In this article, I will discuss the How to Stake Bridging Aggregator Tokens in Vaults. By contributing with these tokens, you can earn rewards and simultaneously support cross-chain liquidity, also referred to as staking.

I will break down what these tokens represent, why staking is important, the prerequisites needed to secure stake these tokens, and how to pick the most suitable vaults to increase your earnings in the DeFi ecosystem.

What Are Bridging Aggregator Tokens?

Bridging aggregator tokens serve as a unique form of cryptocurrency within applications that enable cross-chain transfers of assets.

Such tokens enable users to move their funds by merging different bridging options into a singular route, saving on time and money.

These tokens provide improved liquidity for multiple cross-chain bridges which decreases time, increases security, and reduces transactions fees. They assist in solving the interoperability problem among various blockchains by enabling users to access DeFi services across different ecosystems with ease.

How to Stake Bridging Aggregator Tokens in Vaults

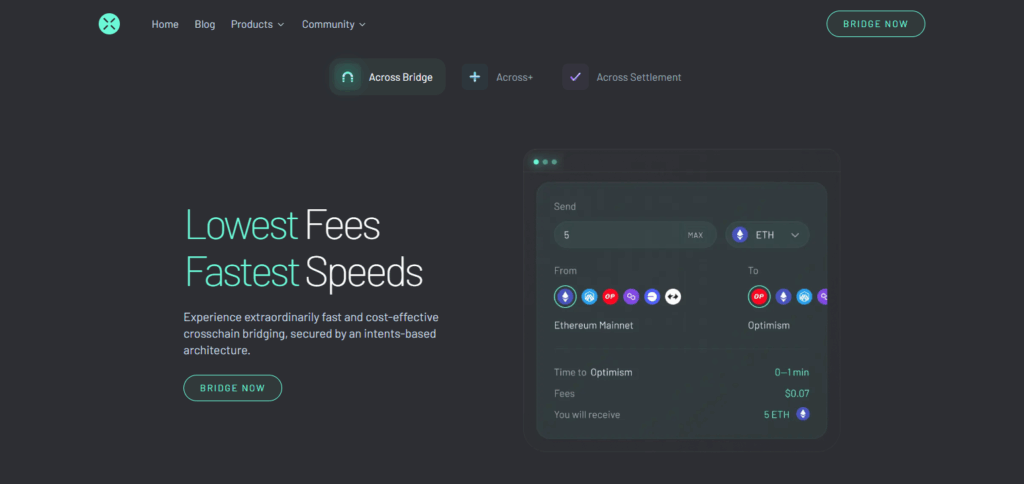

Let’s look at one staker’s approach to stake Bridging Aggregator tokens in vaults using Across Protocol, which is well known for its cross-chain liquidity services.

Staking Bridging Aggregator Tokens on Across Protocol—a step-by-step guide

Provide Liquidity

- Go to the Across Pool page and link your crypto wallet.

- Select from which liquidity pool you wish to withdraw the Bridging Aggregator tokens.

- Deposit the tokens into the pool and receive LP tokens as proof of your deposit.

Staking

- Go through the remaining tabs on the same page until you reach the LP token staking section.

- Press on the liquidity pool where you kept your token deposit.

Staking Your LP Tokens

- Type in the quantity of LP tokens you intend to stake, or choose the MAX button and stake all.

- Approve the needed steps on your wallet.

- Hit Stake after confirming.

Earning Rewards

- All fees made from bridging operations will be paid out to those who stake.

- Visit the rewards page to manage the balance of your staking position and profit.

Unstake When Needed

- Go to theunstaking section if you want to withdraw the tokens you have previously staked.

- Set the amount you intend to withdraw, then hit confirm.

Other Place Where to Stake Bridging Aggregator Tokens in Vaults

Stargate Finance

Stargate Finance stands out as a user friendly platform for staking bridging aggregator tokens into vaults due to its cross chain liquidity with pooled assets.

Its distinguishing feature is instant guaranteed finality which ensures assets are not stranded during transfers at any moment.

Users are awarded passive income by staking on Stargate while earning rewards as a participant in the composable transport layer of liquidity which sustains DeFi interoperability.

This provides a dependable platform for users in pursuit of effective and safe solutions for cross chain staking.

Symbiosis Finance

Symbiosis Finance takes a novel approach to staking bridging aggregator tokens by partnering with Symbiotic restaking protocol.

This cooperation allows users to stake their SIS tokens into customized vaults which subsequently delegate these assets to secure decentralized networks.

Liquid Restaking Tokens represent the staked assets and are issued to users so they can actively participate in staking while retaining liquidity. This capability, alongside earning rewards from staking, is what differentiates Symbiosis in the DeFi landscape.

ChainPort

ChainPort provides a secure private environment for staking bridging aggregator tokens in vaults. Its unique offering is the Private Bridge solution which utilizes cold storage interlaced with a 3-of-5 multi-signature system, thus ensuring that control over fund movement requires consensus rather than unilateral action.

This structure gives token issuers a greater degree of control and security over their assets. Moreover, ChainPort supports several methods of bridging, namely wrapped bridging and native token bridging, thus enabling cross-chain transfers.

Users can stake tokens in ChainPort’s vaults and receive rewards while enjoying customizable bridging services, robust security features, and low risk.

Yearn Finance

Yearn finance solves the problems of staking bridging aggregator tokens by automating yield generation via yVaults. These vaults are not passive; they utilize the multi-strategy approach, a best in class yield maximization technique, to capture the best opportunities in the ever changing DeFi landscape.

Another remarkable characteristic is the “Zap” function which allows users to deposit various tokens and receive one particular token, a vault token, in one trade.

This improves the overall experience for users further broadening the reach of versatility within the Finance landscape, making it accessible for all those who want to stake bridging aggregator tokens seamlessly.

Why Stake Bridging Aggregator Tokens?

Earn Passive Income: Staking permits holders to earn rewards or interest over time thus increasing the utility and long-term value of the token.

Support Cross-Chain Infrastructure: Staking helps in securing and stabilizing bridging protocols which improves their effectiveness and dependability.

Access to Vault Incentives: Most vaults provide further incentives like yield farming bonuses or governance tokens to participants that stake their tokens.

Promote Liquidity: Contributes to the liquidity of cross-chain ecosystems and improves the efficiency of transactions within the ecosystem.

Long-Term Investment Growth: Perfect for those looking to capitalize on the growth and appreciation of the network and the token over time.

Prerequisites Before Staking

Supported Wallet: You must have a compatible crypto wallet such as MetaMask or Trust Wallet and it must be connected to the correct blockchain network.

Token Availability: Ensure that your wallet has an adequate balance of the bridging aggregator token to stake.

Vault Platform Access: Identify a reliable DeFi platform or vault which enables staking for your targeted token.

Network Fees: Make sure that you possess sufficient native blockchain tokens of choice like ETH or BNB to transact or pay gas fees.

Research and Risk Awareness: Identify the risks you may be exposed to such as those arising from smart contracts, impermanent loss, etc.

Risks and Considerations

Smart Contract Vulnerabilities

Bugs or exploits in automated contracts can lead to vaults losing funds, as they depend on the automation of the encrypting agreement.

Platform Reliability

Not all services in DeFi are uniformly safe; use only those which are audited and well-reviewed.

Impermanent Loss

If the value of tokens changes greatly, the earnings may be lesser than just holding the tokens.

Withdrawal Lockups

Access to funds can be restricted due to some bolts having a minimum staking time.

Market Volatility

Prices of the token can fall sharply, impacting the value of staked assets and rewards.

Tips to Maximize Rewards

Use Trustworthy Sites: Use dependable vaults as the primary site to get tracker, change rates, and take a look at their automation effectiveness.

Take The Most Rewarding APR: Try to switch from one bridge rerouting AC token vaults to the other in order to attempt using the higher percent APR.

Check Frequently To Respond To Changes: Change that are responding and following the latest announcement of the platform so as not to be outsmarted by rivals.

Make Solutions For The Rewards: Make sure to make rewards while the gas spending on the network is the most economical.

Discuss Platform With The Community: Encourage teamwork within the community to see the effectiveness leave and watch for risks to enter with ease.

Conclusion

Earning passive income while actively supporting cross-chain infrastructure can be done by staking bridging aggregator tokens in vaults.

Getting the most out of your DeFi ecosystem and rewards requires exposing yourself to reliable platforms, managing risks, and understanding the processes involved.

Growing your reward and getting the most out of your investment is all about information, constant monitoring, and strategic decision making during your staking voyage in the DeFi world.