Hello guys, today i talk about Crypto Bridges. Read my complete article to understand what is this and how it works so let start.

What is Crypto Bridges?

A crypto bridge is basically a conduit which allows the movement of an asset or a token from one blockchain network to another.

Because most stand-alone blockchains such as Ethereum, Bitcoin, and the like, are isolated from one another, crypto bridges enable their users to carry out asset transfers from one blockchain network to another.

This is done through the use of smart contracts and protocols that are safe, efficient, and cheap for the process of transferring.

For instance, a user could transfer assets such as Ethereum tokens to other chains such Binance Smart Chain or carry out Ethereum transfers to Layer 1 or move other assets between Layer 1 and Layer 2 networks.

It is informative to highlight that the growth of DeFi as an ecosystem cannot be well understood without crypto bridges because they facilitate the enhancement of access to a vast number of dApps as well as boost the liquidity in the different blockchain networks.

Key Features & Best Crypto Bridges List

| Crypto Bridge | Key Features |

|---|---|

| Rhino.fi | Multi-chain support, offers a user-friendly interface, low fees, fast transfers. |

| Across Protocol | Focus on Ethereum and Layer-2 scaling solutions, high speed, decentralized. |

| Rango Exchange | Supports a wide range of assets, offers liquidity aggregation, fast swaps. |

| Portal Bridge | Cross-chain liquidity, built for security, scalability, and low fees. |

| Gravity Bridge | Specializes in bridging Ethereum and Cosmos ecosystems, secure, decentralized. |

| Allbridge | Multi-chain support, low fees, offers token swaps between different networks. |

| Celer cBridge | Fast transfers, low-cost, supports cross-chain liquidity across major blockchains. |

| Hop Protocol | Focuses on Layer 2 scaling, efficient and cost-effective transfers. |

| Arbitrum Bridge | Ethereum Layer 2 scaling, fast and low-cost bridging for Ethereum assets. |

| Orbiter Finance | Cross-chain and Layer 2 liquidity, decentralized, offers scalability. |

10 Best Crypto Bridges

1. Rhino.fi

Rhino.fi positions itself as a competitive player in terms of blockchain interoperability as it facilitates support for over 23 networks such as Ethereum, Arbitrum, Solano and Tron.

It is renowned for its quick transaction processing service where finality is achieved within 60 seconds, concurrent with providing liquidity and low fee.

Rhino.fi leverages StarkEx rollup technology to combine these transactions off the chain, thus reducing network traffic and costs.

Inevitably, the numbers speak for themselves, having grown to become a premier platform for cheap cross chain bridging, $2.35 billion valued validation has been completed across 48.8 million transactions for over a million users.

Further, with the backing from the leading companies in the industry, such as ConsenSys and Ledger, Rhino.fi is among the platforms that make cross border DeFi together with EVM and non EVM networks seamless.

Key Features of Rhino.fi

- Effortless asset transfer between Ethereum and many Layer 2 networks

- Low fees for transactions and quick transfer

- Bridging with advanced liquidity routing

- Greater decentralized protocols for better security

- Many blockchains are supported to provide wider integrations

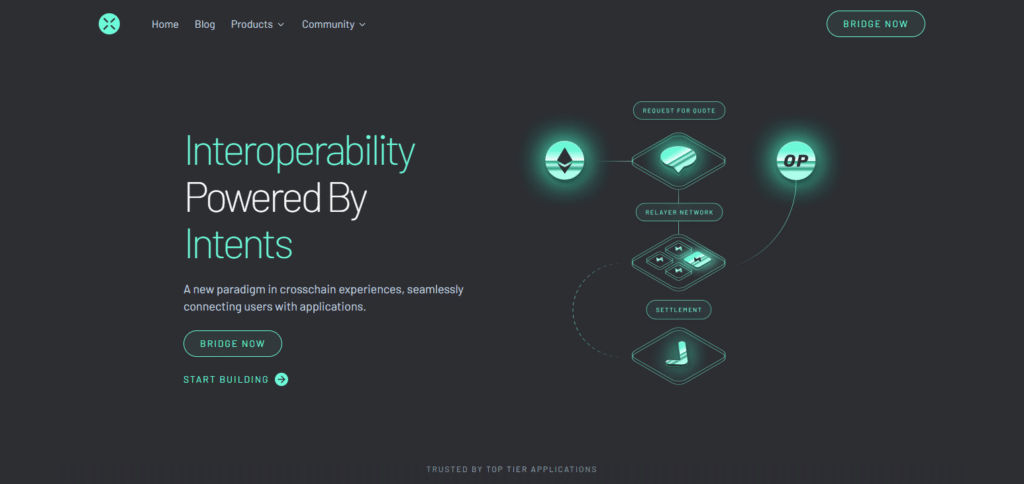

2. Across Protocol

Across Protocol is a cross-chain, Layer 2 bridge solution that specifically uses only the Ethereum network, with the emphasis being on the lowest possible transaction cost , and it allows for seamless transactions from layer-2 networks such as Optimism, Polygon, Arbitrum and Base.

It provides for users to connect straight with applications via a special intents based model which has relayers competiting for the best price and better execution and thus most often than notable the swap is done in less than a minute.

Given its impressive track record of $12 billion in volume transacted with 9 million transfers, Across seems to always be at the forefront when it comes to bridges which are fast.

With slashing transaction costs being the order of the day thanks to its modular architecture that re distributes the risk to relayers who only get paid for successful executions, this means that users also get cheap and seamless transfers.

Key Features of Across Protocol

- Allows for fast and cheap cross-chain transactions

- More than a half-dozen other Layer 1 and 2 networks supported

- Uses a distinctive liquidity network allowing for rapid bridging

- Excellent risk management and strong protection as decentralized

- Cross-Chain EVM Bridges are designed to enhance DeFi and dApp interoperability

3. Rango Exchange

With Rango, users can transfer assets across 60+ different blockchains in a single, convenient interface making it the leading cross-chain bridge aggregator.

With $2 billion dollars in total being exchanged across 1.14 million swaps and 174,000 wallets, Rango utilizes its API to effectively connect with DEXs, cross-chain protocols as well as aggregators ensuring fast asset swaps.

Rango covers Universe coins like Bitcoin and Dogecoin alongside other coins like Solana, and Tron which allows them to use multiple bridges enabling them to get the best execution for asset transfer.

If you are looking to swap assets across different chains, then it is a great option as it is a no-KYC solution ensuring safety and simplicity to the users.

Key Features of Rango Exchange

- A multi-chain functionality that allows one to perform cross-chain asset transfer between different blockchains

- Has the best rates as it sources liquidity from a number of users

- Enables quick and low-priced transactions and reduces slippage costs

- Makes cross-chain exchange easy without a challenge

- High protection because of decentralised infrastructure

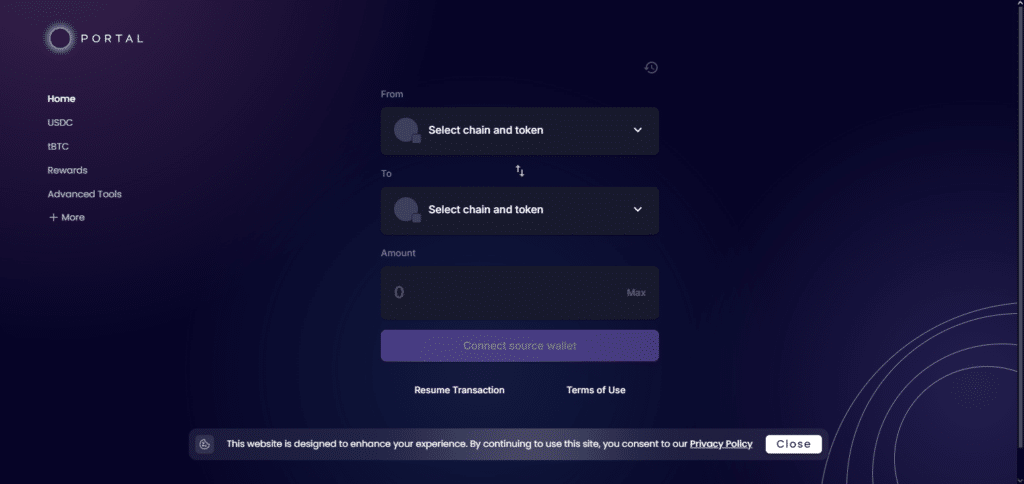

4. Portal Bridge

Portal Bridge emerges as one of the best bridging solutions that facilitates cross-chain interaction between networks such as Solana, Sui, NEAR, and Aptos which are not under the EVM.

Available on the Wormhole supported websites, it uses a process of locking some tokens in a smart contract on the source chain while minting equivalent wrapped tokens on the target chain which significantly eases switching of tokens between native and wrapped assets in a more efficient way.

One more advantage that Portal has over the conventional system is the Wormhole Connect that allows developers to cross-chain transfer new Layer 1 and Layer 2 networks with ease.

The network does not require any additional charges over the gas fees of the originating chain. A decentralized relayer network ensures that all the transactions are completed on target chain gas tokens facilitating instant availability of the usdt.

Key Features of Portal Bridge

- Cross-network transactions among Ethereum and Solana blockchains

- Swift and cost effective asset exchanges at very low operatives costs

- Bridging via decentralized and instil a confidence approachto the security.

- Easy-to-use interface that enhances customer experience

- Compatible with multiple tokens and assets between different networks

5. Gravity Bridge

The Gravity Bridge is truly seamless connective interoperability solution for Cosmos-SDK dermacrates chains such as Osmosis, Evmos, Celestia, Canto, and Kujira and also ethernet.

Its the native token truly enables entire concept of liquidity through ERC20 tokens that are of great use such as DThen with these major tokens and IBC protocol in place, cross chaining functionalities can work wonders for the Cosmos.

For starters, Gravity Bridge is highly scalable and permissionless which enhances decentralization even more to the solution.

Thanks to its large validator support from the validator network, the bridge has phenomenal security and reliability with no recorded exploits or bugs, as previously said.

At present, it supports only USDC and Ethereum transfer but with the expansion updates in place the number of transferable tokens will drastically change.

Key Features of Gravity Bridge

- Decentralized bridge between the Cosmos and Ethereum systems

- High-speed, cheap transfers with great extent of scalability

- Interchain interoperability utilizing Cosmos SDK

- Integrates several assets across Ethereum and Cosmos networks

- Cross chain trustless communication through inter-blockchain protocol integration

6. Allbridge

Allbridge is a cross chain bridge facilitating a variety of blockchain networks allowing the transfer of assets and exchange of data between ecosystems.

The bridge operates with more than twenty chains which include Ethereum, Avalanche, BNB Chain, Solana, and Polygon making it easier to operate between EVM and Non EVM chains.

Its interface supports asset transfers that are both native or wrapped securely which significantly increases both liquidity and accessibility to lower the time needed for transactions.

The pricing of the fees is quite reasonable, and a competitive price tag is attached to them along with a more advanced feature known as smart routing which optimizes the speed and the costs of transactions, resulting in a greater edge over the market.

Allbridge also positions itself as being developer friendly by integrating APIs and SDKs for effortless integration into DeFi applications.

The Allbridge team continues to explore new avenues and blocks in the realm which enables it to be more than just a reliable crypto bridge.

Key Features of Allbridge

- Multi-chain functionality enables easy transfer of assets between different blockchains

- Efficiency in pricing with speedy transactions across different chains

- Clean and simple interface which enables easy bridging process

- Allows the use of ERC-20 and native tokens across different networks

- Strong decentralized bridging network with high liquidity

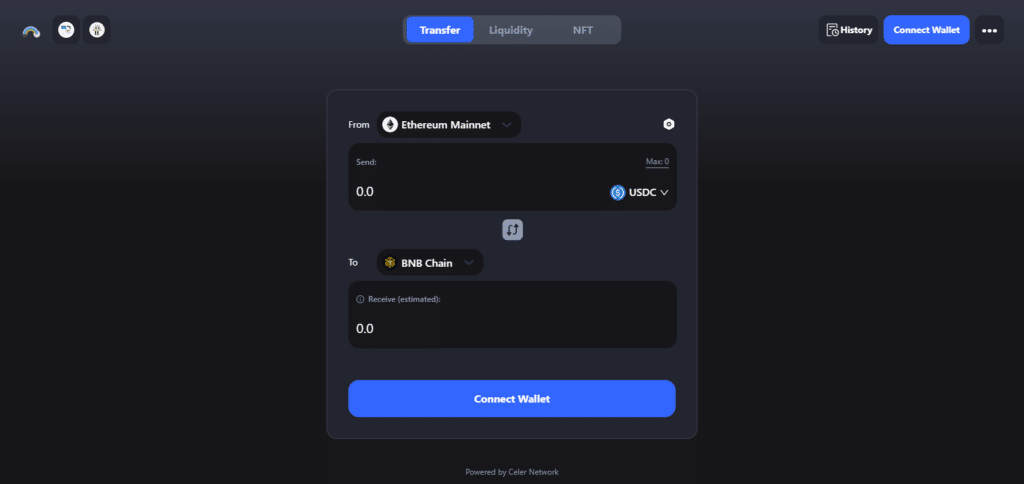

7. Celer cBridge

One of the most important and well-recognized platforms for transferring assets cros-chain is the Celer cBridge.

It is a decentralized cross-chain asset transfer platform that provides users with the ability to transfer tokens and assets across multiple chains such as Ethereum, Binance Smart Chain, Polygon amongst others.

Its transactions are quick, cost effective and simple to use as compared to traditional bridges.

While retaining the Celer’s State Channel properties, it is able to guarantee security and state scalability which allows its users, developers and projects to effectively use it across chains.

Key Features of Celer cBridge

- Quick and affordable cross-blockchain transactions

- Compatible with numerous blockchains such as BSC, Ethereum, and Polygon

- Super fast transaction completion at low cost

- Safe and scalable due to the State Channel technology of Celer

- Simplified interface allowing easy bridging processes

8. Hop Protocol

Hop Protocol is a trustworthy cross-chain bridge that allows the transfer of assets between layer one and layer two solutions, as well as across various layer two networks, with utmost convenience.

Moreover, it allows for an array of leading blockchains including Ethereum, Optimism, Polygon, Arbitrum, and other solutions, making transactions quicker and cheaper.

Having a special designated relayers called “Hop Relayers”, Hop Protocol ensures easy but fluid bridging with near instant liquidity without the necessity of long confirmation periods.

All these, combined with its excellent security features and ease of integration have made it a precious resource for many DeFi projects, developers and users looking something reliable and cross chain efficient.

Key Features of Hop Protocol

- Quick and affordable cross-blockchain transactions

- Compatible with numerous blockchains such as BSC, Ethereum, and Polygon

- Super fast transaction completion at low cost

- Safe and scalable due to the State Channel technology of Celer

- Simplified interface allowing easy bridging processes

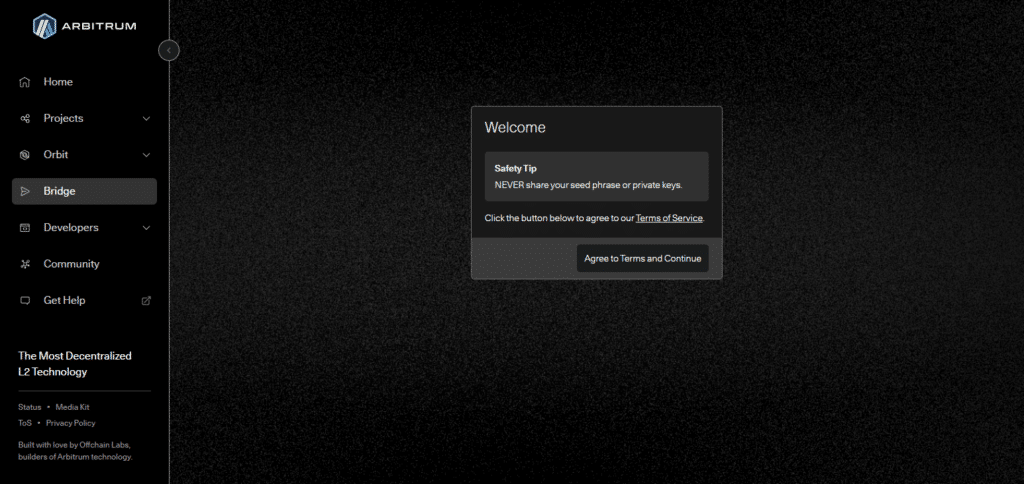

9. Arbitrum Bridge

The Arbitrum Bridge is an effective solution that provides a simple means to transfer tokens from an Ethereum Layer 2 Network to the Arbitrum network and vice versa.

In general, Arbitrum Bridge transactions are cost-effective and prompt while ensuring the security and decentralization offered by the Ethereum platform. It relies on optimistic rollups, which are a Layer 2 scaling technique meant to reduce Ethereum’s congestion and gas cost issues.

The introduction of this bridge instantaneously creates a picture of moving tokens across Eth and Arbi networks without compromising anything regarding performance for both DeFi users and developers who are looking for scaling means without losing their peace of mind..

Key Features of Arbitrum Bridge

- Efficient bridging between Ethereum and Arbitrum L2 network

- Cheap and quick transactions with Optimistic Rollups

- Enhances scalability while securing the Ethereun network

- User-friendly design to facilitate cross-chain operations.

- Wide array of ERC20 tokens and other assets supported

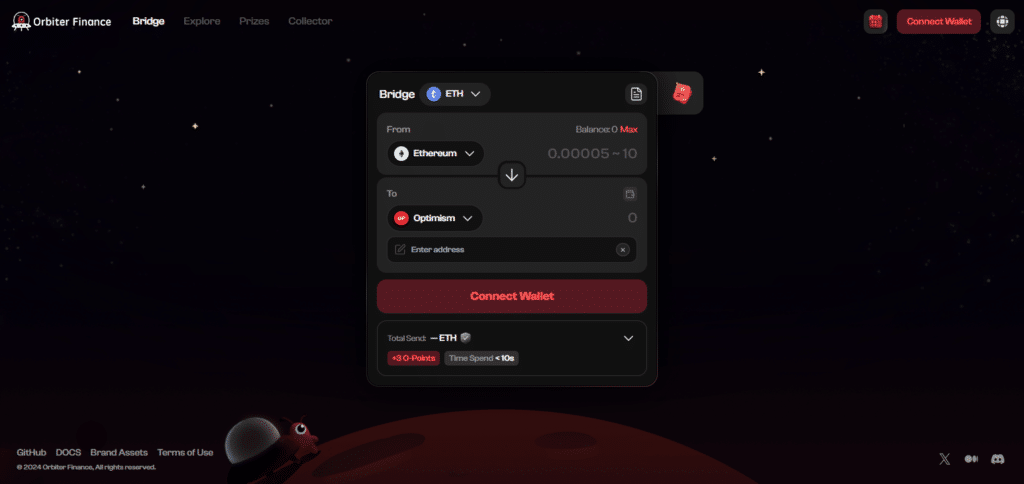

10. Orbiter Finance

Orbiter Finance is a cross-chain bridge that is tethered to Ethereum’s various second-layer solutions, with chain transfers being cheap, secure, and fast.

It is sought after by many users due to its fast and efficient bridging capabilities which allows many to transfer between different blockchains with a short wait time.

Orbiter Finance employs new liquidity protocols and upholds high security standards allowing for effortless asset transfers while also minimizing the cost of a transaction.

It has an unwavering attention on user-friendliness and stability which makes it an appealing option to developers and DeFi users looking for large-scale cross-chain solutions.

Key Features of Orbiter Finance

- Cost-efficient and speedy cross chain transactions with Layer 2 networks as well as Ethereum

- Integrates with multiple Optimism and Arbitrum based Layer 2 solutions

- Best liquidity routing solutions for faster bridging of assets

- Reliable and secure infrastructure that is safer for users

- Easy to follow and intuitive interface that allows cross chain activities effortlesslyWhat is Crypto Bridging?

Is Crypto Bridges Safe?

Crypto bridges can definitely be risky, but the safety heavily relies on the technology and protocols employed.

Cross-chain bridges utilize decentralized methods, smart contract audits, and encryption to guard against users’ assets.

On the other hand, risks such as smart contract risks, liquidity risks and also possibility of exploits do exist.

In order to reduce the risks, it would be better to use bridges which have an established reputation, external audits and some form of protection for the transactions.

Do keep an eye out for any security breaches or updates regarding the bridge you are using.

Importance of Crypto Bridge

Crypto bridges have made a lot of impact in the crypto community and have presented a lot of possibilities such as.

We call that opportunities

The application of crypto bridges enabled the user of the cryptocurrency community to venture into new possibilities.

Normally, users are confined to the blockchain of their choice due to ecosystems which only applies to the cryptocurrencies and the DeFi (decentralized finance) applications in use.

Possibility

The need for isolation in the operation of the Blockchain networks forces developers to create applications that are only possible within that specific network.

This limits the growth in the range of blockchain technology usage within the crypto community. With the development of bridges, the strengths of different blockchains may be leveraged in constructing new financial possibilities and applications.

Cost efficiency

When making a transaction, every blockchain network has its own set fees. However, with a crypto bridge, it is easy to move assets from high-cost platforms to low-cost platforms for low-cost transactions.

Interoperability

Bridges are intended to link distinct block chains allowing the transfer of asset across them to form an interoperable net. Without this the crypto platform would remain a collection of islands which brings about the limitations of usefulness and the growth of the crypto society. A crypto bridge eliminates the requirement of having different crypto wallets for each network.

Pros & Cons Of Best Crypto Bridge

Pros:

Cross-Chain Interoperability: Users can shift from one blockchain network to another without constraints because crypto bridges facilitate suitable dApps and services.

Lower Fees: Most layer two solutions operating on Ethereum and other chains are relatively cost-efficient when transferring digital currencies.

Faster Transactions: Layer two ZK and optimistic rollups have the capacity to process more transactions per second than several chain networks.

Enhanced Liquidity: A number of bridges provide better rates for asset transfers and slippage reduction by pooling liquidity from various places.

Scalability: With the introduction of cross-chains, congestion on investment heavy ones is being resolved while allowing users to access various chains.

Cons:

Security Risks: Risks associated with hacks, exploits or theft due to smart contracts hacking, centralized hacking, or the bridge networks being hacked.

Limited Token Support: Specific tokens are not able to be transferred if the specified network has not been integrated into all tokens.

Complexity: Moving across several networks and protocols can pose issues for less skilled users regarding the interaction with various crypto bridges.

Liquidity Challenges: Due to lack of liquidity, some bridges are unable to deliver or take longer than optimal causing operations to be suboptimal.

Decentralisation Trappe: Certain bridges might be based on a centralised or semi-centralised systems which brings the decentralised philosophy at blockchain networks towards compromise.

Conclusion

Best crypto bridges platforms can be considered the heart of blockchain networks allowing users smooth transferring of assets from one ecosystem to another, giving the sense of interconnectivity.

Moreover, they tend to be cheaper, quicker, and more liquid, which are very important for the advancement of the centralized finance (DeFi) movement.

Nevertheless, risks of security and even headaches caused by trying to use those bridges must be elements of concern for users.

Key aspects like supported tokens, security protocols, and the degree of decentralization can guide users looking to deploy a crypto bridge.

There is no question that the provision of cross-chain interoperability is to an extent risk appetite; however, by utilizing verified, reputable bridges, users can lessen their risks.