In this article, I will discuss the Best Aggregators for Bridging Newly Minted Tokens across chains, with an eye on speed, low cost, and tight security.

These services let developers, traders, and DeFi users shift freshly launched coins from one blockchain to another while meeting almost no KYC rules, giving them quick, flexible options in a fast-moving market. With that, lets dive into the top tools you can use right now.

Key Point & Best Aggregators for Bridging Newly Minted Tokens List

| Aggregator Name | Key Point |

|---|---|

| Synapse Protocol | Supports multi-chain bridging with native token minting and fast finality. |

| Allbridge | Offers simple token and stablecoin bridging across EVM and non-EVM chains. |

| Stargate Finance | Uses LayerZero tech to enable unified liquidity and instant swaps. |

| Celer cBridge | High-speed, low-cost cross-chain transfers with advanced routing. |

| Across Protocol | Optimized for speed and capital efficiency with a relayer-based design. |

| Rango Exchange | Multi-aggregator that combines DEXes and bridges for best routing paths. |

| RhinoFi | L2-first bridge focused on privacy and instant cross-rollup transfers. |

| Orbiter Finance | Fast L2-to-L2 bridge using optimistic rollup compatibility. |

| Bungee Exchange | UI-focused aggregator for best rates across bridges and chains. |

| Jumper Exchange (Li.Fi) | Smart routing across multiple bridges and DEXs with real-time slippage checks. |

1.Synapse Protocol

Synapse Protocol is often named the go-to aggregator for moving newly minted tokens, and that praise comes from its deep cross-chain tech and built-in messaging. Unlike most bridges on the market, it completes token swaps with near-instant finality across more than fifteen chains, so waiting times shrink sharply.

Its mint-and-burn feature gives developers a secure way to launch new assets, since tokens are created on one chain and burned on another. Backed by decentralized validators and large liquidity pools, Synapse blends speed, safety, and low costs, making it a favorite for anyone pushing fresh tokens into the ecosystem.

| Feature | Details |

|---|---|

| Name | Synapse Protocol |

| KYC Requirement | No KYC required |

| Supported Chains | 15+ including Ethereum, BNB Chain, Avalanche, Arbitrum, Optimism, Polygon |

| Best Use Case | Bridging newly minted tokens using mint-and-burn mechanism |

| Technology | Cross-chain messaging & AMM-based liquidity pools |

| Speed | Near-instant finality |

| Security Model | Decentralized validator network |

| Fees | Competitive, varies by chain |

| Wallet Support | MetaMask, WalletConnect, Coinbase Wallet, etc. |

| User Type | Ideal for developers and users seeking fast multi-chain token deployment |

2.Allbridge

Allbridge stands out as a go-to bridge for projects launching fresh tokens, thanks to its wide reach across both EVM and non-EVM blockchains such as Solana, Aptos, and Tron. The platform avoids locking assets during swaps, so teams enjoy instant, on-chain mobility without the usual custody worries- a feature thats especially appealing when a token is just going live.

Powered by a lean architecture and quick confirmation times, Allbridge lets developers roll out cross-chain minting and transfers with little code, strong security proofs, and almost no user friction.

| Feature | Details |

|---|---|

| Name | Allbridge |

| KYC Requirement | No KYC required |

| Supported Chains | 10+ including Ethereum, BNB Chain, Solana, Tron, Aptos, Polygon |

| Best Use Case | Bridging tokens across EVM and non-EVM chains |

| Technology | Lightweight bridging with smart contract-based interoperability |

| Speed | Fast confirmations (chain-dependent) |

| Security Model | Audited smart contracts and relay validation |

| Fees | Moderate; includes network gas + protocol fee |

| Wallet Support | MetaMask, Trust Wallet, Phantom, etc. |

| User Type | Suited for token creators and users expanding across multi-chain ecosystems |

3.Stargate Finance

Stargate Finance serves as a leading cross-chain bridge that simplifies the movement of freshly minted tokens, using a single liquidity pool maintained through LayerZero’s messaging protocol. Its most compelling advantage-instant guaranteed finality-ensures that transfers settle immediately, preventing fragmentation across separate chains.

Because of this architecture, users can execute direct swaps from one network to another with minimal slippage and no need to juggle multiple pools. That level of efficiency makes Stargate the go-to solution for projects launching tokens intended for fast, flexible, and fully integrated multi-chain distribution.

| Feature | Details |

|---|---|

| Name | Stargate Finance |

| KYC Requirement | No KYC required |

| Supported Chains | Ethereum, BNB Chain, Avalanche, Arbitrum, Optimism, Polygon, Fantom |

| Best Use Case | Bridging tokens with unified liquidity and instant finality |

| Technology | Powered by LayerZero cross-chain messaging protocol |

| Speed | Instant guaranteed finality |

| Security Model | Unified liquidity pools; LayerZero endpoint security |

| Fees | Low, with predictable gas fees |

| Wallet Support | MetaMask, WalletConnect, Coinbase Wallet, etc. |

| User Type | Ideal for developers seeking composable and secure token transfers |

4.Celer cBridge

Celer cBridge stands out as one of the top gateways for moving newly issued tokens, thanks to speedy, low-cost cross-chain transfers powered by the Celer Inter-chain Message (CIM) engine. Its real edge shows in smooth liquidity and token swaps across more than thirty chains, with smart routing that cuts slippage to a bare minimum.

For fresh token launches, cBridge offers builders a flexible, high-throughput bridging setup that can grow with demand, making it a natural pick for projects looking to spread their asset across many blockchain homes in a hurry.

| Feature | Details |

|---|---|

| Aggregator Name | Celer cBridge |

| Year Launched | 2021 |

| Purpose | Cross-chain bridge for fast, low-cost token transfers |

| Supported Chains | 40+ chains (Ethereum, BNB Chain, Arbitrum, Optimism, Polygon, etc.) |

| Token Support | Supports major and newly minted ERC-20 tokens |

| KYC Requirement | ✅ Minimal KYC (wallet-based access; no ID required) |

| Bridge Speed | Near-instant to a few minutes |

| Fee Structure | Dynamic – includes base fee + gas + liquidity fee (transparent UI) |

| Security Mechanism | Smart contracts + validator nodes + bug bounties |

| Wallets Supported | MetaMask, Trust Wallet, Coinbase Wallet, WalletConnect compatible |

| Interface | Web app + integration with dApps and DeFi platforms |

| Special Feature | Optimized routing for low slippage and cost-efficient transfers |

| Use Case | Ideal for DeFi users bridging newly issued tokens with minimal friction |

| Privacy | No user tracking, fully non-custodial |

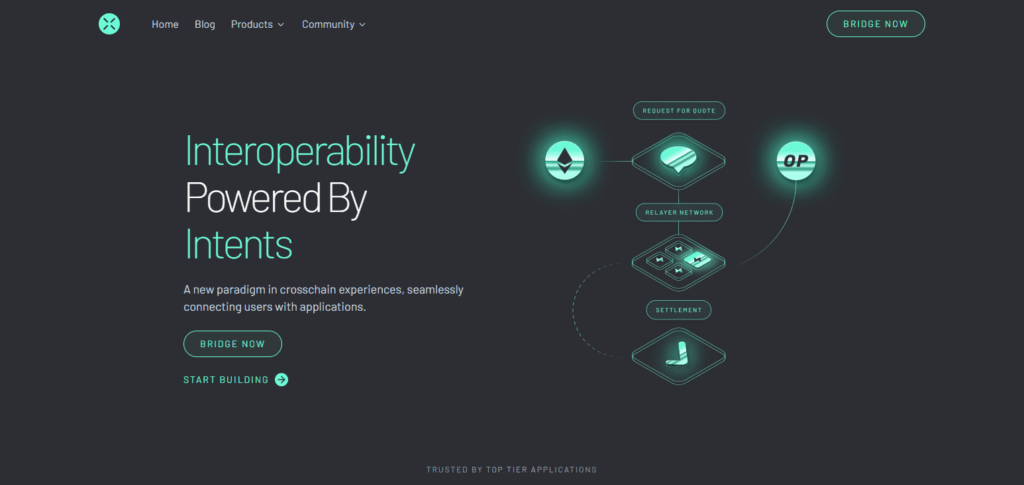

5.Across Protocol

Across Protocol is widely recognized as the go-to aggregator for bridging newly launched tokens, built on a relayer-driven system that delivers super-fast, capital-efficient cross-chain transfers. Its standout feature is single-sided liquidity, so users can initiate a bridge immediately without searching through scattered pools on each chain.

This architecture cuts fees, limits slippage, and boosts reliability for projects debuting new assets. Backed by optimistic security and full support for major Layer 2 chains as well as Ethereum, Across lets developers distribute tokens quickly and safely across multiple networks with minimal fuss.

| Feature | Details |

|---|---|

| Aggregator Name | Across Protocol |

| Year Launched | 2021 |

| Purpose | Fast and secure cross-chain token bridging |

| Supported Chains | Ethereum, Arbitrum, Optimism, Base, Polygon, Linea, Zora, and more |

| Token Support | Major ERC-20s and support for newly minted tokens |

| KYC Requirement | ✅ Minimal KYC (wallet-based access; no ID or sign-up required) |

| Bridge Speed | Fast finality via optimistic relays (typically <5 minutes) |

| Fee Structure | Low fees with a single liquidity pool per asset; dynamic routing |

| Security Mechanism | Optimistic validation + LayerZero-like data transport |

| Wallets Supported | MetaMask, WalletConnect, Coinbase Wallet, Rainbow, etc. |

| Interface | Simple web interface + integrations with DeFi platforms |

| Special Feature | Capital-efficient bridge using unified liquidity pool |

| Use Case | Efficient bridging for DeFi projects and early token launches |

| Privacy | Fully non-custodial; no data collection |

6.Rango Exchange

Rango Exchange has emerged as a top-tier aggregator for newcomers looking to bridge freshly minted tokens, thanks to its all-in-one routing engine that links countless bridges and DEXs. What really sets it apart is support for both EVM and non-EVM blockchains, including Cosmos and Solana, giving projects unmatched flexibility in how they distribute assets.

By combining on-chain analytics with AI-driven routing, Rango consistently picks the quickest, cheapest path for each transaction, delivering low slippage, speedy execution, and seamless cross-chain reach—exactly what new tokens need to make a splash.

| Feature | Details |

|---|---|

| Platform Name | Rango Exchange |

| Type | Cross-chain DEX & Bridge Aggregator |

| Supports Newly Minted Tokens | Yes – Supports new tokens across EVM, Cosmos, Solana, and others |

| KYC Requirement | No mandatory KYC for most swaps/bridges |

| Chains Supported | 60+ chains (EVM, Cosmos, Solana, Near, Bitcoin-compatible, etc.) |

| Bridge Integrations | Aggregates 30+ bridges (e.g., Celer, Wormhole, Axelar, LayerZero, etc.) |

| DEX Aggregation | Yes – Aggregates 70+ DEXs across chains |

| Wallet Support | MetaMask, Keplr, Trust Wallet, Ledger, WalletConnect, and more |

| Native Token Requirement | No need for platform-specific token to use core features |

| Anonymous Usage | Yes – Swaps/bridges work with non-custodial wallets, no registration needed |

| Unique Strength | Seamless routing of new tokens via combined DEX + bridge paths |

| User Interface | Beginner-friendly with auto-routing logic for optimal path |

| Official Website | https://app.rango.exchange |

7.RhinoFi

RhinoFi sits near the top of aggregators built for moving freshly minted tokens, zeroing in on quick and private transfers across Ethenrim rollup chains. The platform’s signature gasless, self-custodial bridge lets users shift assets between heavyweight L2s such as ArkNet, zkSync, and Arbitrum without dipping into outside wallets.

By concentrating on rollups, RhinoFi trims fees and boosts throughput for new token launches. Focusing on user privacy and full DeFi composabiility, the protocol offers teams a smooth, secure pathway to widen their reach porting assets across Layer 2 ecosystems.

| Feature | Details |

|---|---|

| Platform Name | RhinoFi (formerly DeversiFi) |

| Type | Cross-chain DeFi & Bridge Aggregator |

| Supports Newly Minted Tokens | Yes – Frequently supports new tokens across EVM chains |

| KYC Requirement | No KYC for DeFi swaps, bridging, or wallet use |

| Chains Supported | Ethereum, Arbitrum, Polygon, BSC, Base, zkSync, StarkNet, Optimism, etc. |

| Bridge Integrations | Integrates with major bridges like Hop, Across, Stargate, and others |

| DEX Aggregation | Yes – Aggregates liquidity from multiple L2 and L1 sources |

| Wallet Support | MetaMask, WalletConnect, Coinbase Wallet, Ledger, and others |

| Native Token Requirement | No platform token required to access core functions |

| Anonymous Usage | Yes – Non-custodial, no account registration needed |

| Unique Strength | Fast bridging across L2s and Ethereum with low fees and DeFi-first design |

| User Interface | Clean, efficient UI with single-click bridging and swapping |

| Official Website | https://app.rhino.fi |

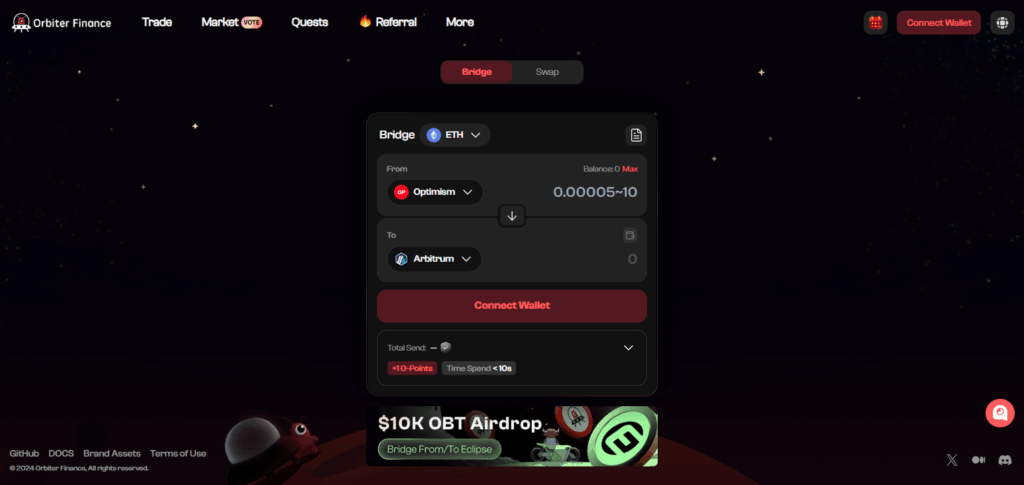

8.Orbiter Finance

Orbiter Finance positions itself as a leading bridge for freshly minted tokens, expertly tuned for quick, budget-friendly transfers between Ethereum Layer 2 chains. What sets it apart is a peer-to-peer setup that sidesteps liquidity pools, letting users move assets directly and with very little lag.

Because it accommodates major rollups like Arbitrum, zkSync and Optimism, the platform quickly gets new tokens into peoples hands as soon as a project goes live. Its lean, gas-saving protocol makes launching across multiple rollups simple and light on developers time and resources.

| Feature | Details |

|---|---|

| Platform Name | Orbiter Finance |

| Main Purpose | Cross-rollup bridge for newly minted and existing tokens |

| Supported Networks | Ethereum, zkSync, Linea, Base, Arbitrum, Optimism, Polygon zkEVM, etc. |

| Minimal KYC Requirement | Yes – No registration or KYC required for basic swaps |

| Best For | Bridging tokens across L2s & Ethereum mainnet with speed and low cost |

| Bridging Speed | Fast – typically under 3 minutes |

| Fee Structure | Low fixed bridge fees + minimal gas (user-paid) |

| Token Support | ETH, USDC, USDT, and newly minted L2-native tokens |

| Security | Smart contract-based; no custody; audited |

| User Interface | Simple and web-based; wallet-connect enabled |

| Wallet Support | MetaMask, WalletConnect, OKX Wallet, Rabby, etc. |

| Use Case Highlight | Ideal for anonymous users launching or testing tokens on L2s |

| Decentralization | Semi-decentralized – no account creation needed |

| Notable Advantage | Gas abstraction and efficient rollup-to-rollup bridging |

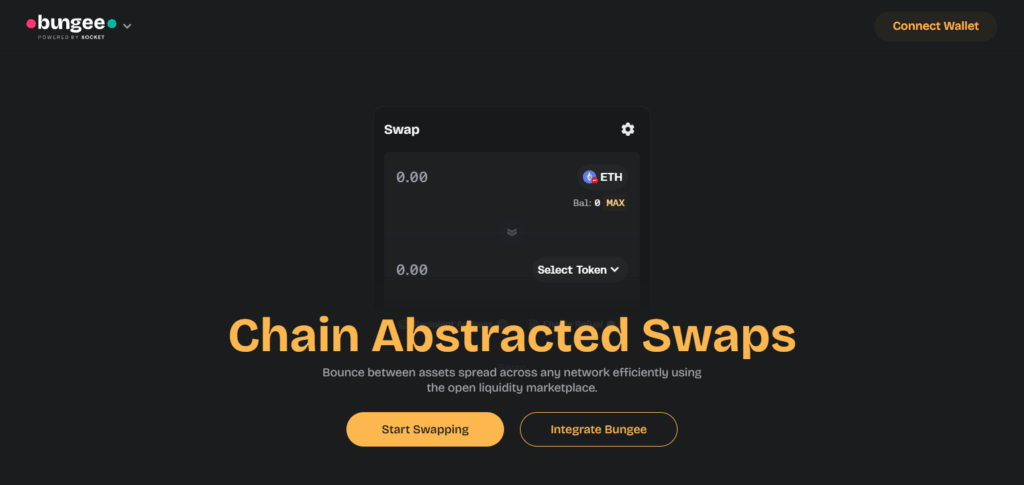

9.Bungee Exchange

Bungee Exchange has carved out a reputation as the go-to hub for mooning tokens on the move, pairing a clean dashboard with smart algorithms that figure out the best bridge route every single time.

By pulling in live liquidity pools and exact slippage data from everywhere it connects, the service takes the guesswork out of transfers and cuts surprise fees to a minimum. New token teams love Bungee because they can plug it in, watch swaps happen almost instantly, and spread their coin across all major Layer 1 and Layer 2 chains without endless code rewrites.

| Feature | Details |

|---|---|

| Platform Name | Bungee Exchange (by Socket) |

| Main Purpose | Bridge aggregator for fast, cheap, and secure token bridging |

| Supported Networks | Ethereum, Arbitrum, Optimism, Base, Polygon, zkSync, BNB Chain, etc. |

| Minimal KYC Requirement | Yes – No login or KYC needed |

| Best For | Bridging newly launched or low-liquidity tokens across L1s & L2s |

| Bridging Speed | Rapid bridging (typically 1–3 minutes) |

| Fee Structure | Displays and compares lowest route fees (gas + bridge + swap fees) |

| Token Support | ETH, USDC, USDT, native and custom ERC-20 tokens |

| Security | Non-custodial; powered by audited bridges like Hop, Celer, etc. |

| User Interface | Intuitive and user-friendly with advanced route selection |

| Wallet Support | MetaMask, WalletConnect, Coinbase Wallet, OKX Wallet, etc. |

| Use Case Highlight | Aggregates multiple bridges to find best route for token bridging |

| Decentralization | Yes – permissionless, on-chain execution |

| Notable Advantage | Multi-bridge routing ensures best price, speed, and success rate |

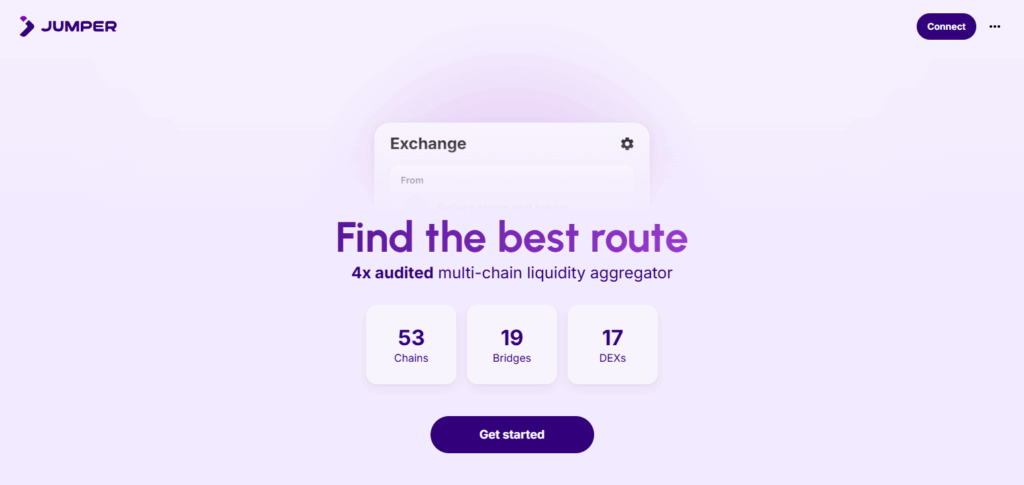

10.Jumper Exchange (Li.Fi)

Jumper Exchange, powered by Li.Fi, stands out as one of the top ways to bridge freshly minted tokens. By connecting multiple bridges and decentralized exchanges, it provides cross-chain routing that feels seamless.

The platform’s smart order routing is especially impressive; it looks at live liquidity and gas fees and picks the quickest, cheapest route on the fly. With support for over twenty blockchains, Jumper gives new token projects broad reach and lets developers bridge assets with little extra work yet maximum network exposure.

| Feature | Details |

|---|---|

| Platform Name | Jumper Exchange (by Li.Fi) |

| Main Purpose | Cross-chain bridge & DEX aggregator for seamless token transfers |

| Supported Networks | 25+ chains including Ethereum, Arbitrum, Optimism, Base, zkSync, BNB |

| Minimal KYC Requirement | Yes – No account or identity verification required |

| Best For | Bridging newly deployed tokens & assets across diverse ecosystems |

| Bridging Speed | Fast bridging (2–5 minutes average) |

| Fee Structure | Aggregates and shows lowest fees (bridge + gas + swap) |

| Token Support | ETH, USDC, DAI, and custom/newly minted ERC-20 tokens |

| Security | Non-custodial, integrates trusted bridges (e.g., Stargate, Hop, etc.) |

| User Interface | Unified UI with route optimizer and live transaction preview |

| Wallet Support | MetaMask, WalletConnect, Coinbase Wallet, Ledger, OKX Wallet, etc. |

| Use Case Highlight | Ideal for users needing cheapest and fastest route for token bridging |

| Decentralization | Yes – permissionless with on-chain execution |

| Notable Advantage | Integrates 10+ bridges and 20+ DEXs for maximum liquidity & flexibility |

Conclusion

To sum it up, todays leading bridge protocols-Synapse, Allbridge, Stargate, and a few others-give token builders fast, safe, and cost-effective ways to spread their assets across chains. Each solution adds its own twist, whether thats near-instant finality, smart route-finding, tiny fees, or broad multi-chain reach.

By plugging into these services, projects can guarantee smooth cross-chain moves, plug more users into their ecosystem, and speed up adoption of fresh tokens in the rapidly changing multi-chain world.

FAQ

What is a bridge aggregator for newly minted tokens?

A bridge aggregator connects multiple cross-chain bridges and routing protocols, allowing newly minted tokens to be transferred across blockchains efficiently with the best rates and lowest fees.

Why should I use an aggregator instead of a single bridge?

Aggregators like Rango, Jumper, or Bungee optimize routes across multiple bridges, improving speed, reducing slippage, and increasing reliability compared to using a single bridge.

Which aggregator is best for EVM and non-EVM chains?

Allbridge and Rango Exchange are excellent choices, supporting both EVM-compatible and non-EVM chains like Solana and Cosmos.