In this article, I will discuss the How to Track Bridging Aggregator Performance. Tracking important measures like transaction velocity, completion rates, and charged fees is important when optimizing cross-chain asset transfers.

With the proper tools, users are able to understand critical performance indicators, thereby guaranteeing smoother, quicker, and less expensive bridging throughout blockchain systems.

What is Bridging Aggregator?

A bridging aggregator connects multiple blockchain bridges into one single platform enabling asset transfers across a variety of networks, hence improving efficiency. Instead of using a single bridge, it chooses the quickest route which is the most cost-efficient and reliable.

This allows users to minimize fees, delays, and enhance the success rate of transferring tokens between chains such as Ethereum, BNB Chain, and Polygon. Bridging aggregators advance the simplification of cross-chain transactions and promote greater interoperability in the entire decentralized system.

How to Track Bridging Aggregator Performance

To properly track how a bridging aggregator is performing, measuring parameters like transaction speed, security, and cost effectiveness is important. Here’s an example using DeFiLlama Meta-Aggregator that works step by step.

Step-by-Step Guide to Tracking Bridging Aggregator Performance

Select the Aggregator

Head over to DeFiLlama’s Meta-Aggregator where you would pick the bridge you wish to analyze.

Monitor Liquidity & Slippage

Observe how well the aggregator is able to obtain liquidity and manage slippage efficiently.

Analyze Transaction Costs

Look at the gas fees and transaction costs across various bridges and analyze them.

Evaluate Speed & Latency

Observe how quickly transactions are completed.

Check Security Measures

To allow for safe transfers, check audits along with security measures and protocols in place.

Use Benchmarking Reports

Review Blockdaemon’s benchmarking analysis for some insights into how well the aggregators performed.

Compare Routes

Experiment with various tokens as well as routes to check how different combinations affect the bridging experience.

Track Historical Performance

Look through previous transactions in order to spot patterns in the efficiency.

Assess User Experience

Analyze the design and the overall ease of use.

Verify Smart Contract reliability

Make sure that the smart contracts belonging to the aggregator are safe and audited.

Other Place Where to Track Bridging Aggregator Performance

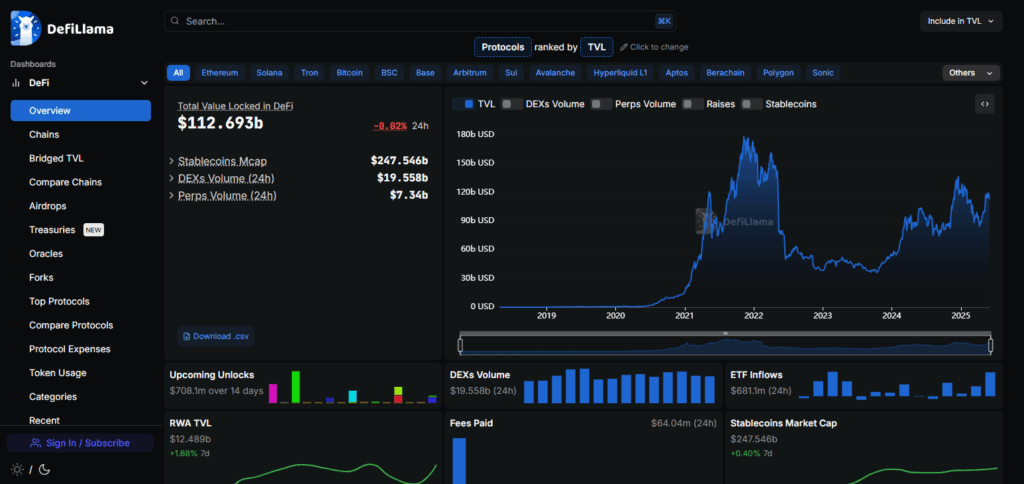

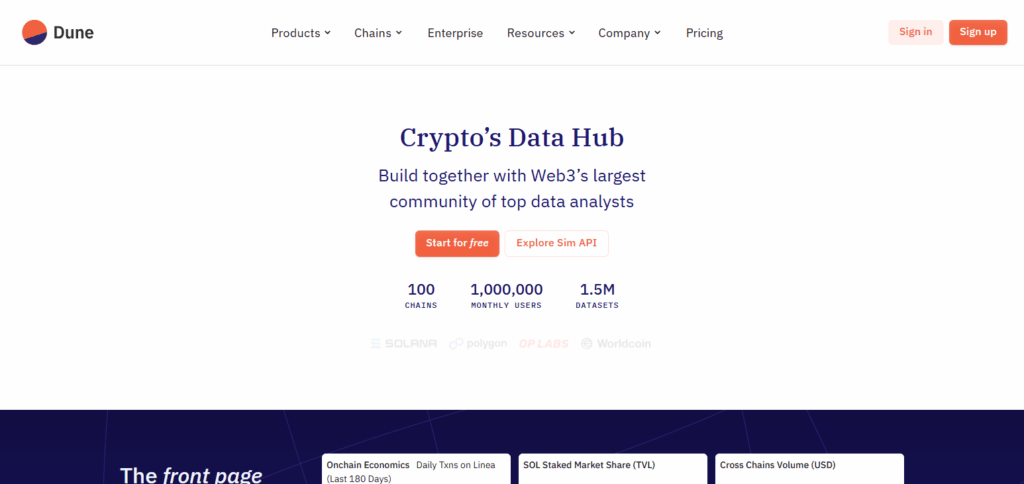

Dune Analytics

Dune Analytics is extremely useful when it comes to monitoring the bridging aggregators’ performance as users can compile dashboards using on-chain data. Its core value is in transparency—users can see metrics of many different blockchains including transaction volume, transaction success rates, and bridge efficiency.

Unlike other platforms that offer static analytics, Dune allows to run specific queries which is ideal for assessing the performance of different aggregators according to given parameters or network activity in a decentralized setting.

Rango Exchange

Rango Exchange is an important tool in monitoring the performance of bridging aggregators since it combines many cross-chain bridges and DEXs into one platform. Rango’s real-time route comparison is unlike anything else as it allows users to measure speed, cost, and reliability of a transaction before executing it.

This transparency fosters performance evaluation of different bridging paths and enables users to simplify the process of finding the most optimal and reliable solutions across blockchains.

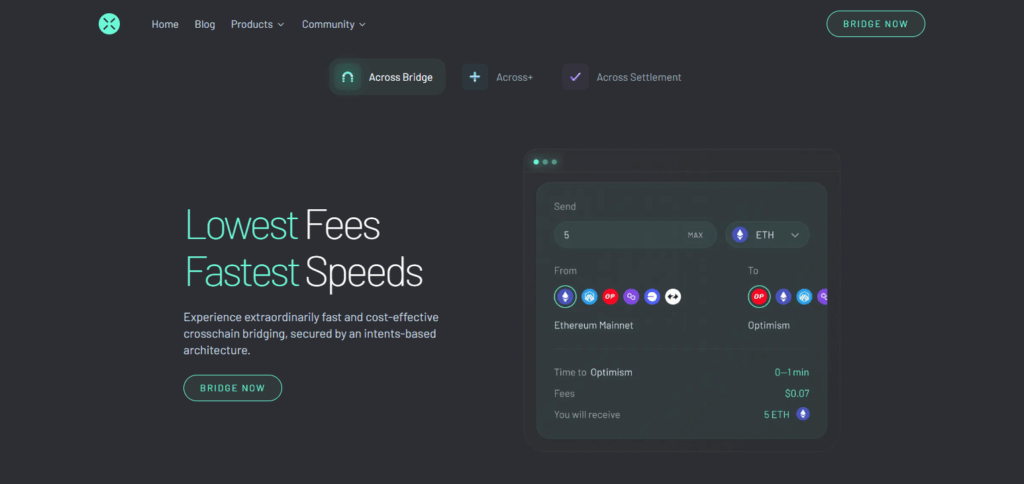

Across Protocol

The scientists show that Across Protocol enables monitoring the performance of bridging aggregators by providing insights into its own cross-chain transfer speeds and costs. Its unique relay-based structure allows quicker transaction processing at lower fees, simplifying performance benchmarking against other bridges.

Users can evaluate real-world performance metrics by analyzing transfer history, confirmation time, and fee consistency across transaction order processes within the protocol and assess how effectively aggregators navigate transactions through the protocol.

Key Performance Metrics to Track

Transaction Speed – Determines the rate at which assets are moved from one chain to another.

Success Rate – Percentage of transactions executed accurately and within the estimated timeframe.

Slippage Rate – Difference in expected versus provided token quantity.

Fees and Costs – Total amount incurred such as gas expenses, bridging service payments, and aggregator fees.

Liquidity Availability – Ability to process sizeable or repeated changes without a breakdown.

Supported Chains – Broad and diverse chains the aggregator interacts with.

User Volume – Quantitative count of users who utilize the services of the aggregator over a period.

Security Track Record – Historical data showcasing the reliability of the system with regard to avoiding severe exploits, downtime, or hacking.

Common Red Flags and Performance Issues

High Transaction Failure Rate

A high number of incomplete or “stuck” transactions point towards lack of consistency.

Slow Transfer Times

Slow bridging of assets may indicate a backlog or ineffectiveness.

Unpredictable Fees

Sudden and unexplained spike in expenses suggests high volatility in cost structures.

Limited Chain Support

Inability to bridge across important chains means lack of versatility.

Lack of Transparency*

Absence of public metrics, analytics, or documentation severely limits credibility.

Incidents of Security Breach

Recurrent hacks/bugs and pausing of services are exceptionally alarming red flag issues.

Tips for Optimizing Usage

Compare Different Aggregators – Research other platforms before bridging, looking for the best fees, speed, and success rates.

Pay Attention to Real-Time Data – Use live data analytics to monitor network congestion and gas prices for effective transfer timing.

Avoid Over-Reliance on A Single Bridge – Shifting transactions among multiple bridges can reduce risk and improve reliability.

Look at the Supported Chains – Confirm that the aggregator can perform operations on both your source and destination blockchains.

Make Sure To Check For Security Updates Frequently – Monitoring updates and audits keeps one from using vulnerable bridges.

Pros & Cons

| Pros | Cons |

|---|---|

| Simplifies cross-chain asset transfers | May have higher fees compared to single bridges |

| Aggregates best routes for cost & speed | Performance varies by network congestion |

| Provides real-time data and analytics | Limited support for some blockchain pairs |

| Enhances transaction success rates | Potential security risks if aggregator is compromised |

| Saves time by automating route selection | Complex for beginners to understand all metrics |

Conclusion

Monitoring bridging aggregator performance contributes to the efficient, secure, and cost-effective cross-chain transactions. User choice is based on performance metrics such as transaction speed, success, fees, and associated liquidity.

Various tools like Dune Analytics or platforms such as Rango Exchange allow monitoring of real-time performance while being cognizant of common pitfalls ensure asset safety. Ultimately, leveraging data enhances guarantee trust while enabling ensuring increased ease of use within the DeFi landscape.