial risk.