In this article, I will discuss the Best Aggregator For Bridging Store-of-value Tokens. Asset transfers require high levels of security, especially when moving valuable tokens between blockchains.

The best aggregators offer minimal fees, fast finality, and strong security while preserving token value. This guide highlights top platforms that excel in bridging store-of-value tokens efficiently and reliably.

Key Point & Best Aggregator For Bridging Store-of-value Tokens List

| Protocol Name | Key Point |

|---|---|

| Across Protocol | Optimized for speed and low fees using relayers and UMA oracle validation |

| Synapse Protocol | Multi-chain AMM & bridge with support for custom assets and smart contracts |

| Portal (Wormhole) | Decentralized interoperability platform connecting 30+ blockchains |

| Stargate Finance | First native asset bridge using LayerZero with instant guaranteed finality |

| Allbridge | Focuses on bridging EVM & non-EVM chains with customizable token support |

| Orbiter Finance | Layer 2-to-Layer 2 bridge focused on fast and low-cost ETH transfers |

| Hop Protocol | Bridges native tokens across L2s like Arbitrum, Optimism, and Polygon |

| Celer cBridge | High-speed, low-cost multi-chain bridge built on Celer Network |

| Rango Exchange | Aggregates multiple bridges and DEXs for optimal cross-chain swaps |

| Bungee Exchange | Aggregator of bridges offering best route, speed, and gas fee optimization |

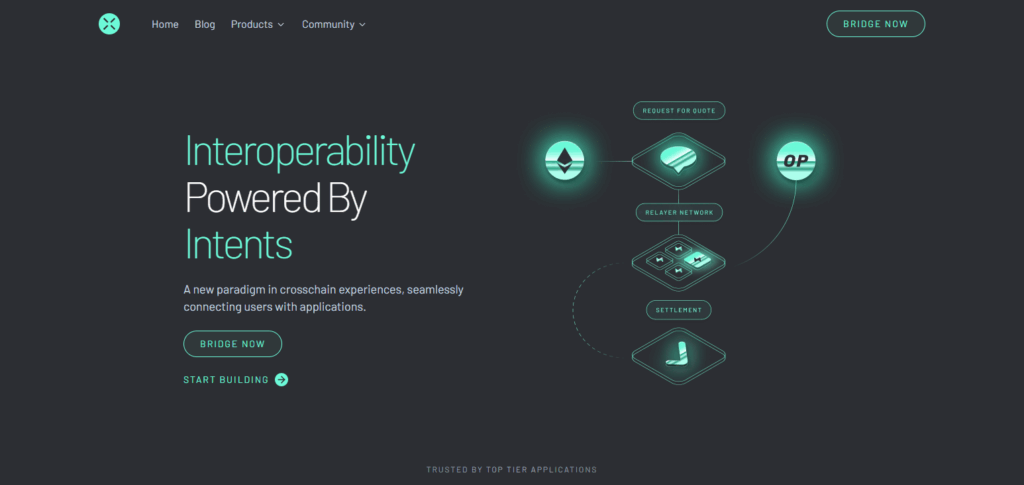

1.Across Protocol

Across Protocol is the leading aggregator for bridging store-of-value tokens because of its capital efficiency and low slippage. Unlike most traditional bridges, Across operates on a unified liquidity pool model using a distributed relayer system and verification through UMA oracles which allows for fast, safe, and inexpensive transfers.

This structure is particularly useful for large-value transactions as it reduces the cost of value preservation during cross-chain transfers. Its strong architecture combined with high liquidity incentives makes it stand out from other protocols when it comes to efficiently managing valuable assets.

| Feature | Details |

|---|---|

| Protocol Name | Across Protocol |

| Main Use Case | Bridging store-of-value tokens |

| KYC Requirement | Minimal to none (depends on destination chain) |

| Security | Uses decentralized relayers and UMA oracle for validation |

| Supported Chains | Ethereum, Arbitrum, Optimism, Avalanche, Polygon, others |

| Token Support | Native tokens and stablecoins with minimal slippage |

| Transfer Speed | Fast finality with low latency |

| Fees | Low fees optimized for large-value transfers |

| Liquidity Model | Unified liquidity pool for efficient capital utilization |

| Unique Point | Capital efficient design ideal for large, secure transfers |

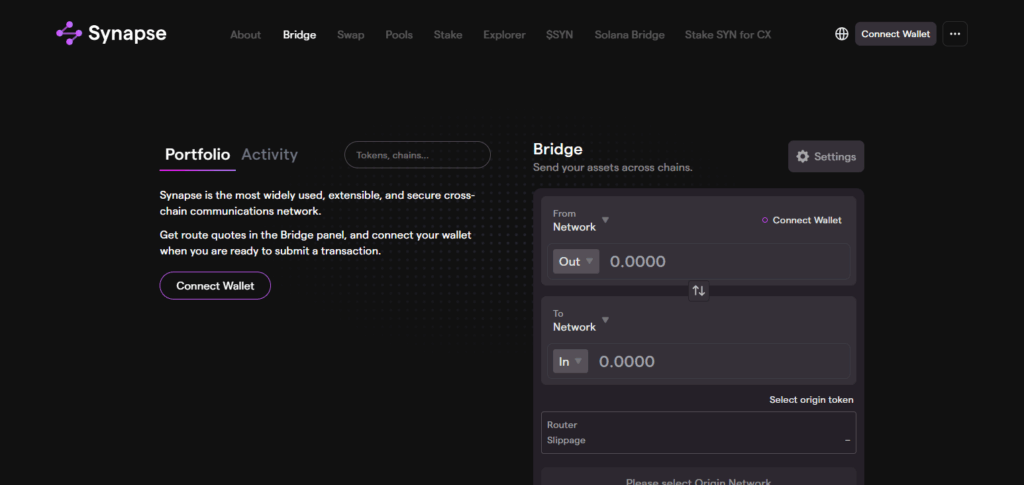

2.Synapse Protocol

As an aggregator Synapse Protocol specializes in bridging store-of-value tokens through maintaining interoperability across blockchains and adhering to the principles of asset preservation.

It offers unique capabilities due to its cross-chain AMM and smart contract integration, which enables secure native asset transfers and liquidity provisioning. Users are therefore able to transfer high-value tokens with greater flexibility and reduced risk. Synapse maintains low-slippage transfers through efficient liquidity routing which supports wrapped or native tokens, thus enabling stable and precise value transfer across chains.

| Feature | Details |

|---|---|

| Protocol Name | Synapse Protocol |

| Main Use Case | Bridging store-of-value tokens |

| KYC Requirement | Minimal to none depending on network and amount |

| Security | Decentralized smart contracts with audited protocols |

| Supported Chains | Ethereum, Binance Smart Chain, Avalanche, Polygon, Fantom, others |

| Token Support | Native tokens, wrapped assets, stablecoins |

| Transfer Speed | Near-instant finality with efficient liquidity routing |

| Fees | Competitive and optimized for large transfers |

| Liquidity Model | Cross-chain AMM pools with dynamic liquidity management |

| Unique Point | Combines cross-chain AMM with smart contract flexibility for secure value transfers |

3.Portal Token Bridge (Wormhole)

Wormhole’s Portal Token Bridge serves as the most advantageous aggregator for bridging store-of-value tokens because of its extensive multi-chain reach and strong security framework. Its specialized cross-chain message relay makes it possible to transfer assets over 30 blockchains without the need of wrapping tokens.

This form of direct interoperability eliminates complexity, which is crucial especially for high-value tokens. Adding on to this, the burden of ensuring that high-value tokens are guarded during transit is lessened by the added trust provided by Wormhole’s guardian network. This greatly facilitates the movement of crypto assets across ecosystems.

| Feature | Details |

|---|---|

| Protocol Name | Portal Token Bridge (Wormhole) |

| Main Use Case | Bridging store-of-value tokens |

| KYC Requirement | Minimal to none, mostly protocol-level |

| Security | Decentralized guardian network verifying cross-chain messages |

| Supported Chains | 30+ chains including Ethereum, Solana, Avalanche, BSC, Polygon |

| Token Support | Native tokens without wrapping, preserving authenticity |

| Transfer Speed | Fast cross-chain finality with robust validation |

| Fees | Low to moderate, optimized for high-value transfers |

| Liquidity Model | Direct asset transfers with decentralized verification |

| Unique Point | Broad multi-chain support with secure, non-wrapped token bridging |

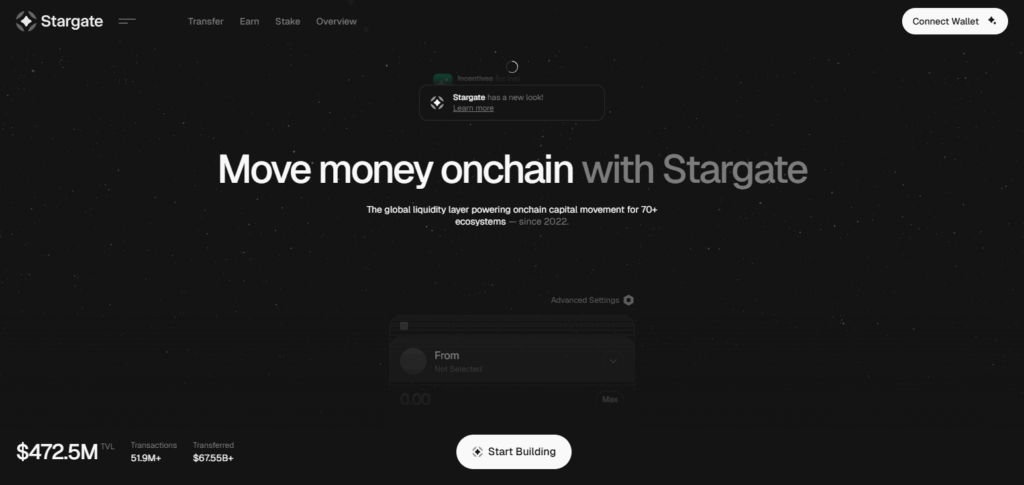

4.Stargate Finance

Stargate Finance remains the top aggregator for bridging store-of-value tokens as it provides cross-chain native asset bridging with guaranteed instant finality.

The seamless, trust-minimized transfers made possible by LayerZero’s unified messaging protocol are executed without relying on wrapped tokens, reducing associated risks and protecting asset value. Stargate’s liquidity pools guarantee deep capital availability, which minimizes slippage even for large transfers.

The combination of these features demonstrates why Stargate is unmatched in cross-chain movements of high-value tokens: outstanding native asset support, rapid settlement, and unparalleled liquidity.

| Feature | Details |

|---|---|

| Protocol Name | Stargate Finance |

| Main Use Case | Bridging store-of-value tokens with native asset support |

| KYC Requirement | Minimal to none, depends on destination chain |

| Security | Uses LayerZero protocol with unified messaging for security |

| Supported Chains | Ethereum, Avalanche, Fantom, BSC, Polygon, Optimism, Arbitrum |

| Token Support | Native tokens, no wrapping needed |

| Transfer Speed | Instant guaranteed finality |

| Fees | Low fees optimized for large-value transfers |

| Liquidity Model | Shared liquidity pools ensuring deep liquidity |

| Unique Point | Native asset bridging with instant finality and low risk |

5.Allbridge

Allbridge serves as the most effective aggregator for bridging store-of-value tokens due to its support for both EVM and lesser known non-EVM chains, which allows for seamless movement of assets throughout various blockchain ecosystems, ensuring flexibility and security.

Its distinct multi-asset support allows users to bridge native tokens without excessive reliance on wrapped assets, thereby safeguarding their value. Allbridge adaptive liquidity control alongside cross-chain messaging optimizes transfer speed while also reducing costs, which assures dependability when securely transferring high-value tokens without undo slippage.

| Feature | Details |

|---|---|

| Protocol Name | Allbridge |

| Main Use Case | Bridging store-of-value tokens across diverse chains |

| KYC Requirement | Minimal to none, based on chain and transfer size |

| Security | Decentralized bridge with audited smart contracts |

| Supported Chains | EVM and non-EVM chains including Ethereum, Solana, Avalanche, Binance Smart Chain, others |

| Token Support | Native tokens and wrapped assets |

| Transfer Speed | Fast cross-chain transfers with optimized routing |

| Fees | Competitive, designed for cost-effective large transfers |

| Liquidity Model | Dynamic liquidity pools with cross-chain messaging |

| Unique Point | Supports broad chain compatibility including non-EVM networks |

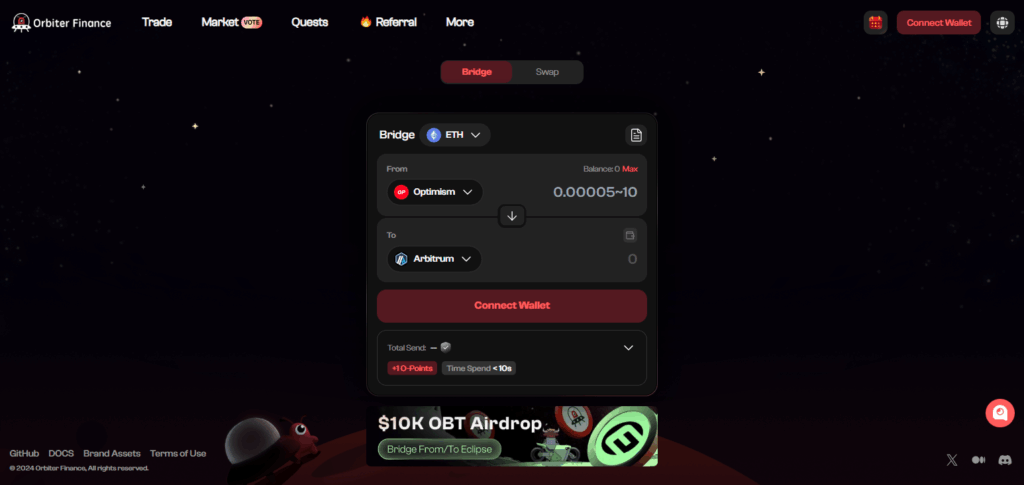

6.Orbiter Finance

Orbiter Finance has proven to be the best aggregator when it comes to bridging value tokens due to its specialization in quick and inexpensive transfers between Layer 2 solutions. Its focus on Layer 2 to Layer 2 bridging mitigates the congestion and high fees of the mainnets which is especially beneficial when transferring large tokens.

The streamlined protocol of Orbiter ensures quick finality with secure cross-chain messaging which in turn provides a reliable bridge while preserving the value store tokens across the scaling networks.

| Feature | Details |

|---|---|

| Protocol Name | Orbiter Finance |

| Main Use Case | Bridging store-of-value tokens across Ethereum Layer 2 rollups |

| KYC Requirement | Minimal to none; no identity verification required for most users |

| Security | Utilizes Zero-Knowledge Proofs (ZKPs) and decentralized validation |

| Supported Chains | 19+ networks including Arbitrum, Optimism, zkSync, StarkNet, Polygon, Base, Linea, Scroll, and more |

| Token Support | ETH, USDC, USDT, DAI, and other major ERC-20 tokens |

| Transfer Speed | Near-instant finality with low latency |

| Fees | Low fees; protocol fee of 0.00023 ETH plus a trading fee of 0.2%–0.3% |

| Liquidity Model | Decentralized liquidity pools with Maker model for efficient routing |

| Unique Point | Cross-rollup transfers with ZKP-based security and no mainnet dependency |

7.Hop Protocol

With its unique emphasis on native token transfers over two Layer 2 networks and sidechains, Hop Protocol stands out as the best aggregator for bridging store-of-value tokens. Hop mitigates risk and maintains a token’s value by allowing direct swaps of ETH and stablecoins without the need for wrapping.

Large transfers are particularly favored because of reduced slippage and transaction costs given efficient liquidity pools and fast settlement times. The design is robust and smooth, protecting the integrity and liquidity of store-of-value tokens across multiple chains.

| Feature | Details |

|---|---|

| Protocol Name | Hop Protocol |

| Main Use Case | Bridging native tokens across Layer 2 solutions and sidechains |

| KYC Requirement | Minimal to none depending on transaction size and chain |

| Security | Decentralized smart contracts with audits |

| Supported Chains | Ethereum, Polygon, Arbitrum, Optimism, Gnosis, BSC |

| Token Support | Native tokens and stablecoins without wrapping |

| Transfer Speed | Fast finality optimized for Layer 2 networks |

| Fees | Low fees designed for large value transfers |

| Liquidity Model | Shared liquidity pools across chains |

| Unique Point | Focus on seamless native asset transfers between Layer 2s |

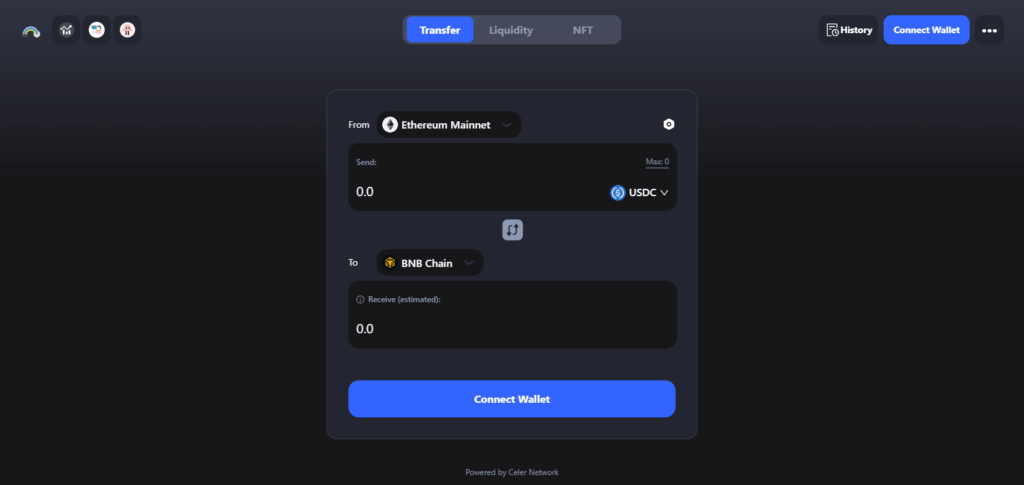

8.Celer cBridge

Celer cBridge offers the fastest and most cost-effective cross-chain transfer and is now the best aggregator for bridging store-of-value tokens. Celer Network’s Layer 2 scaling technology powers it. Its off-chain coupled with fast finality provides liquidity for movement of high-value assets with minimal slippage.

cBridge guarantees multi-chain trustable token bridges by maintaining the integrity and custody of the tokens by securing them with strong security frameworks which protects users and trust while optimizing transfer speed and gas fees. The result is the ideal solution for cross-chain bridging of valuable tokens.

| Feature | Details |

|---|---|

| Protocol Name | Celer cBridge |

| Main Use Case | Bridging store-of-value tokens across Layer 1 and Layer 2 networks |

| KYC Requirement | Minimal to none; depends on destination chain and transfer size |

| Security | Utilizes State Guardian Network (SGN) with hybrid security models |

| Supported Chains | Over 40 chains including Ethereum, BNB Chain, Polygon, Arbitrum, Optimism, Sui, and more |

| Token Support | USDT, USDC, ETH, WBTC, DAI, BUSD, METIS, and various protocol tokens |

| Transfer Speed | Instant finality with low latency |

| Fees | Low fees optimized for large-value transfers |

| Liquidity Model | xAsset (lock-and-mint) and xLiquidity (pool-based) bridging models |

| Unique Point | Hybrid security model with SGN and CELR token collateral for system security |

9.Rango Exchange

Rango Exchange is optimal for bridging store-of-value tokens as it integrates multiple bridges and DEXes into a single interface, providing users the best possible paths for cross-chain transfer. Its unique aggregation technology patented by Rango optimizes for speed, cost, and liquidity eliminating slippage and ensuring the safe movement of high-value assets.

Cross protocol integration brings unparalleled adaptability and ease of use, turning Rango into a one-stop shop for sophisticated users looking for cost-efficient solutions when transferring digital valuables across several blockchains.

| Feature | Details |

|---|---|

| Protocol Name | Rango Exchange |

| Main Use Case | Bridging store-of-value tokens across 70+ blockchains |

| KYC Requirement | Minimal to none; no identity verification required for most users |

| Security | Audited smart contracts by PeckShield; modular architecture for scalability and security |

| Supported Chains | Over 70 chains including Ethereum, Solana, BNB Chain, Polygon, StarkNet, Tron, Cosmos, and more |

| Token Support | ETH, USDC, USDT, DAI, WBTC, Zcash, Monero, and other major tokens |

| Transfer Speed | Fast cross-chain transfers with low latency |

| Fees | Low fees optimized for large-value transfers |

| Liquidity Model | Aggregated liquidity from 100+ DEXs and 25+ bridges |

| Unique Point | Non-custodial, decentralized platform with smart routing for optimal swaps |

10.Bungee Exchange

Bungee Exchange stands out as the leading aggregator when it comes to bridging store-of-value tokens because of its advanced routing mechanism that chooses the quickest and cheapest bridges for every transaction.

Gained from focusing primarily on gas fee and transfer speed optimization, Bungee’s cross-chain transfer solutions have minimal slippage, ensuring that the token value is preserved.

By combining different bridge protocol frameworks into one interface, Bungee enhances the overall experience while providing top-level security and liquidity, serving as an effortless and dependable solution for efficiently transferring valuable tokens across different blockchain ecosystems.

| Feature | Details |

|---|---|

| Protocol Name | Bungee Exchange |

| Main Use Case | Bridging store-of-value tokens across multiple blockchains |

| KYC Requirement | Minimal to none; no identity verification required for most users |

| Security | Utilizes decentralized protocols with smart contract-based security |

| Supported Chains | Ethereum, Binance Smart Chain, Polygon, Avalanche, and more |

| Token Support | USDC, USDT, DAI, ETH, WBTC, and other major ERC-20 tokens |

| Transfer Speed | Fast transfers with low latency |

| Fees | Low fees optimized for large-value transfers |

| Liquidity Model | Aggregated liquidity from various decentralized exchanges and protocols |

| Unique Point | Non-custodial, decentralized platform with smart routing for optimal swaps |

Conclusion

To sum up, the top aggregators for bridging store-of-value tokens focus on maintaining security, speed, and capital efficiency to retain value during cross-chain transfers. Some platforms offer optimized liquidity pools while others have native asset support or advanced routing capabilities, all providing low slippage and minimal fees.

While all of these solutions offer dependable and economical options to efficiently transfer tokens across blockchain ecosystems, each user’s requirements determine which aggregator is best suited.

FAQ

What is a bridging aggregator for store-of-value tokens?

A bridging aggregator connects multiple cross-chain bridges to provide users with the best route for transferring high-value tokens securely and efficiently.

Why is minimal KYC important in these aggregators?

Minimal KYC ensures privacy and ease of use while maintaining compliance, making it convenient for users to move assets without lengthy verification.

How do these aggregators preserve token value during transfers?

They use native token transfers, deep liquidity pools, and low-slippage routing to minimize value loss and avoid unnecessary wrapping or conversions.