In this article, I will focus on the best aggregator for bridging short-term trades. Whenever you have to move an asset rapidly between chains, or take advantage of short-term trading opportunities, a suitable bridge aggregator is a must.

I will analyze services that guarantee quick execution of transactions, minimal costs, and dependable outcomes for effective trading on various blockchains.

Key Points & Best Aggregator For bridging Short-Term Trades List

| Platform | Key Point |

|---|---|

| Socket | Modular interoperability stack enabling seamless cross-chain communication. |

| Rubic | Offers multi-chain swaps and bridge aggregation with over 70+ integrated DEXs. |

| Jumper Exchange | Aggregates multiple bridges to find the best route for cross-chain transfers. |

| Rango Exchange | Supports the most blockchain networks and wallets among bridge aggregators. |

| Portal Token Bridge | Decentralized cross-chain swaps via LayerZero infrastructure. |

| Synapse Protocol | Secure, composable bridge supporting both assets and arbitrary messages. |

| Across Protocol | Fast, capital-efficient bridge using optimistic relayers and liquidity pools. |

| RhinoFi | StarkEx-based platform offering fast, cheap cross-chain swaps. |

| Orbiter Finance | Specializes in L2-to-L2 Ethereum scaling bridge transfers. |

| Hop Protocol | Rollup-to-rollup bridge optimized for quick Ethereum Layer 2 transactions. |

10 Best Aggregator For bridging Short-Term Trades

1.Socket

Socket is a cross-chain aggregator with a modular framework that facilitates quick and affordable bridging.

Traders needing fast execution across multiple chains will appreciate its efficient Socket quick bridging protocol that lowers costs, slippage, and promise lags.

Users benefit as Sockets integration with numerous protocols guarantees optimal rate access.

Socket

- Tailor-made modular design for custom cross-chain solutions.

- Multiple bridges and sources of liquidity are aggregated.

- Prioritizes slippage and speed during transfers.

- Easy integration with dApps and wallets.

2.Rubic

Rubic aggregates over 70 decentralized exchanges and bridges for multi-chain trading, helping users complete trades faster.

Automatic route optimization for every transaction helps Rubic stand out for short-term tactical trades that depend on optimal pricing and speed. A large list of supported tokens and chains increases user flexibility.

Rubic

- Automatic route selection.

- DEXs and bridges over 70 are supported.

- Swap across different chains with minimal input needed.

- Interface is easy to use with support for many tokens.

3.Jumper Exchange

Jumper Exchange compares and routes transactions through top-performing bridges, acting as a meta-bridge aggregator.

It suits cost-focused and speed-focused traders best. Jumper sustains predefined standards for optimal delay and rates selected from numerous bridge service samples in real time.

Jumper Exchange

- Best bridge protocols are combined into one.

- Route selection is completed in real-time.

- Fast bridging using the user-friendly interface.

- EVM-compatible chains supported.

4.Rango Exchange

Rango Exchange is a cross-chain transfer system with flexible infrastructure, with support for various blockchains and wallets. It is adept at executing rapid and precise cross-chain transactions.

Due to its comprehensive integration with central blockchains and advanced deep learning systems, Rango performs exceptionally well for short-term trades that require speed and network switching.

Rango Exchange

- Supports the most chains and wallets.

- Routing is done intelligently across DEXs and bridges.

- Reliable high success rate of transaction completion.

- Great for complicated swaps across different chains.

5.Portal Token Bridge

Portal Token Bridge offers a transfer system without intermediaries, facilitating cross-chain transactions powered by LayerZero. It caters to fast and secure trades, emphasizing reliability and user satisfaction.

The system architecture of Portal reduces the number of supported blockchains and enhances the efficiency of executed transactions.

Portal Token Bridge

- Uses the omnichain technology of layer zero.

- Architecture is completely decentralized and trustless.

- Enables transfer of tokens quickly and securely.

- Minimal fees can be used for several networks with easy support.

6.Synapse Protocol

Synapse Protocol offers a combination of security and speed in cross-chain bridging. Asset swaps and message passing add value for simple trades and complex dApps alike.

Its strong execution guarantees for low execution costs along with high reliability make it suitable for fast-paced trading environments.

Synapse Protocol

- Trusted smart contracts for verification while bridging.

- Arbitrary message passing and token swaps are allowed.

- Several Layer 1s and Layer 2s are compatible.

- Administered by the liquidity pools to allow lower fees and quicker transfers.

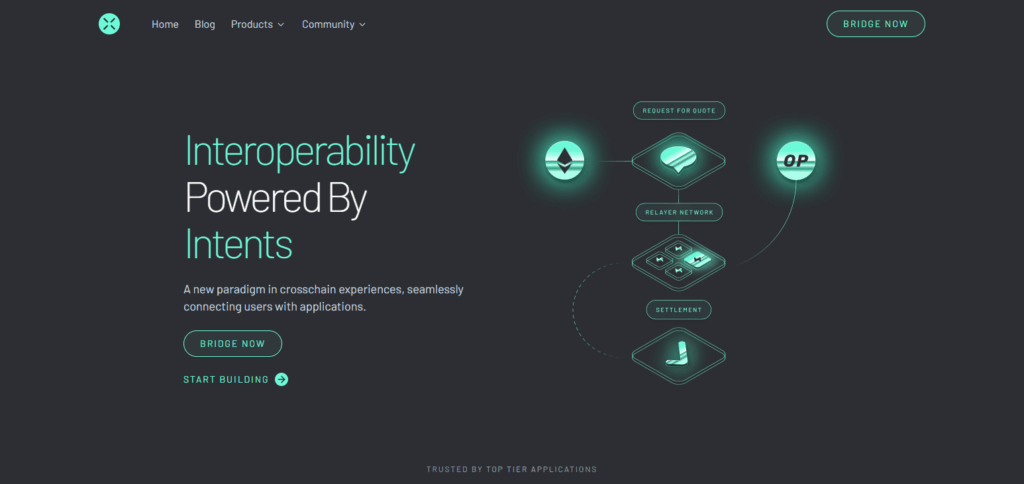

7.Across Protocol

Across Protocol makes inexpensive and efficient cross-chain transfers possible, employing bonded relayers and unique methods for post-transaction disputes. The protocol is focused on maximizing efficiency for fast-paced trading sytems.

It minimizes capital requirements and, consequently, the time needed for transactions, allowing users to swiftly transition from Layer 2s to mainnets.

Across Protocol

- Relayer system cut the cost of bridging.

- Settlement happens late while confirmations are instant.

- Effective transfers from L2 to L1 and L2 to L2

- Dispute management processes which add extra layer of protection

8.RhinoFi

RhinoFi (previously known as DeversiFi) is a platform running on StarkEx that allows for speedy and secure cross-chain trading at low fees.

Users can bridge assets without leaving the app, which makes trading easier. For mercantile traders, RhinoFi offers trade quick execution and ready access to liquidity on Ethereum and Layer 2’s.

RhinoFi

- Lightning-fast Layer 2 trading powered by StarkEx

- The app has an inbuilt cross-chain bridge.

- Low cost and fast settlement.

- Access to a number of DeFi protocols.

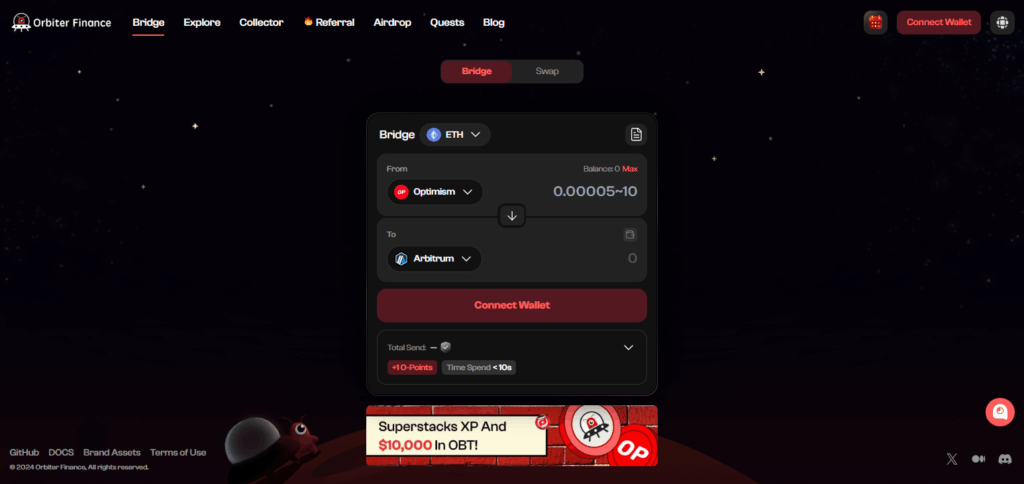

9.Orbiter Finance

Orbiter Finance specializes in transfers between Ethereum Layer 2, allowing fast and cheap bridging between rollups. Its speed makes it ideal for short-term trades where users need to switch lays fast.

Orbiter guarantees minimal delay and with a low to no latency and lightweight interface designed specifically for crypto traders and active crypto.

Orbiter Finance

- Focuses on L2-to-L2 transfers on Ethereum.

- Fast execution and low gas prices.

- Minimal interface for easy access.

- Live monitoring of transactions.

10.Hop Protocol

Hop Protocol facilitates rollup-to-rollup transfers with emphasis on speed and efficiency. It allows fast bridging of assets across Ethereum Layer 2s like Arbitrum and Optimism.

Hop excels in these conditions due to low fees, high throughput, and short wait period ideal for burst traders who need to rely on quick execution between L2 environments.

Hop Protocol

- Supports Ethereum Layer 2 bridges.

- Roll up liquidity pools to pulse transfer-laden pools.

- Low cost native asset bridging.

- Works with Optimism and Arbitrum among others.

Conclusion

To summarize, Socket, Rango and Jumper Exchange are ideal platforms as they excel in route optimization which is key for short-term trading.

All of these work reliably in providing fast, efficient, and seamless transfer of assets across different chains without overwhelming fees.

Synapse and Across have a specialized focus on providing safe and ample resources for bridging which bolsters their standing as competitive tools.

Overall tool selection depends on specific requirements pertaining to speed, the network’s scope, and user-friendliness relative to trading demands.