I will discuss the How to Stake Bridging Aggregator Tokens on Sidechains. Enhanced transaction speeds, reduced fees, and greater flexibility are all advantages of staking on sidechains.

This will cover the critical steps, tools, and optimal strategies necessary to securely and efficiently stake your tokens across various blockchain networks.

What is Sidechains?

Sidechains are self-sufficient blockchains that operate alongside the main blockchain and enable secure transfer of data and assets. They are created to improve scalability and allow quick, inexpensive transactions with little congestion while maintaining the integrity of the main chain.

With sidechains, developers are able to support a particular application or test new features without interfering with the primary network. When it comes to staking, sidechains provide a better working environment which allows users to earn rewards with less effort, and lowers transactions fees.

How to Stake Bridging Aggregator Tokens on Sidechains

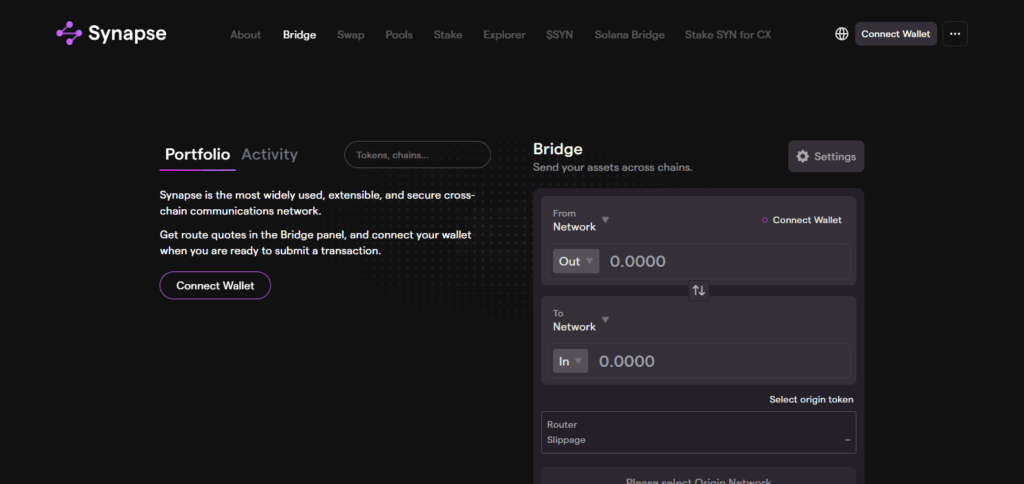

Example: How to Stake Synapse (SYN) Tokens on Arbitrum Sidechain

Staking token on sidechains, like Synapse (SYN) on the Arbitrum sidechain, supports liquidity cross-chain and will earn the users rewards in the process. We have elaborated the process down below for better understanding.

Step 1: Purchase SYN Tokens

- Purchase SYN tokens on SushiSwap or Uniswap, they are dex exchanges.

- You also have the option to bridge SYN tokens from Ethereum to Arbitrum via Synapse Bridge.

Step 2: Connect your Wallet

- Click on the Synapse Staking Platform, Head along to the Connect wallet option on displayed.

- Choose a MetaMask or any other Web3 wallet and select Conncect Wallet.

- Make sure your wallet is on the Arbitrum network.

Step 3: Staking Portion

- Click SYN on the Stake Then Synapse pulls up its staking tab.

- Select the number of SYN tokens from the list to stake further down.

Step 4: Finalising Stakes and Transactions(in wallet options)

- Hit Slots then click stake and sign the transaction on your wallet.

- Confirm the approval and sign on the wallets screen.

Step 5: Claim Periodic Rewards

- Transaction fee as well as liquidity have their incentives based on them thus Staked SYN turning rewards on.

- They can also be claimed periodically and reinvested so they can have compounding benwith.

Step 6: Unstake Whenever You Want

- From the withdrawal section, decide the amount you want to withdraw.

- After confirming the transaction, you will get your SYN tokens back in your wallet.

Other Place Where to Stake Bridging Aggregator Tokens on Sidechains

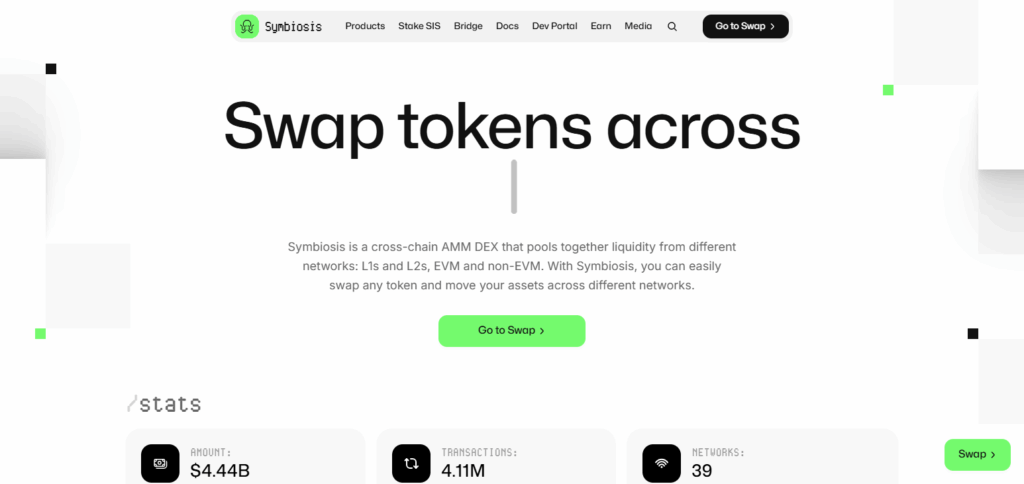

Symbiosis Finance

Symbiosis Finance is a multichain liquidity protocol facilitating effortless token exchanges across networks which is particularly useful for staking bridging aggregator tokens on sidechains. Its innovation stems from the blend of decentralized interoperability and a single-click simplified interface.

Allowing users to stake on sidechains directly through its platform reduces Symbiosis’ complexity and gas costs while providing quicker transaction speeds.

This unmatched staked sidechain access enables users to maneuver through different blockchain ecosystems with ease, enhancing their return on investment without much work.

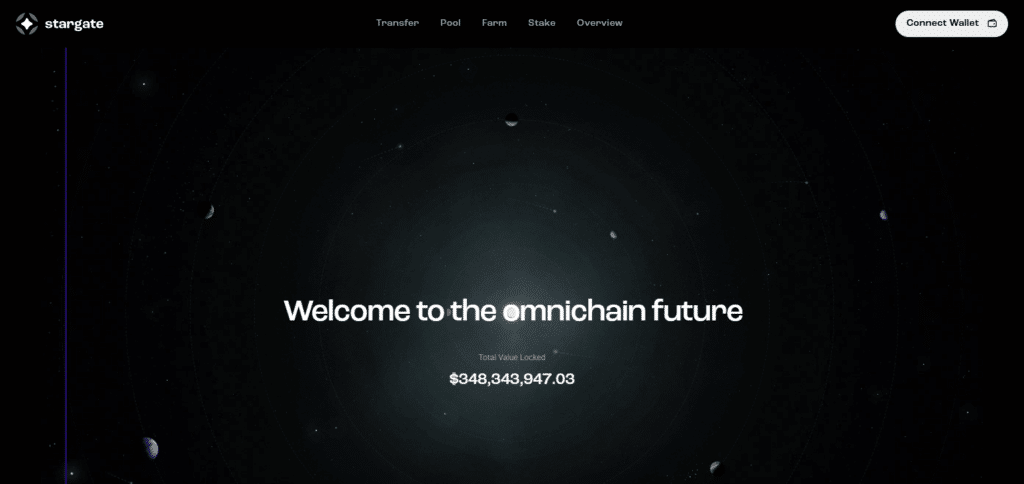

Stargate Finance

Stargate Finance relieves the complications associated with staking bridging aggregator tokens on sidechains by providing instantaneous and streamlined cross-chain liquidity protocols as well as transfer of assets across blockchains.

Its most noticeable characteristic is the elimination of wrapped tokens, enabling users to bridge assets natively. This allows users to stake original tokens on supported sidechains without further modifications.

Stargate’s architecture increases users’ confidence and efficiency in their staking, optimally positioning the protocol for users looking for convenience and minimalistic friction during the staking procedure while ensuring secure and genuine interoperability across the movement of tokens.

ChainPort

ChainPort is the latest cross-chain bridge enabling multi-chain token transfers while providing security and efficiency for transferring tokens across blockchains.

By incorporating multi-signature and cold storage methods, it is possible to enhance security while maintaining seamless interoperability, enabling users to bridge tokens without reverting to the original chain.

This qualitative functionality improves user experience while preserving the assets value and security across various blockchain ecosystems, thus making it a prime candidate for staking bridging aggregator tokens on sidechains.

Why Stake Bridging Aggregator Tokens on Sidechains?

Less Costly Gas Fees

Staking costs are less expensive on sidechains due to significantly reduced gas fees relative to the mainnet.

Speedier Processing Times

Transactions and staking activities are performed faster on sidechains, allowing more reward collection with less interaction time.

Increased Performance Metrics

Moving staking activities to sidechains minimizes main blockchain traffic, reducing performance obstacles caused by network congestion.

Enhanced Yield Opportunities

Some sidechains reserve specific or heightened staking yields to draw in more liquidity and participants.

Greater Yield Opportunities

Stacking on sidechains permits greater responsiveness to multi-chain activities and enhances cross-chain initiatives.

Prerequisites Before Staking

Compatible Wallet Setup: Check that you have a Web3 wallet such as MetaMask or Trust Wallet that is compatible with the specific sidechain and northward crossing tokens.

Own Bridging Aggregator Tokens: Purchase the Bridging Aggregator Tokens from a centralized exchange or through swapping them on a DeFi platform.

Bridge Tokens to the Sidechain: Staking is only possible after moving tokens from the mainnet to the desired sidechain through a cross-chain bridge.

Sufficient Network Fees: Ensure that your wallet has enough native tokens, for instance MATIC for Polygon, to pay transaction or staking fees.

Platform Research: As a best practice, avoid scams and maximize benefits by checking the validity of the staking platform, supported chains, lock-up period, and APY terms.

Tips for Maximizing Staking Rewards

Take full advantage of yield farms

Look at different staking pools on different platforms and combine them with APY to choose the best pool without compromising security.

Participate during promotional periods and offer boosts

Communicate with other stakers and time active promotional periods and reward supercharges to increase payout temporarily.

Select reputable sidechains

Collect known sidechains and utilize the ones that have low fees and fast processing to maximize time and resource.

Reinvest add-on bonuses consistently

Reinvestment should be done on a schedule that will benefit from compounding.

Be up to date on reward and participation changes

Follow project updates and prepare on what to change to mark adjust value on change of rate, lock duration, or migration scheme plan.

Pros & Cons

| Pros | Cons |

|---|---|

| Lower transaction fees compared to mainnets | Requires bridging, which can involve risks |

| Faster transaction confirmation times | Limited support on some wallets and platforms |

| Access to high-yield or exclusive staking pools | Potential smart contract vulnerabilities |

| Reduces congestion on main blockchain | May need technical knowledge to navigate |

| Enables cross-chain DeFi participation | Some sidechains have lower liquidity |

Conclusion

To summarize, sidechains have become an effective method of earning because of their lower fees, faster transactions, and increased cross-chain utility. Staking bridging aggregator tokens provides users with rewards.

Since there are many ecosystems in blockchain, users need to be equipped with the right tools and preparation in order to maximize their staking possibilities. While engaging on DeFi platforms, always make sure they are staked securely.

Stay apprised of changes in the underlying protocols and be informed when devising staking strategies to optimize your holdings.